Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1: Dandy Desks Company manufactures two products: a standing desk and a portable desk. The portable desks are more complex of the two products,

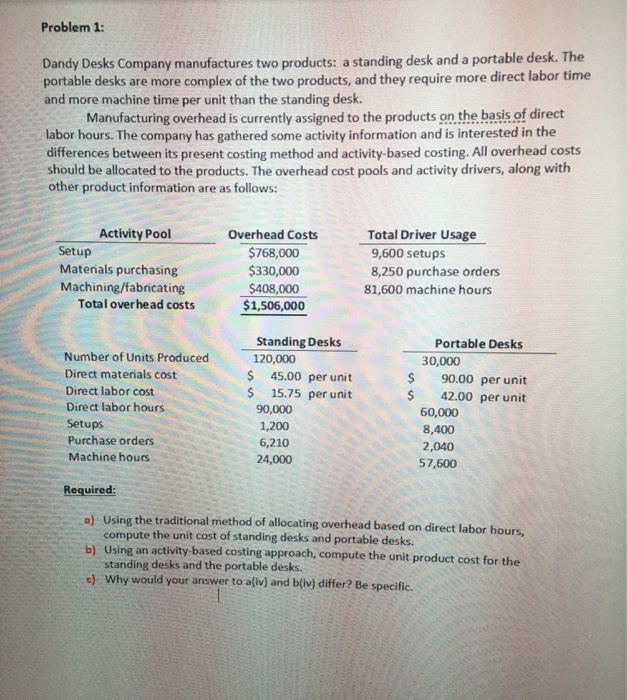

Problem 1: Dandy Desks Company manufactures two products: a standing desk and a portable desk. The portable desks are more complex of the two products, and they require more direct labor time and more machine time per unit than the standing desk. Manufacturing overhead is currently assigned to the products on the basis of direct labor hours. The company has gathered some activity information and is interested in the differences between its present costing method and activity-based costing. All overhead costs should be allocated to the products. The overhead cost pools and activity drivers, along with other product information are as follows: Activity Pool Setup Materials purchasing Machining/fabricating Total over head costs Overhead Costs $768,000 $330,000 $408,000 $1,506,000 Total Driver Usage 9,600 setups 8,250 purchase orders 81,600 machine hours Number of Units Produced Direct materials cost Direct labor cost Direct labor hours Setups Purchase orders Machine hours Standing Desks 120,000 $ 45.00 per unit $ 15.75 per unit 90,000 1,200 6,210 24,000 Portable Desks 30,000 90.00 per unit 42.00 per unit 60,000 8,400 2,040 57,600 Required: a) Using the traditional method of allocating overhead based on direct labor hours, compute the unit cost of standing desks and portable desks. b) Using an activity-based costing approach, compute the unit product cost for the standing desks and the portable desks. c) Why would your answer to aliv) and (iv) differ? Be specific

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started