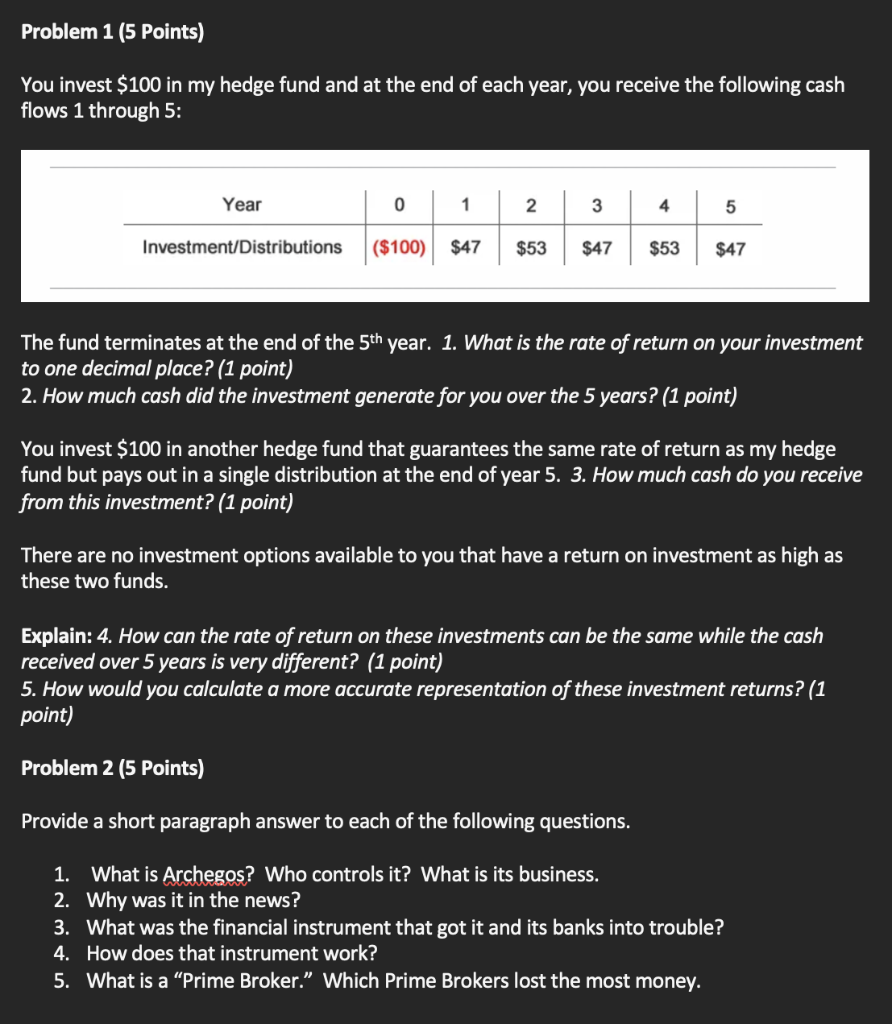

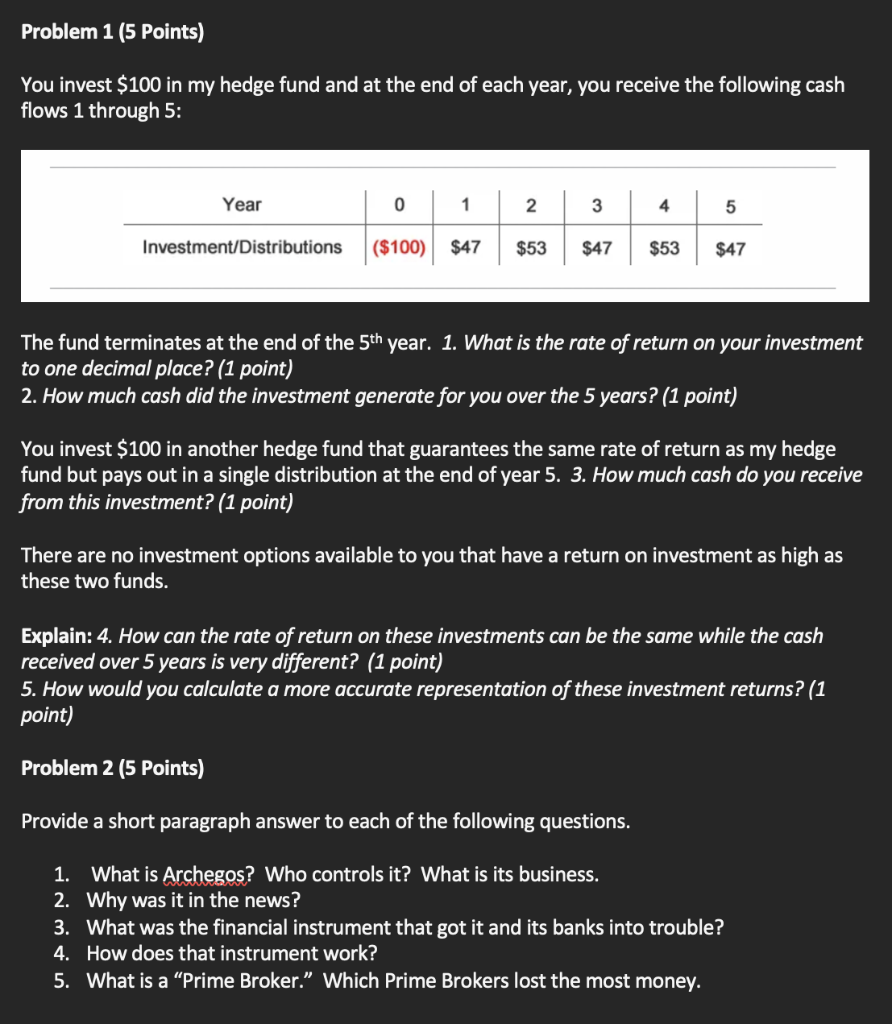

Problem 1 (5 Points) You invest $100 in my hedge fund and at the end of each year, you receive the following cash flows 1 through 5: Year 0 1 2. 3 4 5 Investment/Distributions ($100) $47 $53 $47 $53 $47 The fund terminates at the end of the 5th year. 1. What is the rate of return on your investment to one decimal place? (1 point) 2. How much cash did the investment generate for you over the 5 years? (1 point) You invest $100 in another hedge fund that guarantees the same rate of return as my hedge fund but pays out in a single distribution at the end of year 5. 3. How much cash do you receive from this investment? (1 point) There are no investment options available to you that have a return on investment as high as these two funds. Explain: 4. How can the rate of return on these investments can be the same while the cash received over 5 years is very different? (1 point) 5. How would you calculate a more accurate representation of these investment returns? (1 point) Problem 2 (5 Points) Provide a short paragraph answer to each of the following questions. 1. What is Who controls it? What is its business. 2. Why was it in the news? 3. What was the financial instrument that got it and its banks into trouble? 4. How does that instrument work? 5. What is a Prime Broker. Which Prime Brokers lost the most money. Problem 1 (5 Points) You invest $100 in my hedge fund and at the end of each year, you receive the following cash flows 1 through 5: Year 0 1 2. 3 4 5 Investment/Distributions ($100) $47 $53 $47 $53 $47 The fund terminates at the end of the 5th year. 1. What is the rate of return on your investment to one decimal place? (1 point) 2. How much cash did the investment generate for you over the 5 years? (1 point) You invest $100 in another hedge fund that guarantees the same rate of return as my hedge fund but pays out in a single distribution at the end of year 5. 3. How much cash do you receive from this investment? (1 point) There are no investment options available to you that have a return on investment as high as these two funds. Explain: 4. How can the rate of return on these investments can be the same while the cash received over 5 years is very different? (1 point) 5. How would you calculate a more accurate representation of these investment returns? (1 point) Problem 2 (5 Points) Provide a short paragraph answer to each of the following questions. 1. What is Who controls it? What is its business. 2. Why was it in the news? 3. What was the financial instrument that got it and its banks into trouble? 4. How does that instrument work? 5. What is a Prime Broker. Which Prime Brokers lost the most money