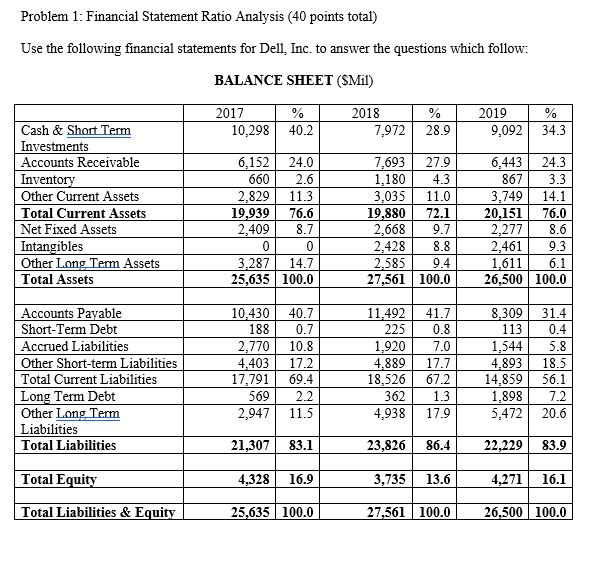

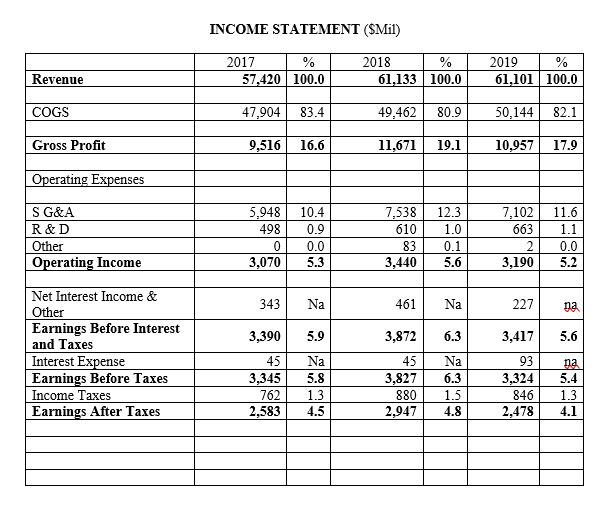

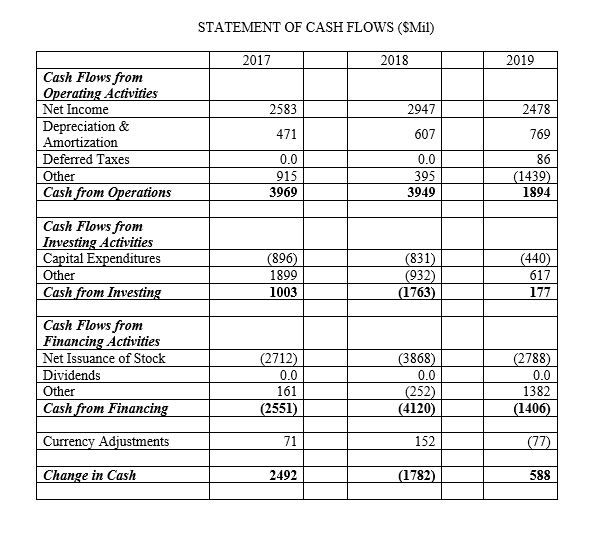

