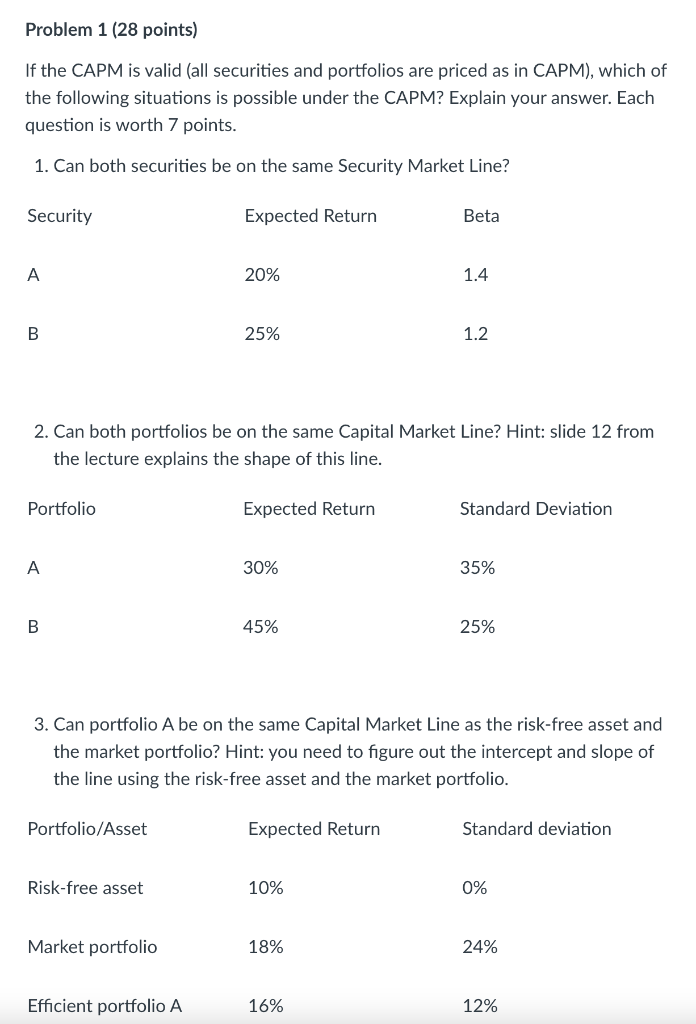

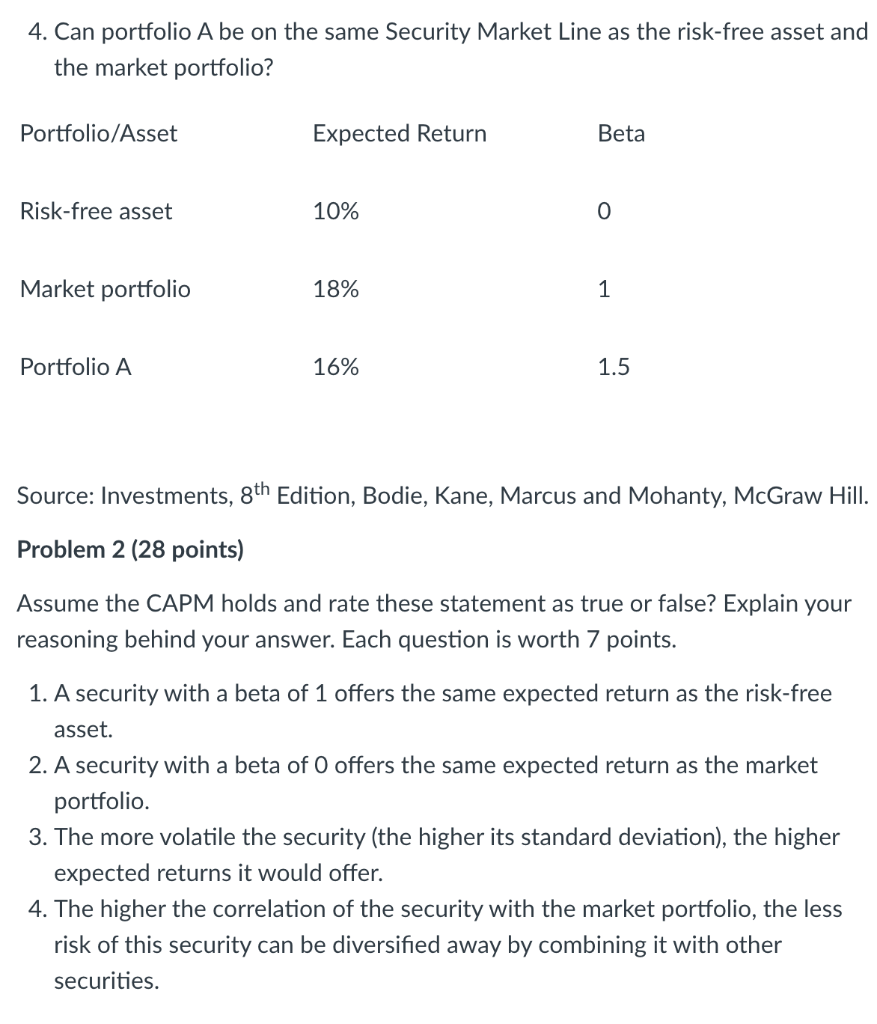

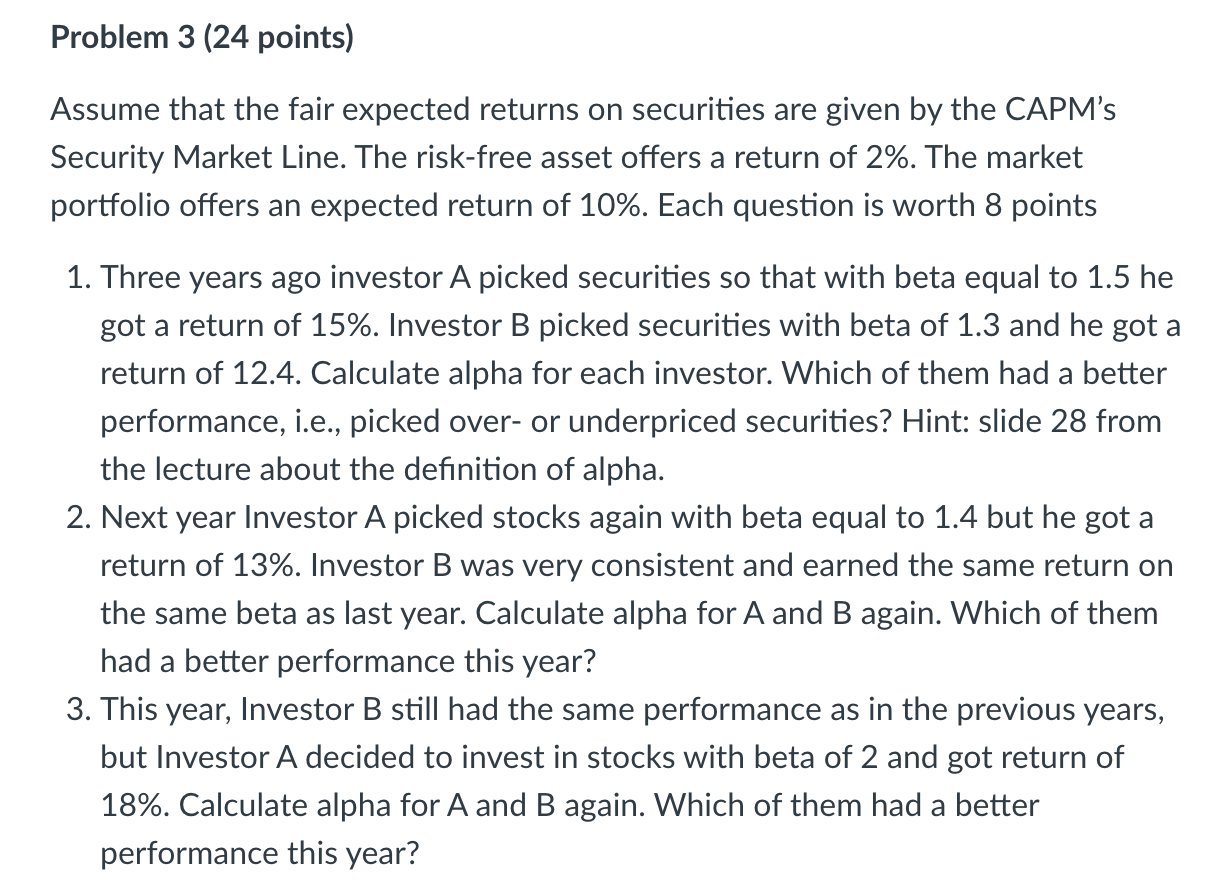

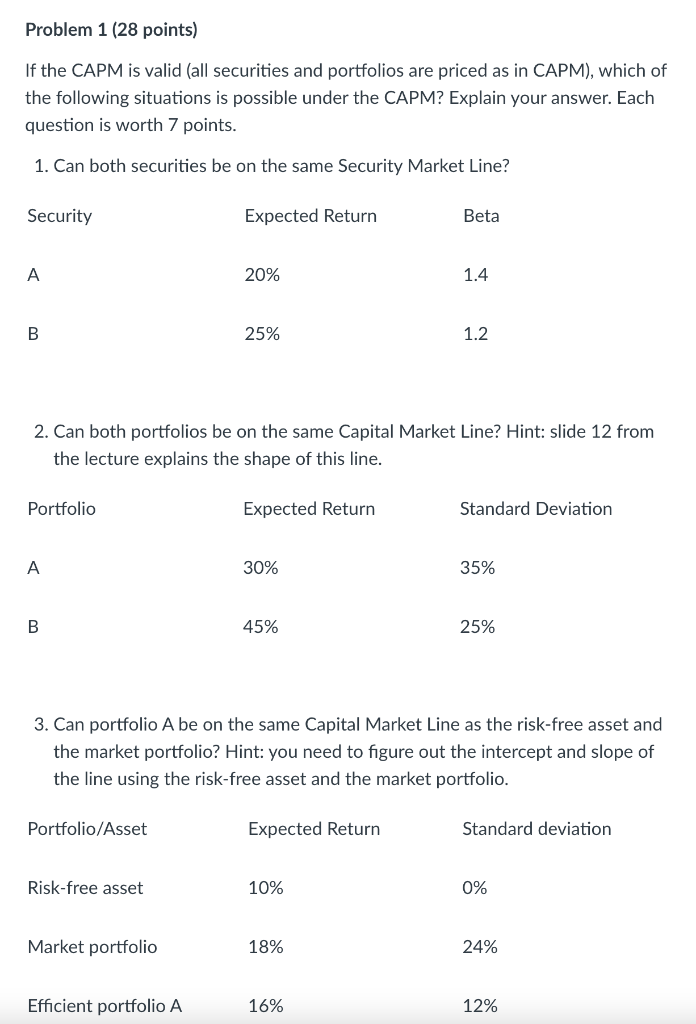

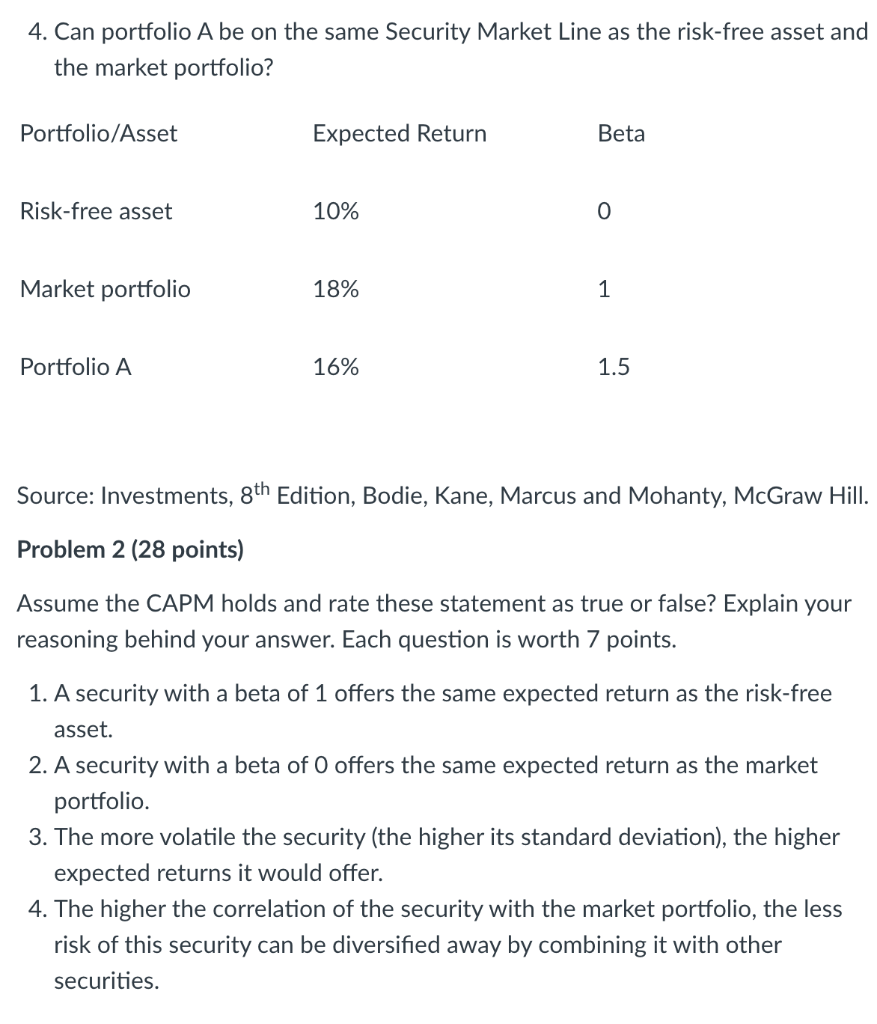

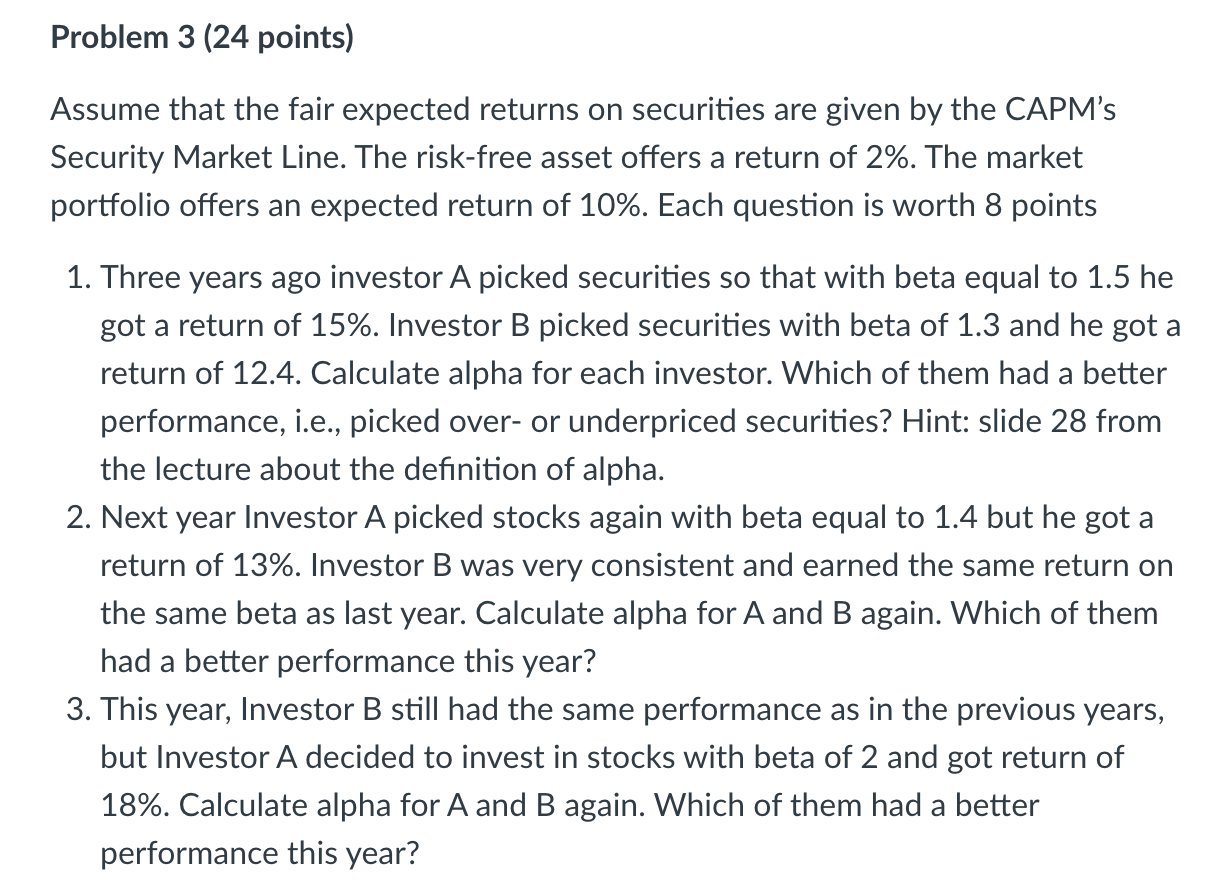

Problem 1 ( 28 points) If the CAPM is valid (all securities and portfolios are priced as in CAPM), which of the following situations is possible under the CAPM? Explain your answer. Each question is worth 7 points. 1. Can both securities be on the same Security Market Line? 2. Can both portfolios be on