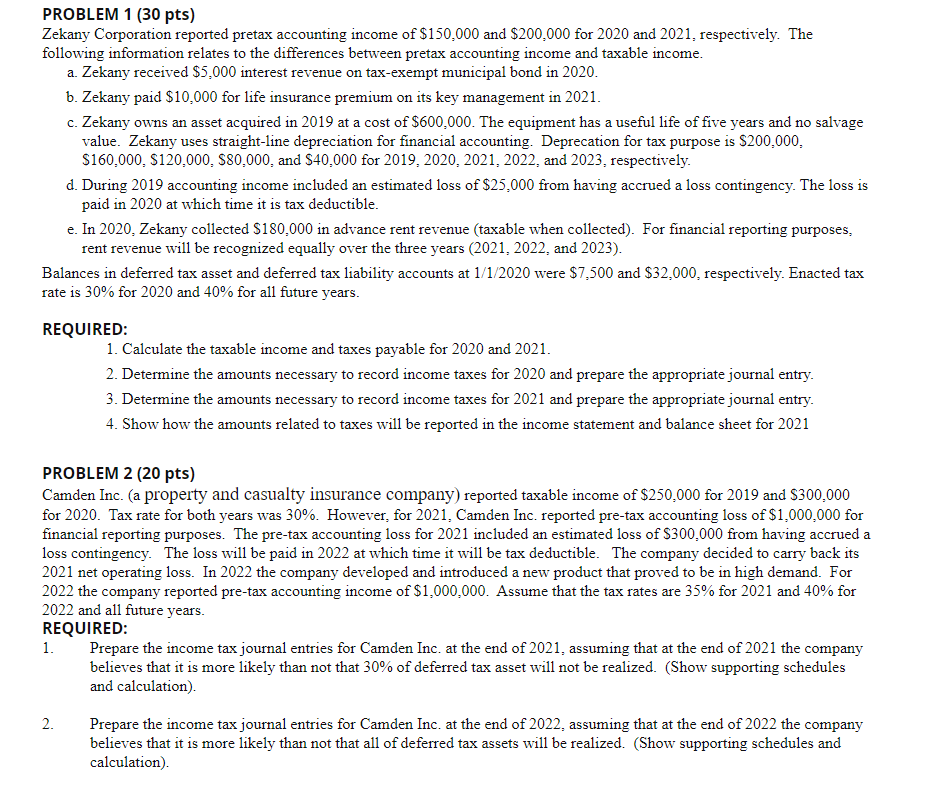

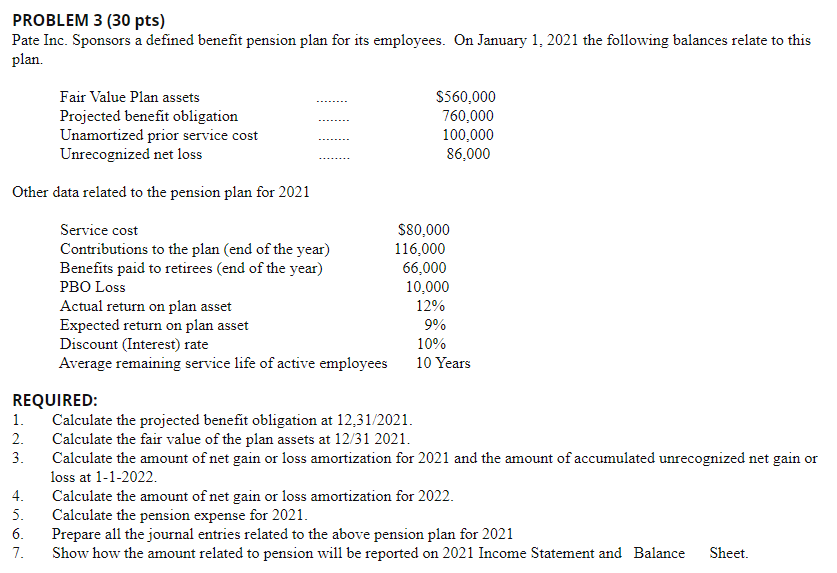

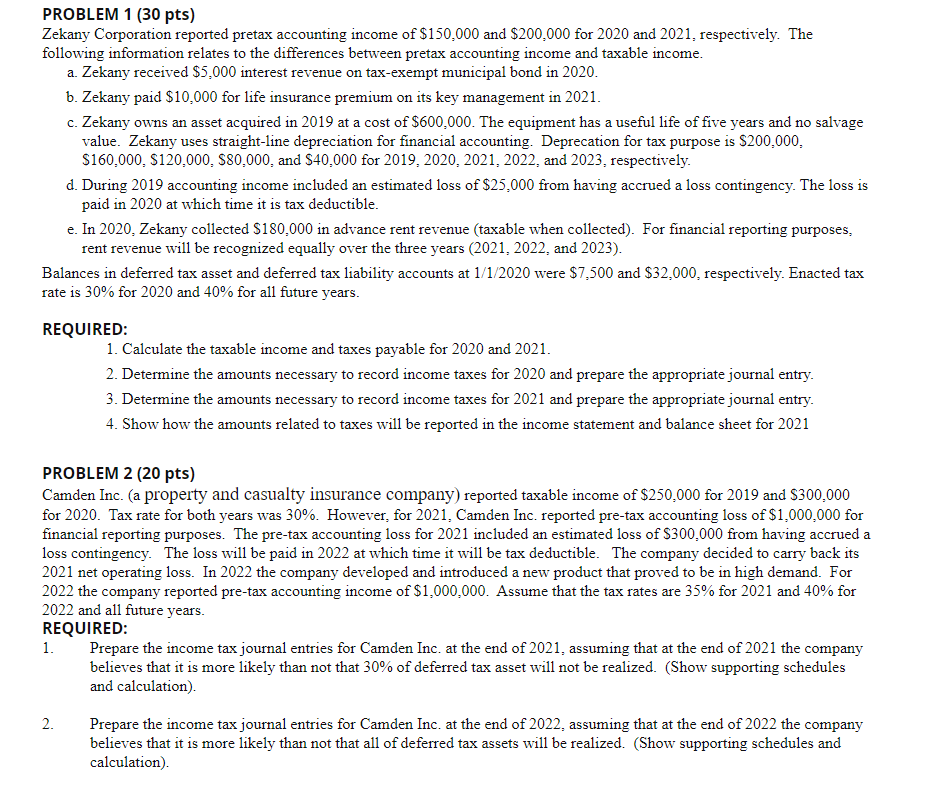

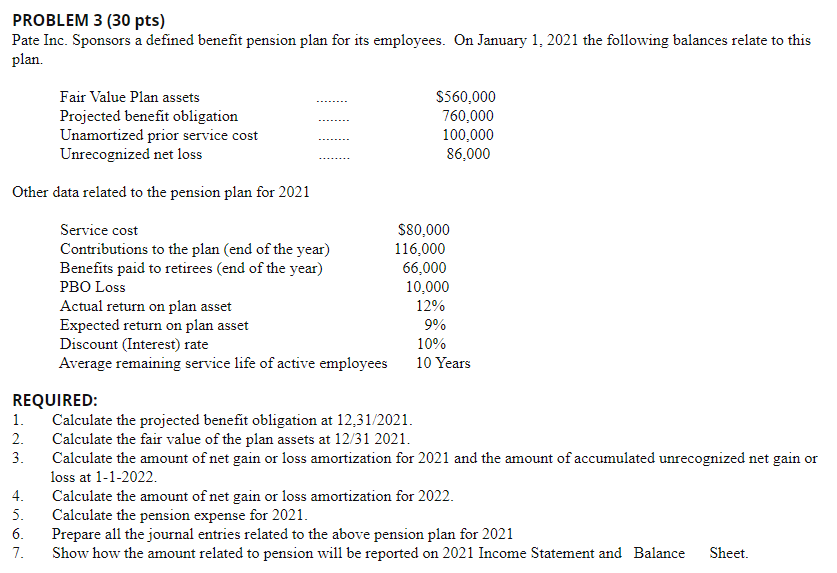

PROBLEM 1 (30 pts) Zekany Corporation reported pretax accounting income of $150,000 and $200,000 for 2020 and 2021, respectively. The following information relates to the differences between pretax accounting income and taxable income. a. Zekany received $5,000 interest revenue on tax-exempt municipal bond in 2020. b. Zekany paid $10,000 for life insurance premium on its key management in 2021. c. Zekany owns an asset acquired in 2019 at a cost of $600,000. The equipment has a useful life of five years and no salvage value. Zekany uses straight-line depreciation for financial accounting. Deprecation for tax purpose is $200,000. $160.000. $120.000, S80,000, and $40,000 for 2019, 2020 2021 2022, and 2023, respectively. d. During 2019 accounting income included an estimated loss of $25,000 from having accrued a loss contingency. The loss is paid in 2020 at which time it is tax deductible. e. In 2020. Zekany collected $180.000 in advance rent revenue (taxable when collected). For financial reporting purposes, rent revenue will be recognized equally over the three years (2021, 2022, and 2023). Balances in deferred tax asset and deferred tax liability accounts at 1/1/2020 were $7,500 and $32,000, respectively. Enacted tax rate is 30% for 2020 and 40% for all future years. REQUIRED: 1. Calculate the taxable income and taxes payable for 2020 and 2021. 2. Determine the amounts necessary to record income taxes for 2020 and prepare the appropriate journal entry. 3. Determine the amounts necessary to record income taxes for 2021 and prepare the appropriate journal entry. 4. Show how the amounts related to taxes will be reported in the income statement and balance sheet for 2021 PROBLEM 2 (20 pts) Camden Inc. (a property and casualty insurance company) reported taxable income of $250,000 for 2019 and $300.000 for 2020. Tax rate for both years was 30%. However, for 2021. Camden Inc. reported pre-tax accounting loss of $1,000,000 for financial reporting purposes. The pre-tax accounting loss for 2021 included an estimated loss of $300.000 from having accrued a loss contingency. The loss will be paid in 2022 at which time it will be tax deductible. The company decided to carry back its 2021 net operating loss. In 2022 the company developed and introduced a new product that proved to be in high demand. For 2022 the company reported pre-tax accounting income of $1,000,000. Assume that the tax rates are 35% for 2021 and 40% for 2022 and all future years. REQUIRED: 1. Prepare the income tax journal entries for Camden Inc. at the end of 2021, assuming that at the end of 2021 the company believes that it is more likely than not that 30% of deferred tax asset will not be realized. (Show supporting schedules and calculation) 2. Prepare the income tax journal entries for Camden Inc. at the end of 2022, assuming that at the end of 2022 the company believes that it is more likely than not that all of deferred tax assets will be realized. (Show supporting schedules and calculation) PROBLEM 3 (30 pts) Pate Inc. Sponsors a defined benefit pension plan for its employees. On January 1, 2021 the following balances relate to this plan. Fair Value Plan assets Projected benefit obligation Unamortized prior service cost Unrecognized net loss $560,000 760,000 100,000 86,000 Other data related to the pension plan for 2021 Service cost Contributions to the plan (end of the year) Benefits paid to retirees (end of the year) PBO Loss Actual return on plan asset Expected return on plan asset Discount (Interest) rate Average remaining service life of active employees $80,000 116,000 66,000 10,000 12% 9% 10% 10 Years REQUIRED: 1. Calculate the projected benefit obligation at 12,31/2021. 2. Calculate the fair value of the plan assets at 12/31 2021. 3. Calculate the amount of net gain or loss amortization for 2021 and the amount of accumulated unrecognized net gain or loss at 1-1-2022. 4. Calculate the amount of net gain or loss amortization for 2022. 5. Calculate the pension expense for 2021. 6. Prepare all the journal entries related to the above pension plan for 2021 7. Show how the amount related to pension will be reported on 2021 Income Statement and Balance Sheet