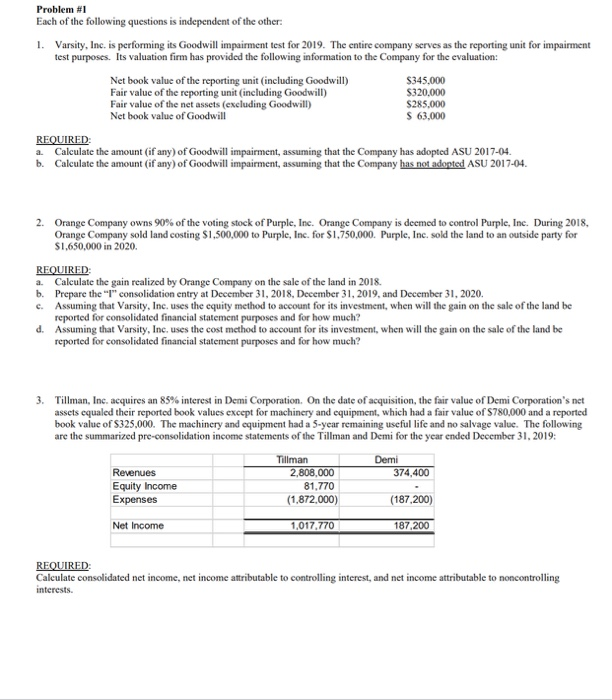

Problem #1 Each of the following questions is independent of the other: 1. Varsity, Inc. is performing its Goodwill impairment test for 2019. The entire company serves as the reporting unit for impairment test purposes. Its valuation firm has provided the following information to the Company for the evaluation: Net book value of the reporting unit (including Goodwill) Fair value of the reporting unit (including Goodwill) Fair value of the net assets (excluding Goodwill) Net book value of Goodwill $345.000 $320.000 $285,000 S 63.000 REQUIRED a. Calculate the amount (if any) of Goodwill impairment, assuming that the Company has adopted ASU 2017-04. b. Calculate the amount (if any) of Goodwill impairment, assuming that the Company has not adopted ASU 2017-04. 2. Orange Company owns 90% of the voting stock of Purple, Inc. Orange Company is deemed to control Purple, Inc. During 2018, Orange Company sold land costing $1,500,000 to Purple, Inc. for $1,750,000. Purple, Inc. sold the land to an outside party for $1,650,000 in 2020. REQUIRED: a. Calculate the gain realized by Orange Company on the sale of the land in 2018. b. Prepare the "I"consolidation entry at December 31, 2018, December 31, 2019, and December 31, 2020. c. Assuming that Varsity, Inc. uses the equity method to account for its investment, when will the gain on the sale of the land be reported for consolidated financial statement purposes and for how much? d. Assuming that Varsity, Inc. uses the cost method to account for its investment, when will the gain on the sale of the land be reported for consolidated financial statement purposes and for how much? 3. Tillman, Inc. acquires an 85% interest in Demi Corporation. On the date of acquisition, the fair value of Demi Corporation's net assets equaled their reported book values except for machinery and equipment, which had a fair value of $780,000 and a reported book value of $325,000. The machinery and equipment had a 5-year remaining useful life and no salvage value. The following are the summarized pre-consolidation income statements of the Tillman and Demi for the year ended December 31, 2019: Demi 374,400 Revenues Equity Income Expenses Tillman 2,808,000 81.770 (1,872,000) (187,200) Net Income 1,017.770 187,200 REQUIRED Calculate consolidated net income, net income attributable to controlling interest, and net income attributable to noncontrolling interests