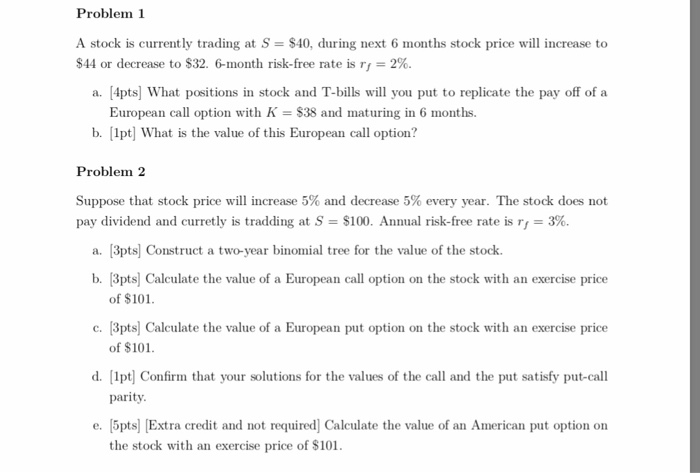

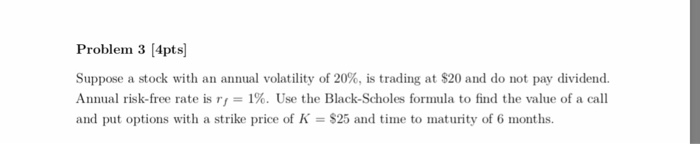

Problem 1 A stock is currently trading at S $40, during next 6 months stock price will increase to $44 or decrease to $32-6-month risk-free rate is r,--2%. a. [4pts] What positions in stock and T-bills will you put to replicate the pay off of a European call option with K-S38 and maturing in 6 months. b. lpt What is the value of this European call option? Problem 2 Suppose that stock price will increase 5% and decrease 5% every year. The stock does not pay dividend and curretly is trading at S-$100. Annual risk-free rate is rf-3%. a. [3pts] Construct a two-year binomial tree for the value of the stock. b. 3pts Calculate the value of a European call option on the stock with an exercise price of $101 c. 3pts] Caleulate the value of a European put option on the stock with an exercise price d. [1pt Confirm that your solutions for the values of the call and the put satisfy put-call e. 5pts Extra credit and not required] Calculate the value of an American put option on of $101 parity the stock with an exercise price of S101 Problem 3 [4pts Suppose a stock with an annual volatility of 20%, is trading at $20 and do not pay dividend. Annual risk-free rate is r, = 1%. Use the Black-Scholes formula to find the value of a call and put options with a strike price of K $25 and time to maturity of 6 months. Problem 1 A stock is currently trading at S $40, during next 6 months stock price will increase to $44 or decrease to $32-6-month risk-free rate is r,--2%. a. [4pts] What positions in stock and T-bills will you put to replicate the pay off of a European call option with K-S38 and maturing in 6 months. b. lpt What is the value of this European call option? Problem 2 Suppose that stock price will increase 5% and decrease 5% every year. The stock does not pay dividend and curretly is trading at S-$100. Annual risk-free rate is rf-3%. a. [3pts] Construct a two-year binomial tree for the value of the stock. b. 3pts Calculate the value of a European call option on the stock with an exercise price of $101 c. 3pts] Caleulate the value of a European put option on the stock with an exercise price d. [1pt Confirm that your solutions for the values of the call and the put satisfy put-call e. 5pts Extra credit and not required] Calculate the value of an American put option on of $101 parity the stock with an exercise price of S101 Problem 3 [4pts Suppose a stock with an annual volatility of 20%, is trading at $20 and do not pay dividend. Annual risk-free rate is r, = 1%. Use the Black-Scholes formula to find the value of a call and put options with a strike price of K $25 and time to maturity of 6 months