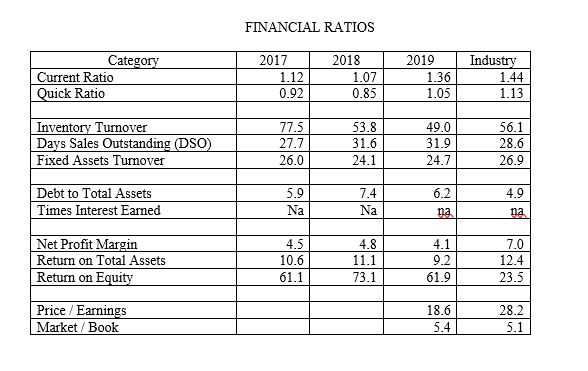

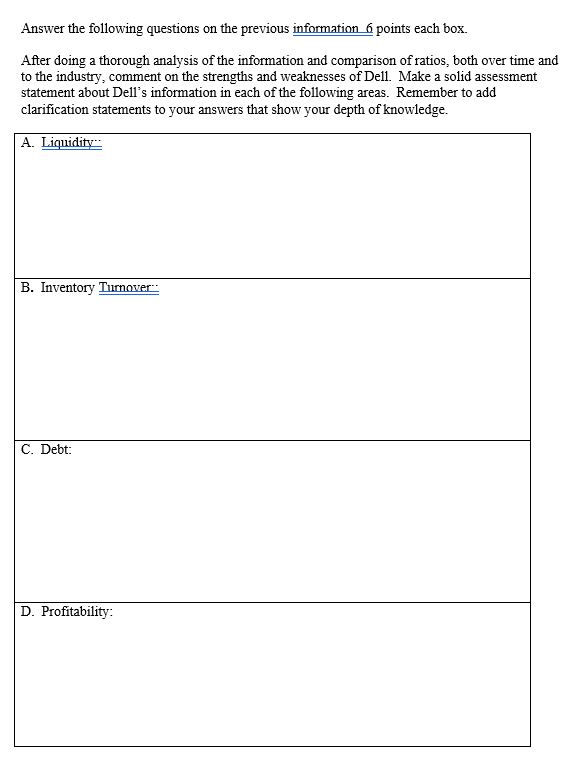

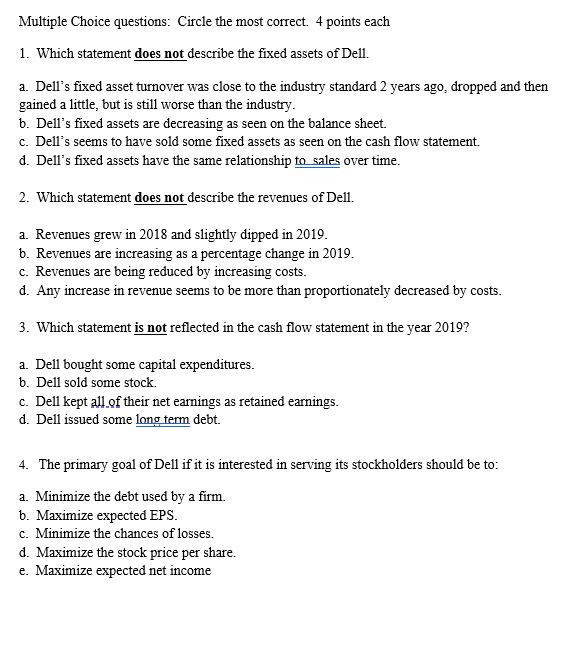

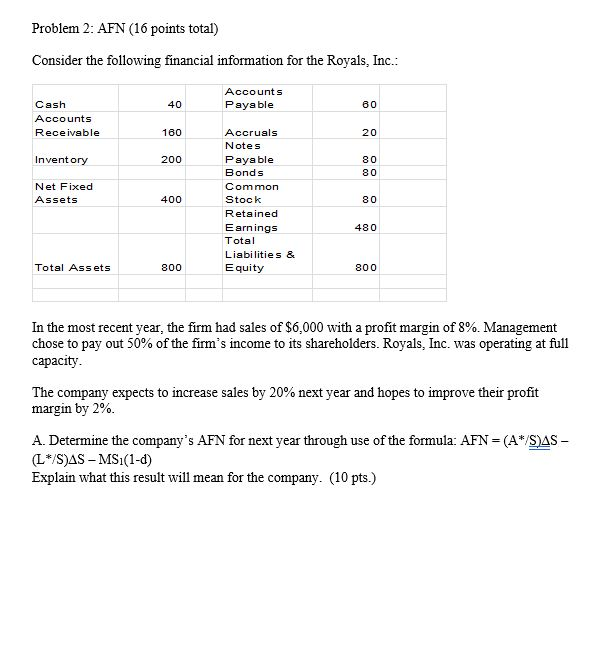

