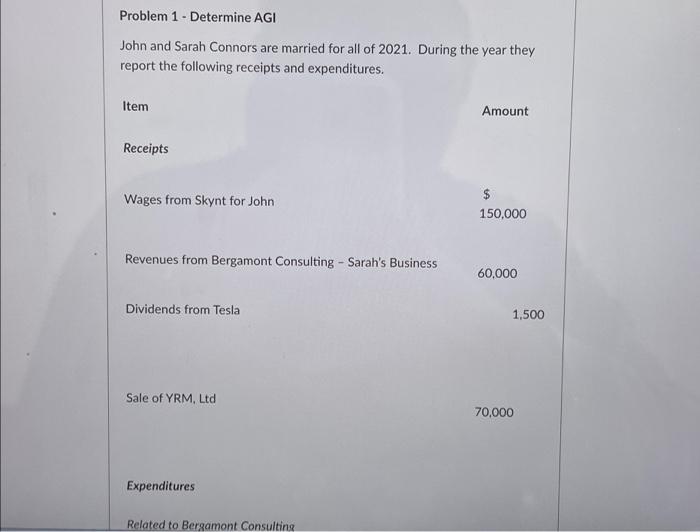

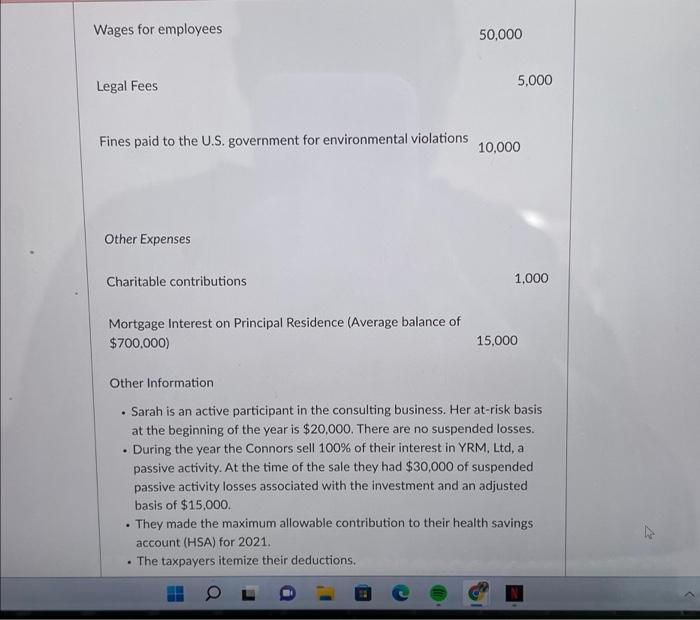

Problem 1 - Determine AGI John and Sarah Connors are married for all of 2021. During the year they report the following receipts and expenditures. Item Amount Receipts Wages from Skynt for John 150,000 Revenues from Bergamont Consulting - Sarah's Business 60,000 Dividends from Tesla 1,500 Sale of YRM, Ltd 70,000 Expenditures Related to Bergamont Consulting Wages for employees 50,000 Legal Fees 5,000 Fines paid to the U.S. government for environmental violations 10.000 Other Expenses Charitable contributions 1,000 Mortgage Interest on Principal Residence (Average balance of $700.000) 15,000 . . Other Information . Sarah is an active participant in the consulting business. Her at-risk basis at the beginning of the year is $20,000. There are no suspended losses. During the year the Connors sell 100% of their interest in YRM, Ltd, a passive activity. At the time of the sale they had $30,000 of suspended passive activity losses associated with the investment and an adjusted basis of $15,000. They made the maximum allowable contribution to their health savings account (HSA) for 2021. The taxpayers itemize their deductions. . Problem 1 - Determine AGI John and Sarah Connors are married for all of 2021. During the year they report the following receipts and expenditures. Item Amount Receipts Wages from Skynt for John 150,000 Revenues from Bergamont Consulting - Sarah's Business 60,000 Dividends from Tesla 1,500 Sale of YRM, Ltd 70,000 Expenditures Related to Bergamont Consulting Wages for employees 50,000 Legal Fees 5,000 Fines paid to the U.S. government for environmental violations 10.000 Other Expenses Charitable contributions 1,000 Mortgage Interest on Principal Residence (Average balance of $700.000) 15,000 . . Other Information . Sarah is an active participant in the consulting business. Her at-risk basis at the beginning of the year is $20,000. There are no suspended losses. During the year the Connors sell 100% of their interest in YRM, Ltd, a passive activity. At the time of the sale they had $30,000 of suspended passive activity losses associated with the investment and an adjusted basis of $15,000. They made the maximum allowable contribution to their health savings account (HSA) for 2021. The taxpayers itemize their deductions