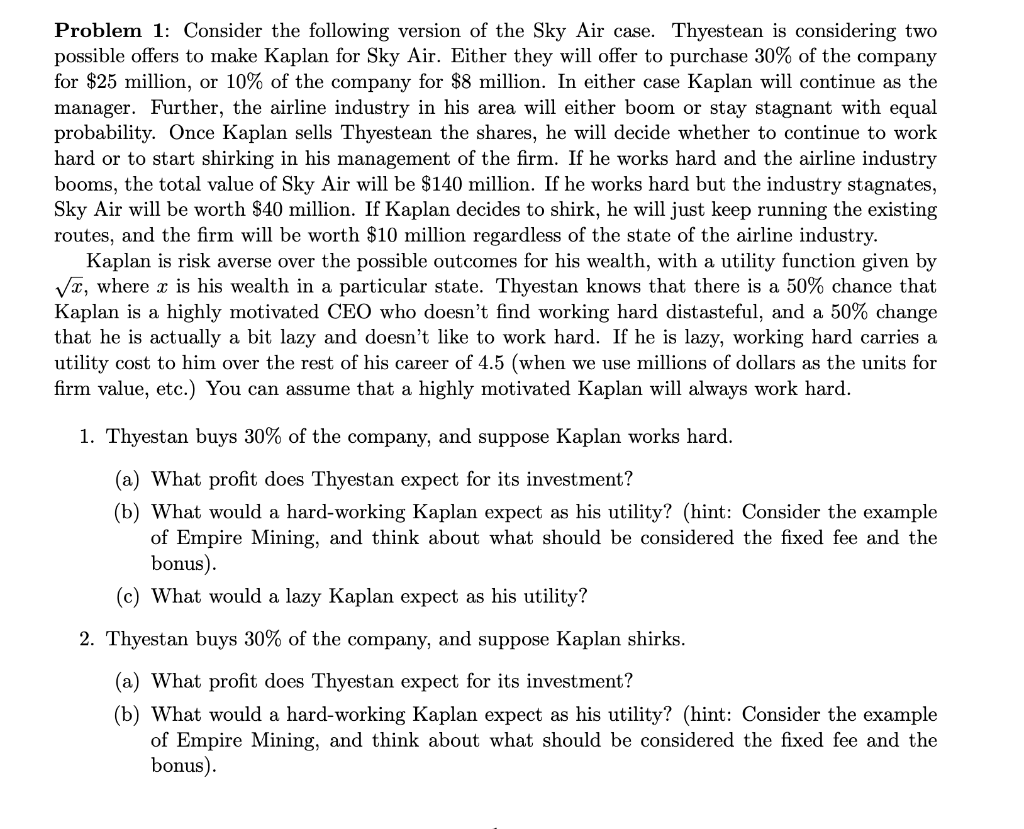

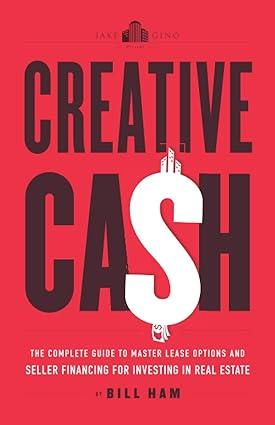

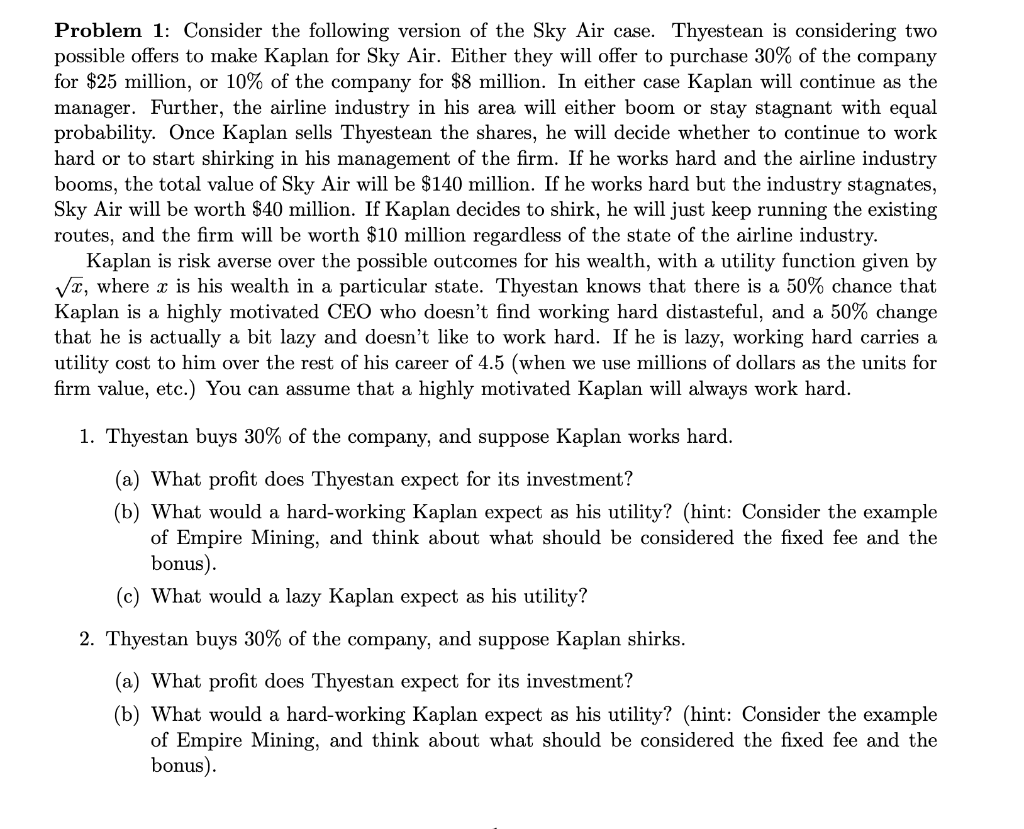

Problem 1: Consider the following version of the Sky Air case. Thyestean is considering two possible offers to make Kaplan for Sky Air. Either they will offer to purchase 30% of the company for $25 million, or 10% of the company for $8 million. In either case Kaplan will continue as the manager. Further, the airline industry in his area will either boom or stay stagnant with equal probability. Once Kaplan sells Thyestean the shares, he will decide whether to continue to work hard or to start shirking in his management of the firm. If he works hard and the airline industry booms, the total value of Sky Air will be $140 million. If he works hard but the industry stagnates, Sky Air will be worth $40 million. If Kaplan decides to shirk, he will just keep running the existing routes, and the firm will be worth $10 million regardless of the state of the airline industry. Kaplan is risk averse over the possible outcomes for his wealth, with a utility function given by Vr, where x is his wealth in a particular state. Thyestan knows that there is a 50% chance that Kaplan is a highly motivated CEO who doesn't find working hard distasteful, and a 50% change that he is actually a bit lazy and doesn't like to work hard. If he is lazy, working hard carries a utility cost to him over the rest of his career of 4.5 (when we use millions of dollars as the units for firm value, etc.) You can assume that a highly motivated Kaplan will always work hard. 1. Thyestan buys 30% of the company, and suppose Kaplan works hard. (a) What profit does Thyestan expect for its investment? (b) What would a hard-working Kaplan expect as his utility? (hint: Consider the example of Empire Mining, and think about what should be considered the fixed fee and the bonus). (c) What would a lazy Kaplan expect as his utility? 2. Thyestan buys 30% of the company, and suppose Kaplan shirks. (a) What profit does Thyestan expect for its investment? (b) What would a hard-working Kaplan expect as his utility? (hint: Consider the example of Empire Mining, and think about what should be considered the fixed fee and the bonus). (c) What would a lazy Kaplan expect as his utility? 3. Answer the questions above, but with Thyestan purchasing only 10% of the company. 4. Which contract do you expect that Thyestan will offer. 