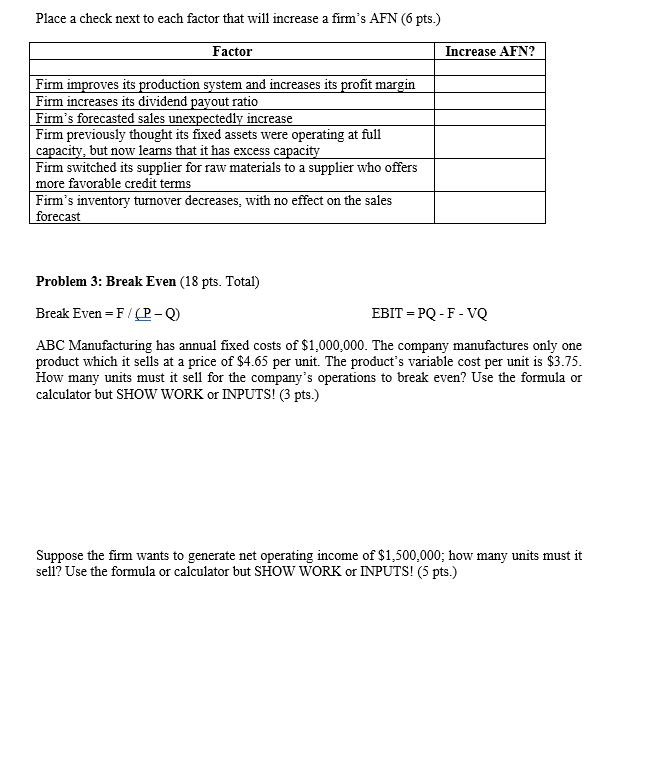

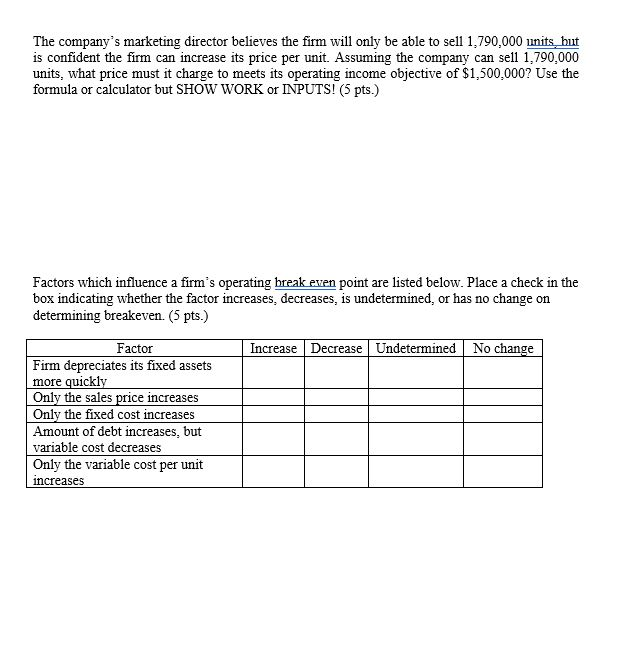

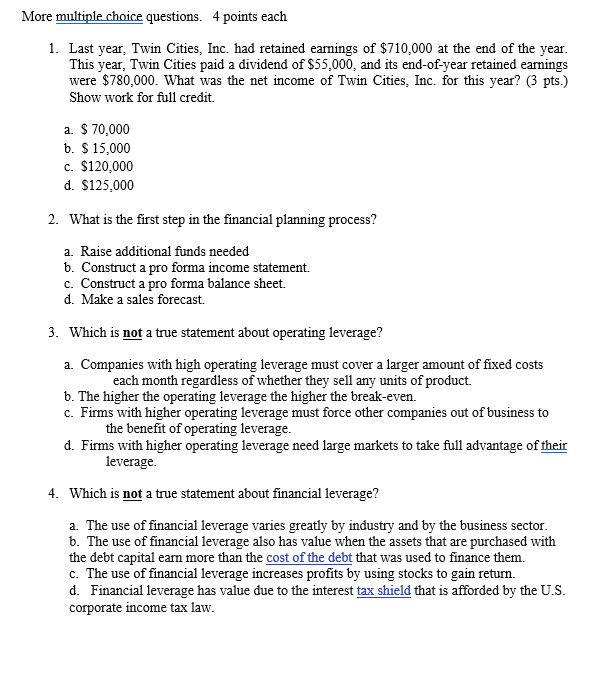

