Answered step by step

Verified Expert Solution

Question

1 Approved Answer

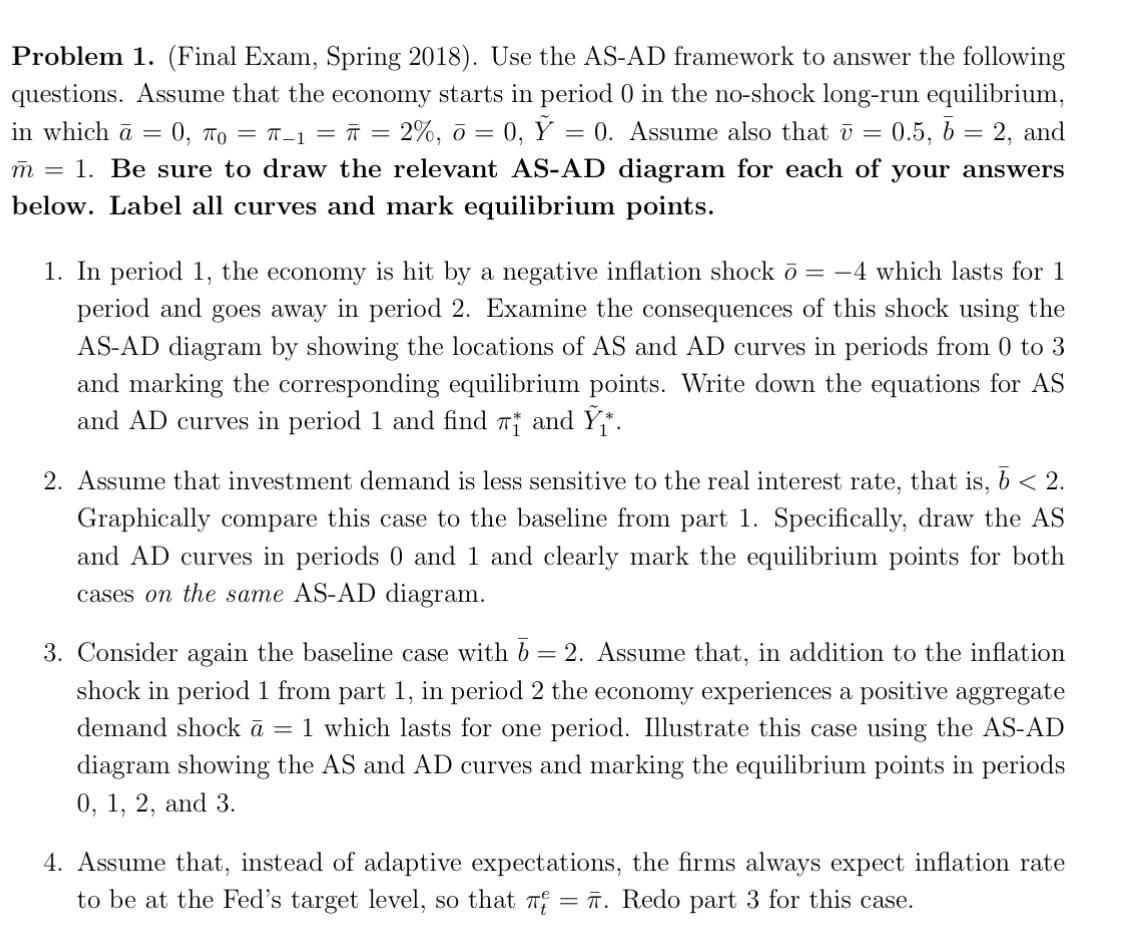

Problem 1. (Final Exam, Spring 2018). Use the AS-AD framework to answer the following questions. Assume that the economy starts in period 0 in

Problem 1. (Final Exam, Spring 2018). Use the AS-AD framework to answer the following questions. Assume that the economy starts in period 0 in the no-shock long-run equilibrium, in which a = 0 To = -1 = = 2%, 0 = 0, 0. Assume also that v = 0.5, 6 = 2, and m = 1. Be sure to draw the relevant AS-AD diagram for each of your answers below. Label all curves and mark equilibrium points. 1. In period 1, the economy is hit by a negative inflation shock = -4 which lasts for 1 period and goes away in period 2. Examine the consequences of this shock using the AS-AD diagram by showing the locations of AS and AD curves in periods from 0 to 3 and marking the corresponding equilibrium points. Write down the equations for AS and AD curves in period 1 and find and *. 2. Assume that investment demand is less sensitive to the real interest rate, that is, 6 < 2. Graphically compare this case to the baseline from part 1. Specifically, draw the AS and AD curves in periods 0 and 1 and clearly mark the equilibrium points for both cases on the same AS-AD diagram. 3. Consider again the baseline case with 6 = 2. Assume that, in addition to the inflation shock in period 1 from part 1, in period 2 the economy experiences a positive aggregate demand shock a = 1 which lasts for one period. Illustrate this case using the AS-AD diagram showing the AS and AD curves and marking the equilibrium points in periods. 0, 1, 2, and 3. 4. Assume that, instead of adaptive expectations, the firms always expect inflation rate to be at the Fed's target level, so that = . Redo part 3 for this case.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started