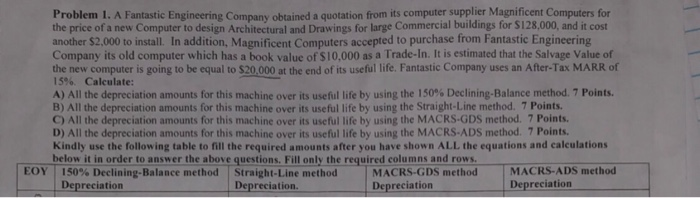

Problem 1. A Fantastic Engineering Company obtained a quotation from its computer supplier Magnificent Computers for the price of a new Computer to design Architectural and Drawings for large Commercial buildings for $128,000, and it cost another $2,000 to install. In addition, Magnificent Computers accepted to purchase from Fantastic Engineering Company its old computer which has a book value of $10,000 as a Trade-In. It is estimated that the Salvage Value of the new computer is going to be equal to $20,000 at the end of its useful life. Fantastic Company uses an After-Tax MARR of 15% Calculate A) All the depreciation amounts for this machine over its useful life by using the 150% Declining Balance method. Points. B) All the depreciation amounts for this machine over its useful life by using the Straight-Line method. 7 Points. C) All the depreciation amounts for this machine over its useful life by using the MACRS-GDS method. 7 Points. D) All the depreciation amounts for this machine over its useful life by using the MACRS-ADS method. 7 Points. Kindly use the following table to fill the required amounts after you have shown ALL the equations and calculations below it in order to answer the above questions. Fill only the required columns and rows. EOV 150% Declining Balance method Depreciation Straight Line method Depreciation. MACRSGDS-method Depreciation MAC RS ADS method Depreciation Problem 1. A Fantastic Engineering Company obtained a quotation from its computer supplier Magnificent Computers for the price of a new Computer to design Architectural and Drawings for large Commercial buildings for $128,000, and it cost another $2,000 to install. In addition, Magnificent Computers accepted to purchase from Fantastic Engineering Company its old computer which has a book value of $10,000 as a Trade-In. It is estimated that the Salvage Value of the new computer is going to be equal to $20,000 at the end of its useful life. Fantastic Company uses an After-Tax MARR of 15% Calculate A) All the depreciation amounts for this machine over its useful life by using the 150% Declining Balance method. Points. B) All the depreciation amounts for this machine over its useful life by using the Straight-Line method. 7 Points. C) All the depreciation amounts for this machine over its useful life by using the MACRS-GDS method. 7 Points. D) All the depreciation amounts for this machine over its useful life by using the MACRS-ADS method. 7 Points. Kindly use the following table to fill the required amounts after you have shown ALL the equations and calculations below it in order to answer the above questions. Fill only the required columns and rows. EOV 150% Declining Balance method Depreciation Straight Line method Depreciation. MACRSGDS-method Depreciation MAC RS ADS method Depreciation