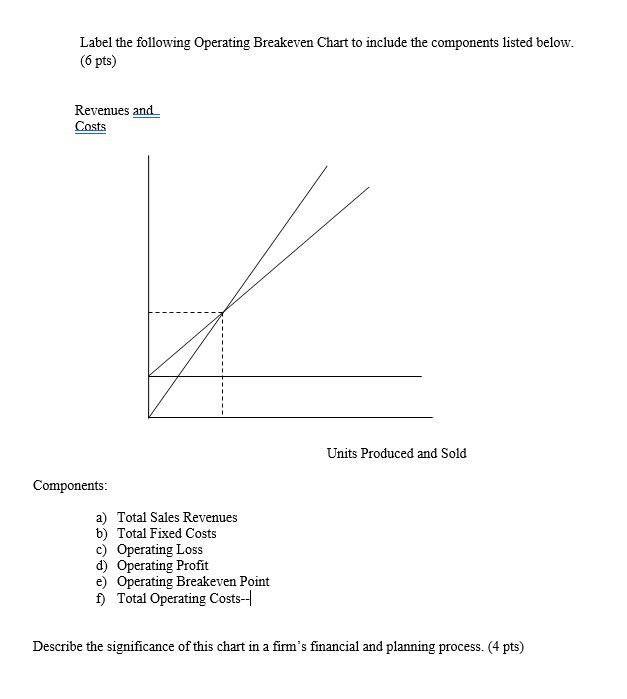

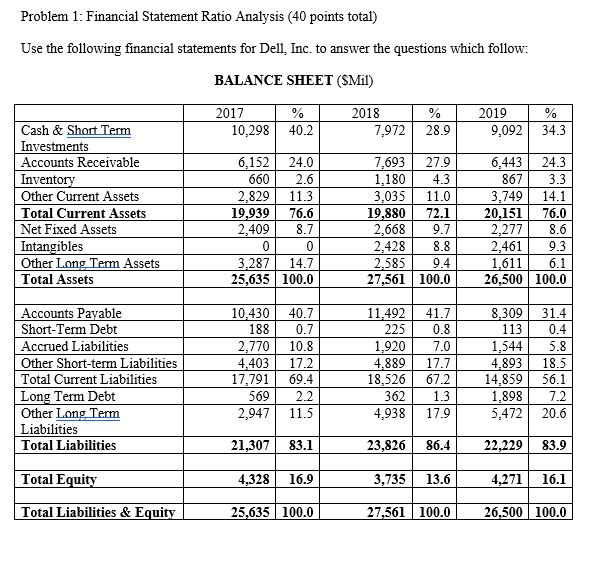

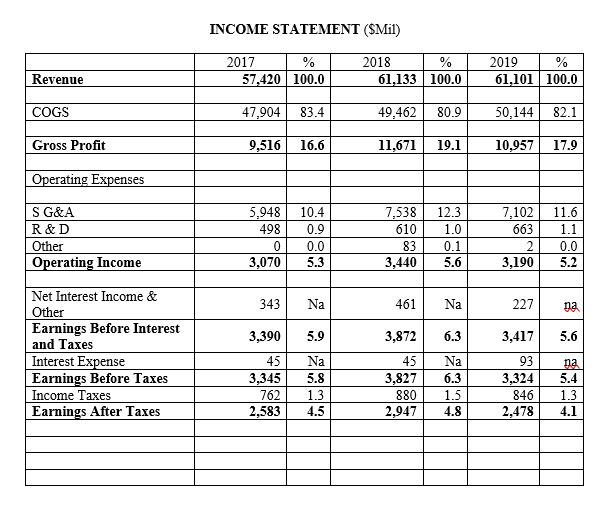

