Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 3 - 2 1 ( Algo ) Dropping or Retaining a Flight [ L 0 1 3 - 2 ] Profits have been

Problem Algo Dropping or Retaining a Flight L

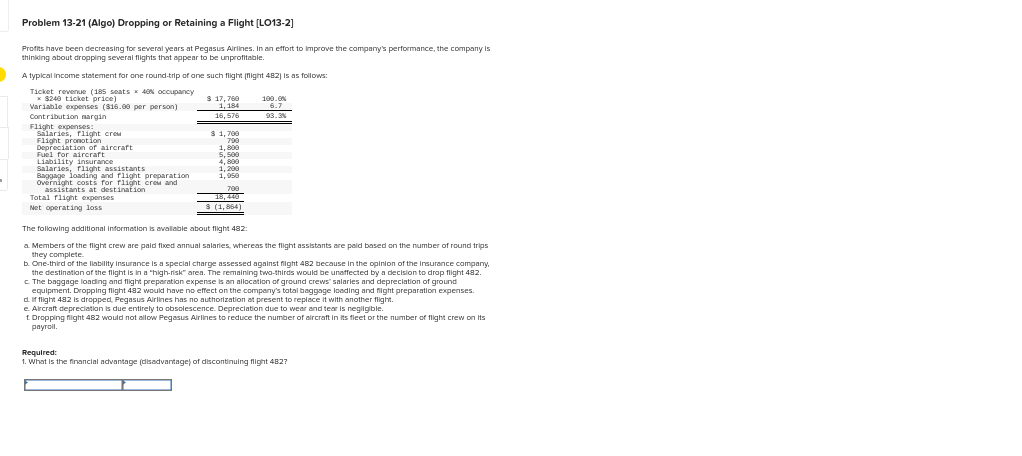

Profits have been decreasing for several years at Pegasus Airlines. In an effort to Improve the compary's performance, the company is

thinking about dropping several flights that appear to be unproflitable.

A typical income statement for one roundtrip of one such flight ilight is as follows:

The follawing additional information is avalable about flight :

a Members of the flight crew are paid flwed annual salaries, whereas the flight assistants are pald based on the number of round trips

they complete.

b Onethird of the llability insurance is a special charge assessed against filght because in the coinion of the insurance compary,

the destination of the flight is in a "highrisk" area. The remaining twothirds would be unaffected by a decision to drop flight

c The baggage loading and flight preparation expense is an allocation of ground crews' salaries and depreciation of ground

equipment. Dropping flight would have no effect on the company's tatal baggoge looding and filght preparation expenses.

di if flight is dropped, Pegasus Alrlines has no authorization at present to replace it with another flight.

e Alrcraft depreciation is due entirely to obsolescence. Depreciation due to wear and tear is negligble.

t Dropping filight would not allow Pegasus Airlines to reduce the number of alrcraft in its fleet or the number of tilight crew on its

payroll.

Required:

What is the financial actvantage disadvantage of discontinuing filght

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started