the same Capital Market Line? Hint: slide 12 from the lecture explains the shape of this line. 3. Can portfolio A be on the same Capital Market Line as the risk-free asset and the market portfolio? Hint: you need to figure out the intercept and slope of the line using the risk-free asset and the market portfolio. 4. Can portfolio A be on the same Security Market Line as the risk-free asset and the market portfolio? Source: Investments, 8th Edition, Bodie, Kane, Marcus and Mohanty, McGraw Hill. Problem 2 (28 points) Assume the CAPM holds and rate these statement as true or false? Explain your reasoning behind your answer. Each question is worth 7 points. 1. A security with a beta of 1 offers the same expected return as the risk-free asset. 2. A security with a beta of 0 offers the same expected return as the market portfolio. 3. The more volatile the security (the higher its standard deviation), the higher expected returns it would offer. 4. The higher the correlation of the security with the market portfolio, the less risk of this security can be diversified away by combining it with other securities. Assume that the fair expected returns on securities are given by the CAPM's Security Market Line. The risk-free asset offers a return of 2%. The market portfolio offers an expected return of 10%. Each question is worth 8 points 1. Three years ago investor A picked securities so that with beta equal to 1.5 he got a return of 15\%. Investor B picked securities with beta of 1.3 and he got a return of 12.4. Calculate alpha for each investor. Which of them had a better performance, i.e., picked over- or underpriced securities? Hint: slide 28 from the lecture about the definition of alpha. 2. Next year Investor A picked stocks again with beta equal to 1.4 but he got a return of 13\%. Investor B was very consistent and earned the same return on the same beta as last year. Calculate alpha for A and B again. Which of them had a better performance this year? 3. This year, Investor B still had the same performance as in the previous years, but Investor A decided to invest in stocks with beta of 2 and got return of 18%. Calculate alpha for A and B again. Which of them had a better performance this year