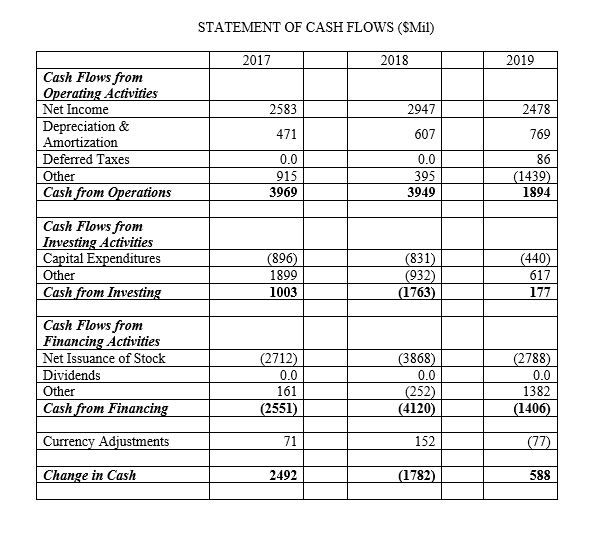

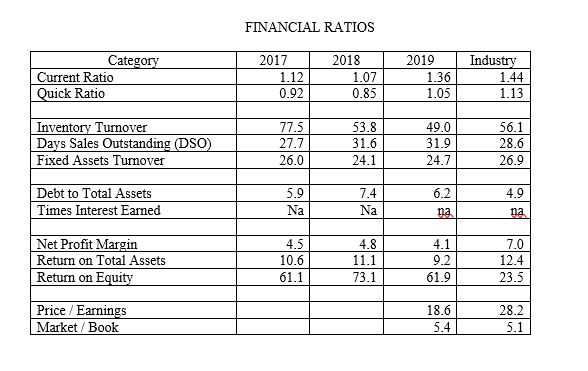

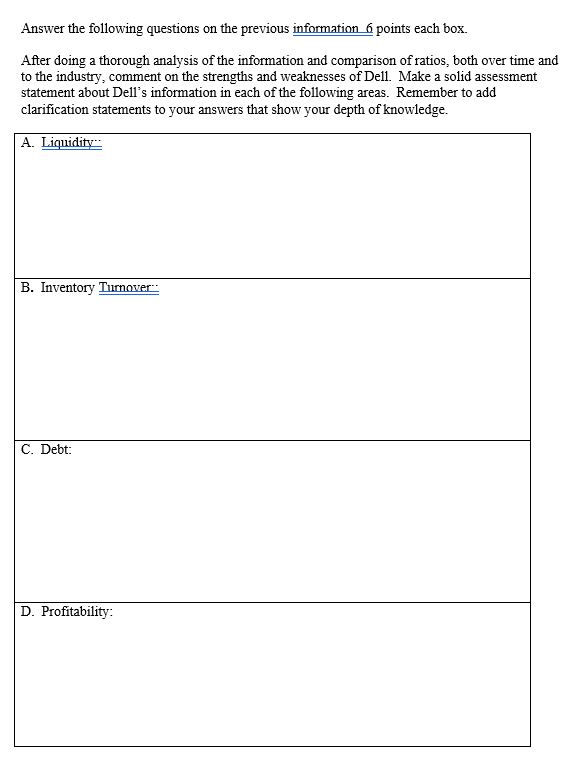

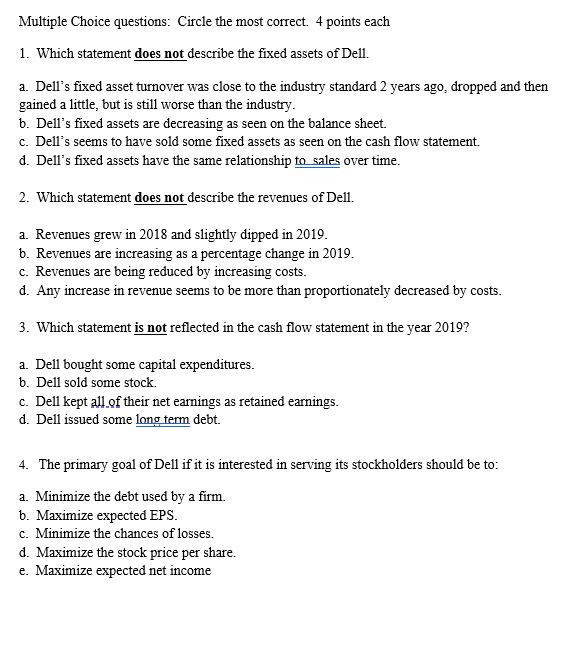

