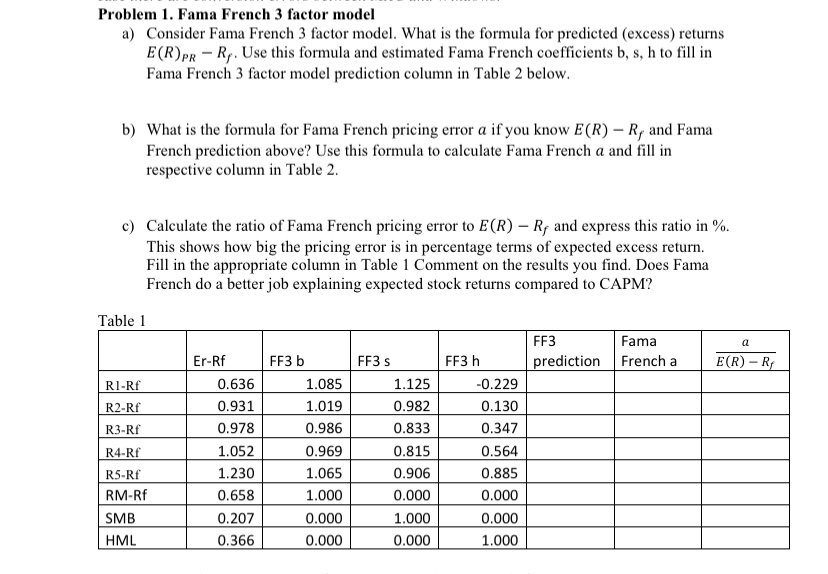

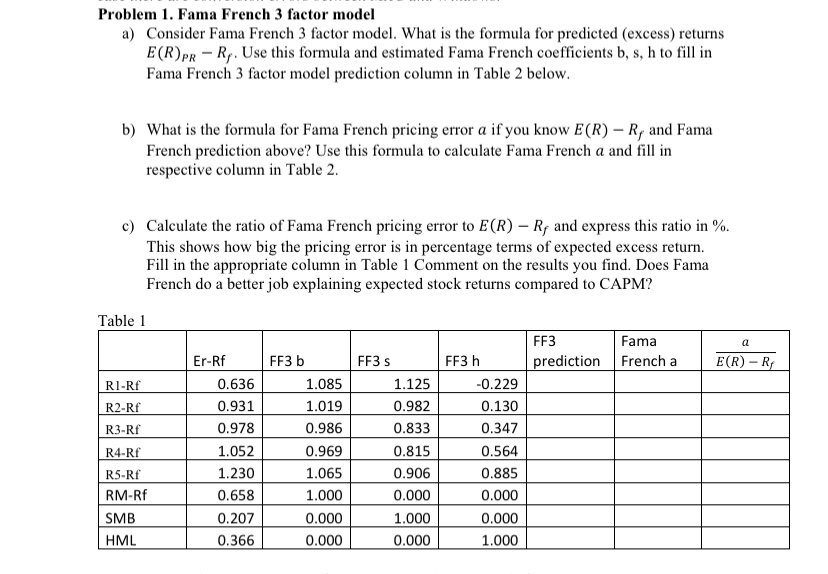

Problem 1. Fama French 3 factor model a) Consider Fama French 3 factor model. What is the formula for predicted (excess) returns E(R) pp - Rr. Use this formula and estimated Fama French coefficients b, s, h to fill in Fama French 3 factor model prediction column in Table 2 below. b) What is the formula for Fama French pricing error a if you know E(R) - R, and Fama French prediction above? Use this formula to calculate Fama French a and fill in respective column in Table 2. c) Calculate the ratio of Fama French pricing error to E(R) - R, and express this ratio in %. This shows how big the pricing error is in percentage terms of expected excess return. Fill in the appropriate column in Table 1 Comment on the results you find. Does Fama French do a better job explaining expected stock returns compared to CAPM? Table 1 FF3 prediction Fama French a FF3 E(R) - R RI-Rf R2-Rf R3-Rf R4-Rf R5-Rf RM-Rf SMB HML Er-Rf 0.636 0.931 0.978 1.052 1.230 0.658 0.207 FF3 b 1.085 1.019 0.986 0.969 1.065 1.000 0.000 0.000 1.125 0.982 0.833 0.815 0.906 0.000 1.000 0.000 FF3 h -0.229 0.130 0.347 0.564 0.885 0.000 0.000 1.000 0.366 Problem 1. Fama French 3 factor model a) Consider Fama French 3 factor model. What is the formula for predicted (excess) returns E(R) pp - Rr. Use this formula and estimated Fama French coefficients b, s, h to fill in Fama French 3 factor model prediction column in Table 2 below. b) What is the formula for Fama French pricing error a if you know E(R) - R, and Fama French prediction above? Use this formula to calculate Fama French a and fill in respective column in Table 2. c) Calculate the ratio of Fama French pricing error to E(R) - R, and express this ratio in %. This shows how big the pricing error is in percentage terms of expected excess return. Fill in the appropriate column in Table 1 Comment on the results you find. Does Fama French do a better job explaining expected stock returns compared to CAPM? Table 1 FF3 prediction Fama French a FF3 E(R) - R RI-Rf R2-Rf R3-Rf R4-Rf R5-Rf RM-Rf SMB HML Er-Rf 0.636 0.931 0.978 1.052 1.230 0.658 0.207 FF3 b 1.085 1.019 0.986 0.969 1.065 1.000 0.000 0.000 1.125 0.982 0.833 0.815 0.906 0.000 1.000 0.000 FF3 h -0.229 0.130 0.347 0.564 0.885 0.000 0.000 1.000 0.366