Answered step by step

Verified Expert Solution

Question

1 Approved Answer

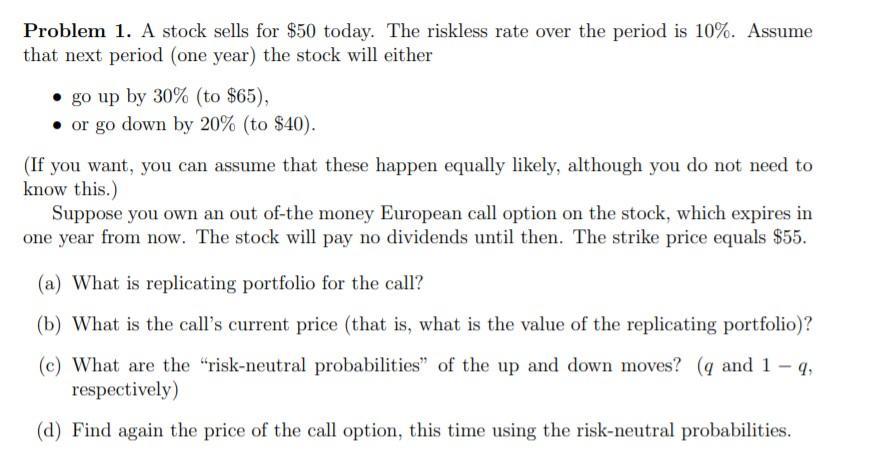

Problem 1. A stock sells for $50 today. The riskless rate over the period is 10%. Assume that next period (one year) the stock

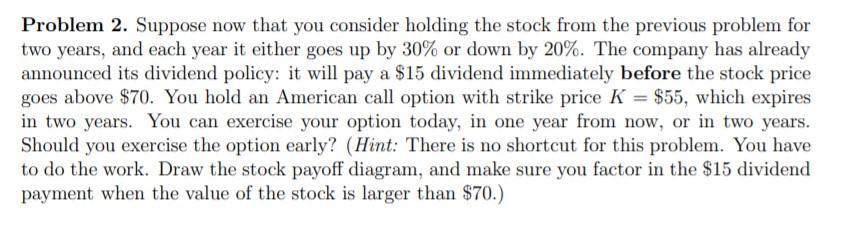

Problem 1. A stock sells for $50 today. The riskless rate over the period is 10%. Assume that next period (one year) the stock will either go up by 30% (to $65), or go down by 20% (to $40). (If you want, you can assume that these happen equally likely, although you do not need to know this.) Suppose you own an out of-the money European call option on the stock, which expires in one year from now. The stock will pay no dividends until then. The strike price equals $55. (a) What is replicating portfolio for the call? (b) What is the call's current price (that is, what is the value of the replicating portfolio)? (c) What are the "risk-neutral probabilities" of the up and down moves? (q and 1-q, respectively) (d) Find again the price of the call option, this time using the risk-neutral probabilities. Problem 2. Suppose now that you consider holding the stock from the previous problem for two years, and each year it either goes up by 30% or down by 20%. The company has already announced its dividend policy: it will pay a $15 dividend immediately before the stock price goes above $70. You hold an American call option with strike price K = $55, which expires in two years. You can exercise your option today, in one year from now, or in two years. Should you exercise the option early? (Hint: There is no shortcut for this problem. You have to do the work. Draw the stock payoff diagram, and make sure you factor in the $15 dividend payment when the value of the stock is larger than $70.)

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

aj Let D be the amount of shares to be bought and B the amount to borrow R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started