Problem 1: E18-5 in page 18-58

Problem 2: E18-12 in page 18-59

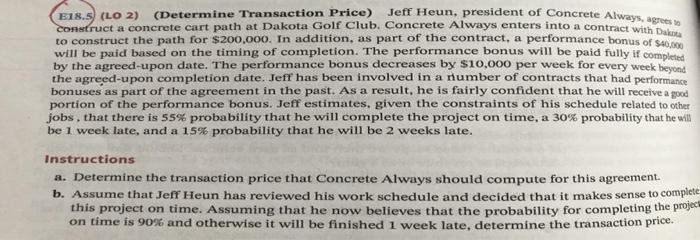

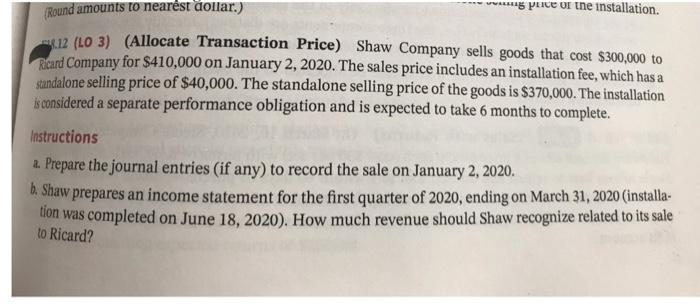

E18.5) (LO 2) (Determine Transaction Price) Jeff Heun, president of Concrete Always, agrees to construct a concrete cart path at Dakota Golf Club. Concrete Always enters into a contract with Dakota to construct the path for $200.000. In addition, as part of the contract, a performance bonus of $40,000 will be paid based on the timing of completion. The performance bonus will be paid fully if completed by the agreed-upon date. The performance bonus decreases by $10,000 per week for every week beyond the agreed-upon completion date. Jeff has been involved in a number of contracts that had performance bonuses as part of the agreement in the past. As a result, he is fairly confident that he will receive a good portion of the performance bonus. Jeff estimates, given the constraints of his schedule related to other jobs, that there is 55% probability that he will complete the project on time, a 30% probability that he will be 1 week late, and a 15% probability that he will be 2 weeks late. Instructions a. Determine the transaction price that Concrete Always should compute for this agreement. b. Assume that Jeff Heun has reviewed his work schedule and decided that it makes sense to complete this project on time. Assuming that he now believes that the probability for completing the project on time is 90% and otherwise it will be finished 1 week late, determine the transaction price. w Puce or the installation. (Round amounts to nearest dollar.) 3.12 (LO 3) (Allocate Transaction Price) Shaw Company sells goods that cost $300,000 to Ricard Company for $410,000 on January 2, 2020. The sales price includes an installation fee, which has a standalone selling price of $40,000. The standalone selling price of the goods is $370,000. The installation is considered a separate performance obligation and is expected to take 6 months to complete. Instructions 2. Prepare the journal entries (if any) to record the sale on January 2, 2020. b. Shaw prepares an income statement for the first quarter of 2020, ending on March 31, 2020 (installa- tion was completed on June 18, 2020), How much revenue should Shaw recognize related to its sale to Ricard