5. Is this the efficient outcome? That is, is there another outcome, perhaps not an equilibrium, which is better for both parties? Problem 1: Consider the following version of the Sky Air case. Thyestean is considering two possible offers to make Kaplan for Sky Air. Either they will offer to purchase 30% of the company for $25 million, or 10% of the company for $8 million. In either case Kaplan will continue as the manager. Further, the airline industry in his area will either boom or stay stagnant with equal probability. Once Kaplan sells Thyestean the shares, he will decide whether to continue to work hard or to start shirking in his management of the firm. If he works hard and the airline industry booms, the total value of Sky Air will be $140 million. If he works hard but the industry stagnates, Sky Air will be worth $40 million. If Kaplan decides to shirk, he will just keep running the existing routes, and the firm will be worth $10 million regardless of the state of the airline industry. Kaplan is risk averse over the possible outcomes for his wealth, with a utility function given by Vr, where x is his wealth in a particular state. Thyestan knows that there is a 50% chance that Kaplan is a highly motivated CEO who doesn't find working hard distasteful, and a 50% change that he is actually a bit lazy and doesn't like to work hard. If he is lazy, working hard carries a utility cost to him over the rest of his career of 4.5 (when we use millions of dollars as the units for firm value, etc.) You can assume that a highly motivated Kaplan will always work hard. 1. Thyestan buys 30% of the company, and suppose Kaplan works hard. (a) What profit does Thyestan expect for its investment? (b) What would a hard-working Kaplan expect as his utility? (hint: Consider the example of Empire Mining, and think about what should be considered the fixed fee and the bonus). (c) What would a lazy Kaplan expect as his utility? 2. Thyestan buys 30% of the company, and suppose Kaplan shirks. (a) What profit does Thyestan expect for its investment? (b) What would a hard-working Kaplan expect as his utility? (hint: Consider the example of Empire Mining, and think about what should be considered the fixed fee and the bonus). (c) What would a lazy Kaplan expect as his utility? 3. Answer the questions above, but with Thyestan purchasing only 10% of the company. 4. Which contract do you expect that Thyestan will offer. 5. Is this the efficient outcome? That is, is there another outcome, perhaps not an equilibrium, which is better for both parties