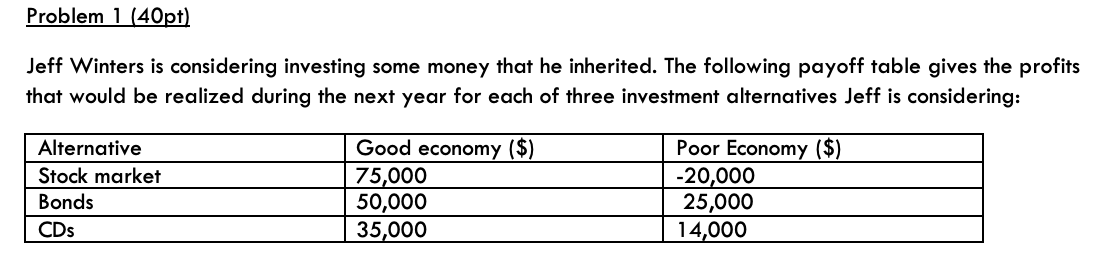

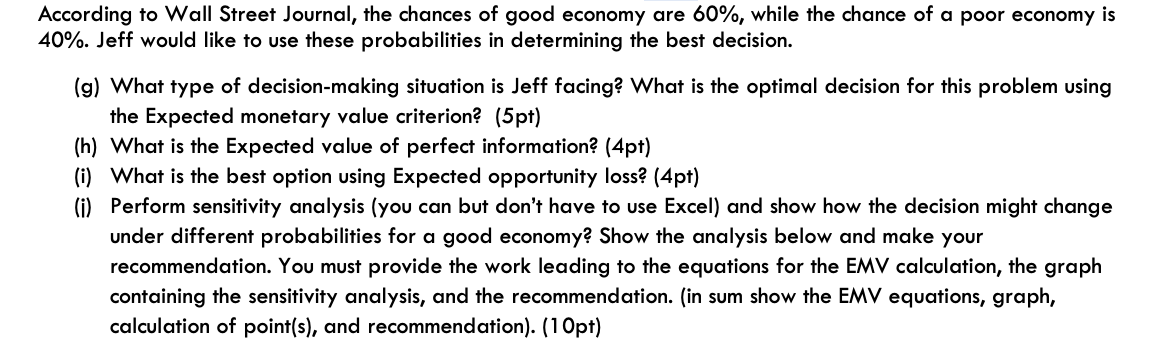

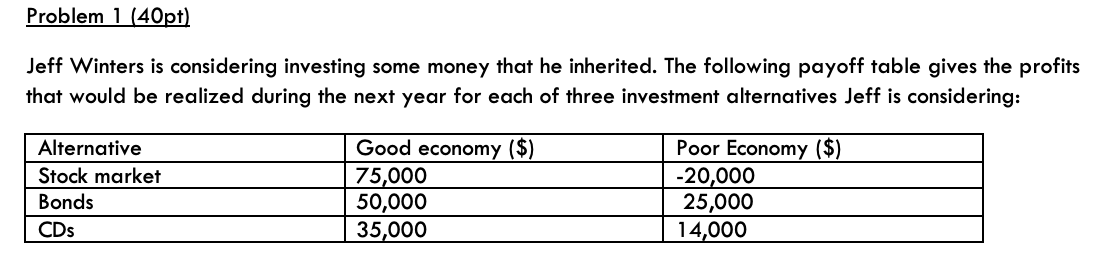

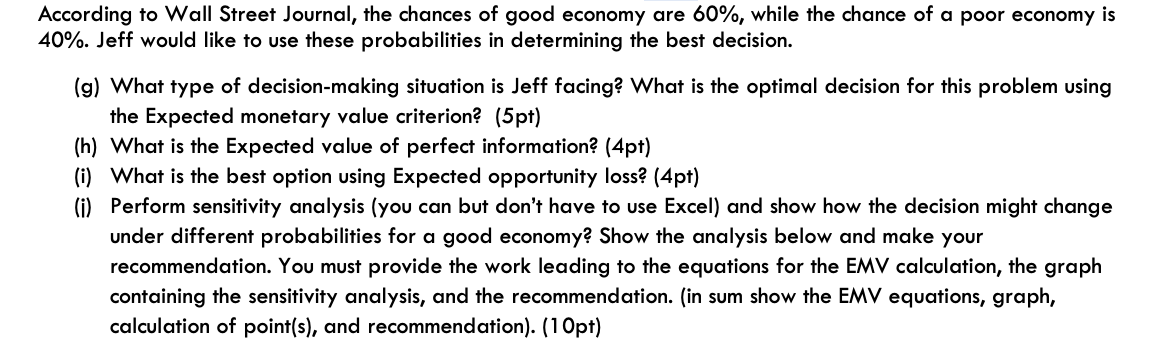

Problem 1 (40pt) Jeff Winters is considering investing some money that he inherited. The following payoff table gives the profits that would be realized during the next year for each of three investment alternatives Jeff is considering: Alternative Stock market Bonds CDs Good economy ($) 75,000 50,000 35,000 Poor Economy ($) -20,000 25,000 14,000 According to Wall Street Journal, the chances of good economy are 60%, while the chance of a poor economy is 40%. Jeff would like to use these probabilities in determining the best decision. (g) What type of decision-making situation is Jeff facing? What is the optimal decision for this problem using the Expected monetary value criterion? (5pt) (h) What is the Expected value of perfect information? (4pt) (i) What is the best option using Expected opportunity loss? (4pt) (i) Perform sensitivity analysis (you can but don't have to use Excel) and show how the decision might change under different probabilities for a good economy? Show the analysis below and make your recommendation. You must provide the work leading to the equations for the EMV calculation, the graph containing the sensitivity analysis, and the recommendation. (in sum show the EMV equations, graph, calculation of point(s), and recommendation). (10pt) Problem 1 (40pt) Jeff Winters is considering investing some money that he inherited. The following payoff table gives the profits that would be realized during the next year for each of three investment alternatives Jeff is considering: Alternative Stock market Bonds CDs Good economy ($) 75,000 50,000 35,000 Poor Economy ($) -20,000 25,000 14,000 According to Wall Street Journal, the chances of good economy are 60%, while the chance of a poor economy is 40%. Jeff would like to use these probabilities in determining the best decision. (g) What type of decision-making situation is Jeff facing? What is the optimal decision for this problem using the Expected monetary value criterion? (5pt) (h) What is the Expected value of perfect information? (4pt) (i) What is the best option using Expected opportunity loss? (4pt) (i) Perform sensitivity analysis (you can but don't have to use Excel) and show how the decision might change under different probabilities for a good economy? Show the analysis below and make your recommendation. You must provide the work leading to the equations for the EMV calculation, the graph containing the sensitivity analysis, and the recommendation. (in sum show the EMV equations, graph, calculation of point(s), and recommendation). (10pt)