Answered step by step

Verified Expert Solution

Question

1 Approved Answer

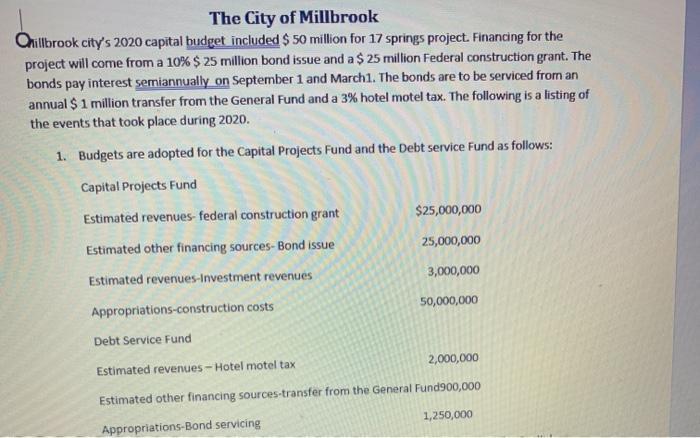

The City of Millbrook Chillbrook city's 2020 capital budget included $ 50 million for 17 springs project. Financing for the project will come from

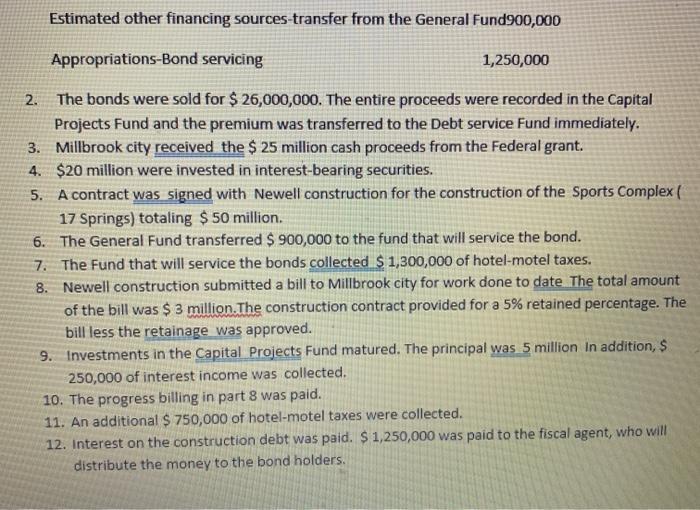

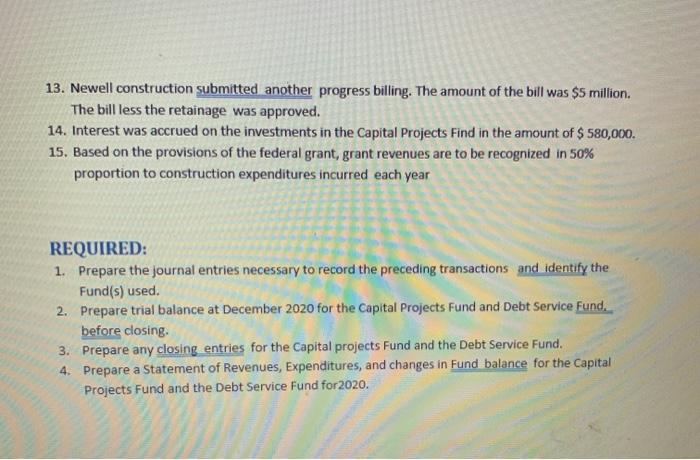

The City of Millbrook Chillbrook city's 2020 capital budget included $ 50 million for 17 springs project. Financing for the project will come from a 10% $ 25 million bond issue and a $ 25 million Federal construction grant. The bonds pay interest semiannually on September 1 and March1. The bonds are to be serviced from an annual $1 million transfer from the General Fund and a 3% hotel motel tax. The following is a listing of the events that took place during 2020. 1. Budgets are adopted for the Capital Projects Fund and the Debt service Fund as follows: Capital Projects Fund Estimated revenues- federal construction grant Estimated other financing sources-Bond issue Estimated revenues-Investment revenues Appropriations-construction costs Debt Service Fund $25,000,000 25,000,000 3,000,000 50,000,000 Estimated revenues-Hotel motel tax 2,000,000 Estimated other financing sources-transfer from the General Fund900,000 Appropriations-Bond servicing 1,250,000 Appropriations-Bond servicing 2. The bonds were sold for $ 26,000,000. The entire proceeds were recorded in the Capital Projects Fund and the premium was transferred to the Debt service Fund immediately. Millbrook city received the $ 25 million cash proceeds from the Federal grant. 3. 4. Estimated other financing sources-transfer from the General Fund900,000 1,250,000 $20 million were invested in interest-bearing securities. 5. A contract was signed with Newell construction for the construction of the Sports Complex ( 17 Springs) totaling $ 50 million. 6. The General Fund transferred $ 900,000 to the fund that will service the bond. 7. 8. The Fund that will service the bonds collected $1,300,000 of hotel-motel taxes. Newell construction submitted a bill to Millbrook city for work done to date. The total amount of the bill was $ 3 million.The construction contract provided for a 5% retained percentage. The bill less the retainage was approved. 9. Investments in the Capital Projects Fund matured. The principal was 5 million In addition, $ 250,000 of interest income was collected. 10. The progress billing in part 8 was paid. 11. An additional $ 750,000 of hotel-motel taxes were collected. 12. Interest on the construction debt was paid. $1,250,000 was paid to the fiscal agent, who will distribute the money to the bond holders. 13. Newell construction submitted another progress billing. The amount of the bill was $5 million. The bill less the retainage was approved. 14. Interest was accrued on the investments in the Capital Projects Find in the amount of $ 580,000. 15. Based on the provisions of the federal grant, grant revenues are to be recognized in 50% proportion to construction expenditures incurred each year REQUIRED: 1. Prepare the journal entries necessary to record the preceding transactions and identify the Fund(s) used. 2. Prepare trial balance at December 2020 for the Capital Projects Fund and Debt Service Fund. before closing. 3. Prepare any closing entries for the Capital projects Fund and the Debt Service Fund. 4. Prepare a Statement of Revenues, Expenditures, and changes in Fund balance for the Capital Projects Fund and the Debt Service Fund for 2020.

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 The budgets for the Capital Projects Fund and the Debt Service Fund are adopted Capital Projects Fund Debit Credit Federal construction grant 25000000 Bond issue 25000000 Investment revenues 2000000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started