Question: Problem 1& 3. Show all work such as formulas. If it can be use in excel, then show excel formulas. (DDM) Bogey, Inc. has recently

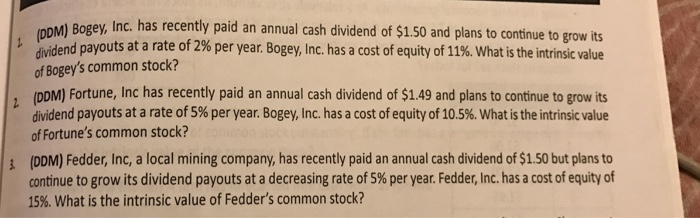

(DDM) Bogey, Inc. has recently paid an annual cash dividend of $1.50 and plans to continue to grow its vidend payouts at a rate of 2% per year Bogey, Inc. has a cost of equity of 11% What of Bogey's common stock? DDM) Fortune, Inc has recently paid an annual cash dividend of $1.49 and plans to continue to grow its dividend payouts at a rate of 5% per year. Bogey, Inc. has a cost of equity of 10.5%. What is the intrinsic value of Fortune's common stock? (DDM) Fedder, Inc, a local mining company, has recently paid an annual cash dividend of$1.50 but plans to continue to grow its dividend payouts at a decreasing rate of S5%peryear. Fedder,Inc. has a cost of equity of 15%. What is the intrinsic value of Fedder's common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts