Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 4 - 1 Cumulative Abnormal Returns Delta, United, and American Airlines announced purchases of planes on July 1 8 ( 7 / 1

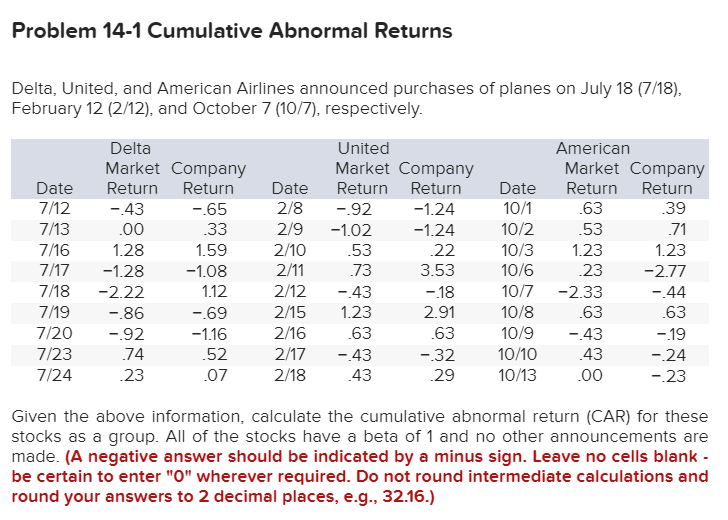

Problem Cumulative Abnormal Returns

Delta, United, and American Airlines announced purchases of planes on July February and October respectively.

tableDeltaUnited,AmericanMarket,Company,,Market,Company,,Market,CompanyDateReturn,Return,Date,Return,Return,Date,Return,Return

Given the above information, calculate the cumulative abnormal return CAR for these stocks as a group. All of the stocks have a beta of and no other announcements are made. A negative answer should be indicated by a minus sign. Leave no cells blank be certain to enter wherever required. Do not round intermediate calculations and round your answers to decimal places, egtabletableDays fromannouncementAbnormal returns RiRMtableAverage abnormalreturntableCumulativeabnormal returnDeltaUnited,American,Sum

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started