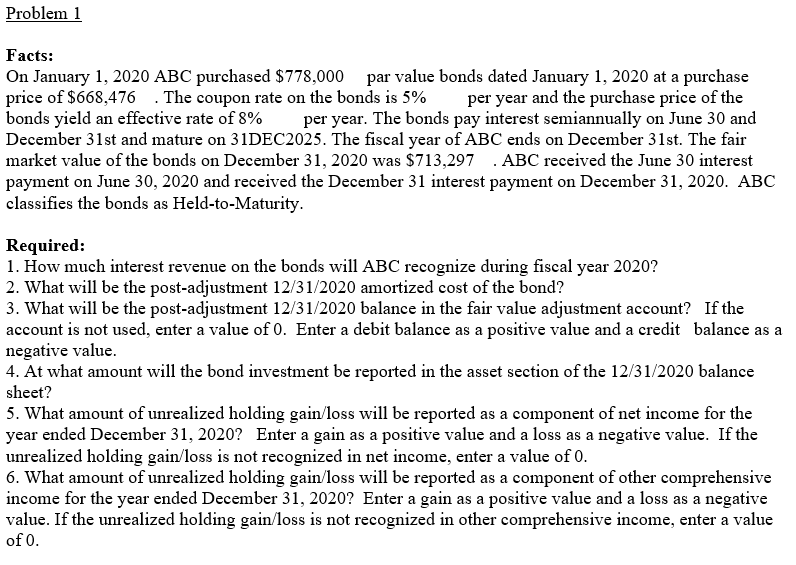

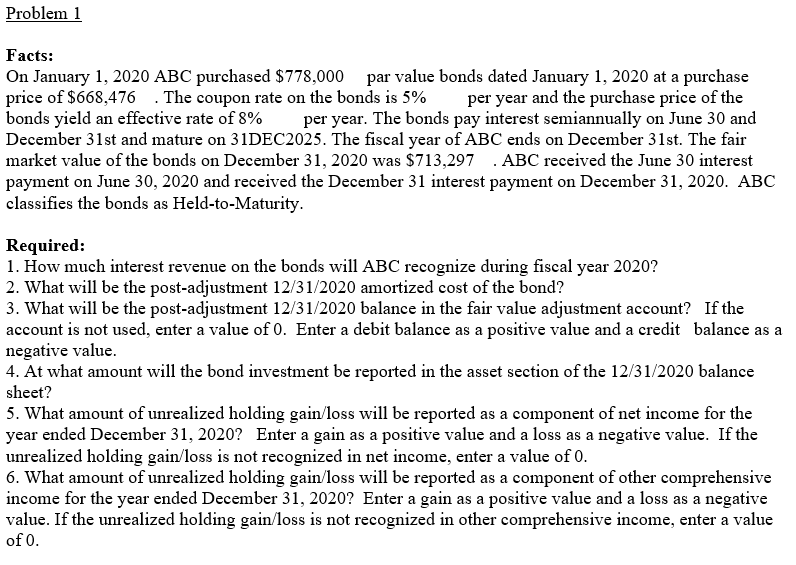

Problem 1 Facts: On January 1, 2020 ABC purchased $778,000 par value bonds dated January 1, 2020 at a purchase price of $668,476 . The coupon rate on the bonds is 5% per year and the purchase price of the bonds yield an effective rate of 8% per year. The bonds pay interest semiannually on June 30 and December 31st and mature on 31DEC2025. The fiscal year of ABC ends on December 31st. The fair market value of the bonds on December 31, 2020 was $713,297 ABC received the June 30 interest payment on June 30, 2020 and received the December 31 interest payment on December 31, 2020. ABC classifies the bonds as Held-to-Maturity. Required: 1. How much interest revenue on the bonds will ABC recognize during fiscal year 2020? 2. What will be the post-adjustment 12/31/2020 amortized cost of the bond? 3. What will be the post-adjustment 12/31/2020 balance in the fair value adjustment account? If the account is not used, enter a value of 0. Enter a debit balance as a positive value and a credit balance as a negative value. 4. At what amount will the bond investment be reported in the asset section of the 12/31/2020 balance sheet? 5. What amount of unrealized holding gain/loss will be reported as a component of net income for the year ended December 31, 2020? Enter a gain as a positive value and a loss as a negative value. If the unrealized holding gain/loss is not recognized in net income, enter a value of 0. 6. What amount of unrealized holding gain/loss will be reported as a component of other comprehensive income for the year ended December 31, 2020? Enter a gain as a positive value and a loss as a negative value. If the unrealized holding gain/loss is not recognized in other comprehensive income, enter a value of o. Problem 1 Facts: On January 1, 2020 ABC purchased $778,000 par value bonds dated January 1, 2020 at a purchase price of $668,476 . The coupon rate on the bonds is 5% per year and the purchase price of the bonds yield an effective rate of 8% per year. The bonds pay interest semiannually on June 30 and December 31st and mature on 31DEC2025. The fiscal year of ABC ends on December 31st. The fair market value of the bonds on December 31, 2020 was $713,297 ABC received the June 30 interest payment on June 30, 2020 and received the December 31 interest payment on December 31, 2020. ABC classifies the bonds as Held-to-Maturity. Required: 1. How much interest revenue on the bonds will ABC recognize during fiscal year 2020? 2. What will be the post-adjustment 12/31/2020 amortized cost of the bond? 3. What will be the post-adjustment 12/31/2020 balance in the fair value adjustment account? If the account is not used, enter a value of 0. Enter a debit balance as a positive value and a credit balance as a negative value. 4. At what amount will the bond investment be reported in the asset section of the 12/31/2020 balance sheet? 5. What amount of unrealized holding gain/loss will be reported as a component of net income for the year ended December 31, 2020? Enter a gain as a positive value and a loss as a negative value. If the unrealized holding gain/loss is not recognized in net income, enter a value of 0. 6. What amount of unrealized holding gain/loss will be reported as a component of other comprehensive income for the year ended December 31, 2020? Enter a gain as a positive value and a loss as a negative value. If the unrealized holding gain/loss is not recognized in other comprehensive income, enter a value of o