Answered step by step

Verified Expert Solution

Question

1 Approved Answer

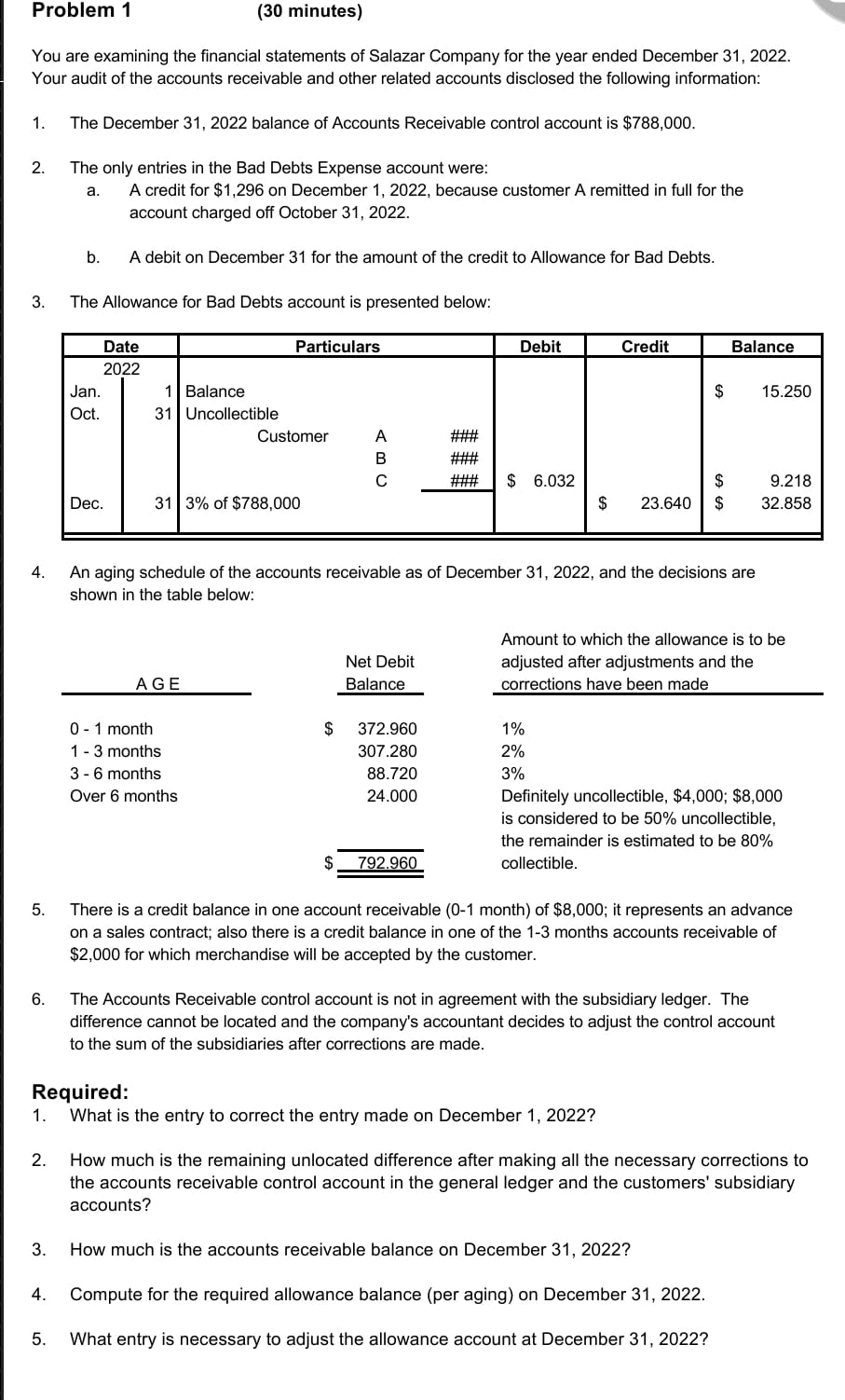

Problem 1 (30 minutes) You are examining the financial statements of Salazar Company for the year ended December 31, 2022. Your audit of the

Problem 1 (30 minutes) You are examining the financial statements of Salazar Company for the year ended December 31, 2022. Your audit of the accounts receivable and other related accounts disclosed the following information: 1. 2. 3. 4. 5. 6. 1. 2. 3. The December 31, 2022 balance of Accounts Receivable control account is $788,000. The only entries in the Bad Debts Expense account were: a. A credit for $1,296 on December 1, 2022, because customer A remitted in full for the account charged off October 31, 2022. 5. b. The Allowance for Bad Debts account is presented below: Jan. Oct. A debit on December 31 for the amount of the credit to Allowance for Bad Debts. Date 2022 Dec. 1 Balance 31 Uncollectible Particulars 31 3% of $788,000 AGE Customer 0-1 month 1 - 3 months 3 - 6 months Over 6 months A B C $ Net Debit Balance 372.960 307.280 88.720 24.000 ### 792.960 ### ### Debit $ 6.032 An aging schedule of the accounts receivable as of December 31, 2022, and the decisions are shown in the table below: $ 1% 2% 3% Required: What is the entry to correct the entry made on December 1, 2022? Credit $ $ 23.640 $ Balance Amount to which the allowance is to be adjusted after adjustments and the corrections have been made 15.250 Definitely uncollectible, $4,000; $8,000 is considered to be 50% uncollectible, the remainder is estimated to be 80% collectible. How much is the accounts receivable balance on December 31, 2022? 9.218 32.858 There is a credit balance in one account receivable (0-1 month) of $8,000; it represents an advance on a sales contract; also there is a credit balance in one of the 1-3 months accounts receivable of $2,000 for which merchandise will be accepted by the customer. 4. Compute for the required allowance balance (per aging) on December 31, 2022. What entry is necessary to adjust the allowance account at December 31, 2022? The Accounts Receivable control account is not in agreement with the subsidiary ledger. The difference cannot be located and the company's accountant decides to adjust the control account to the sum of the subsidiaries after corrections are made. How much is the remaining unlocated difference after making all the necessary corrections to the accounts receivable control account in the general ledger and the customers' subsidiary accounts?

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here are the solutions to the problems stepbystep 1 Entry to correct the December 1 2022 entry Bad D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started