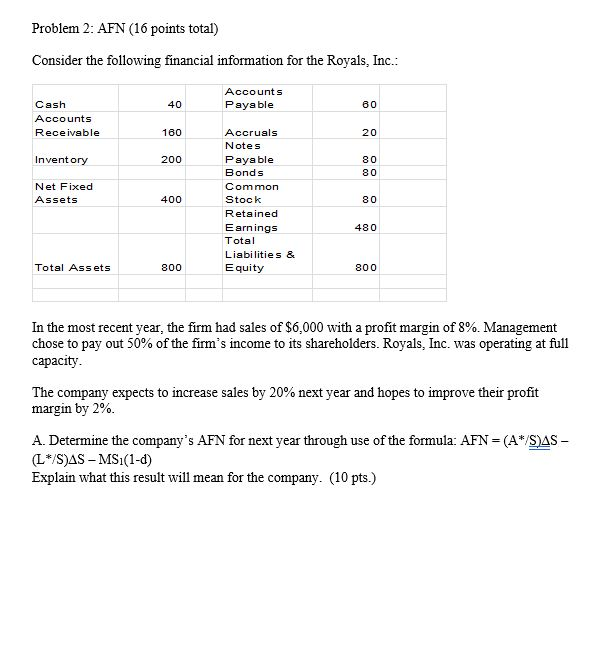

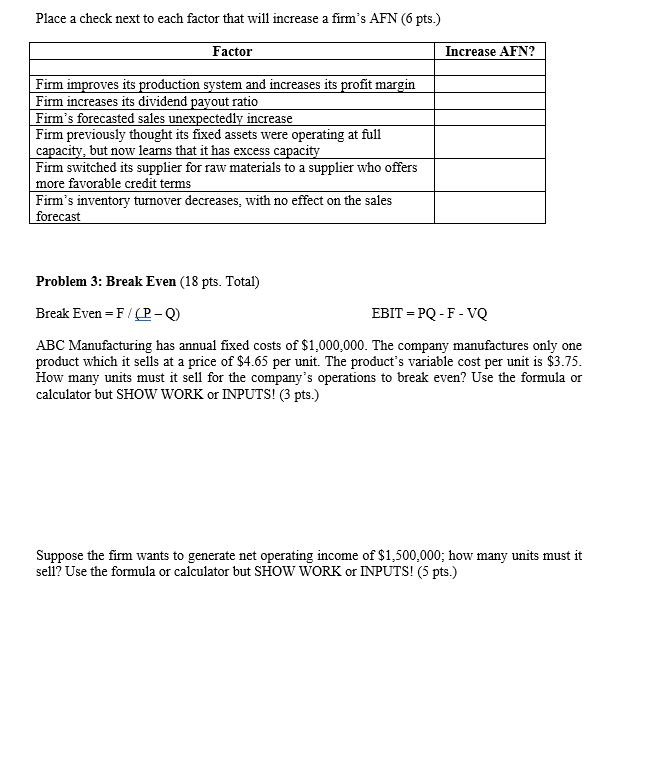

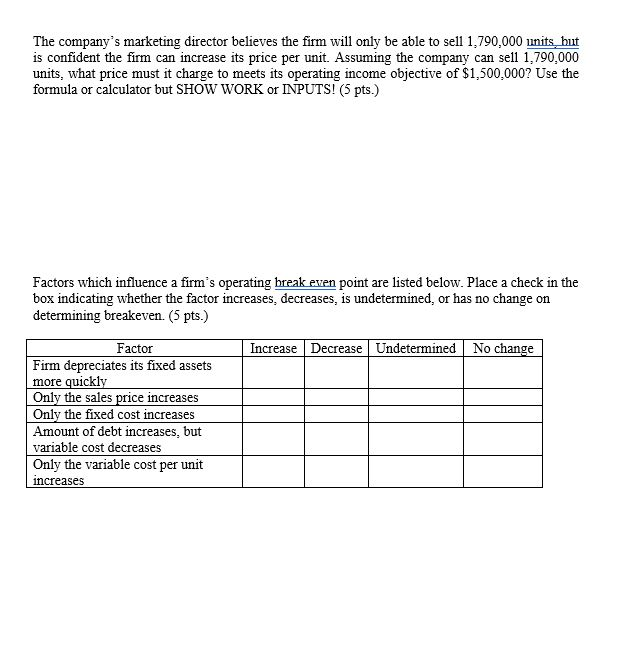

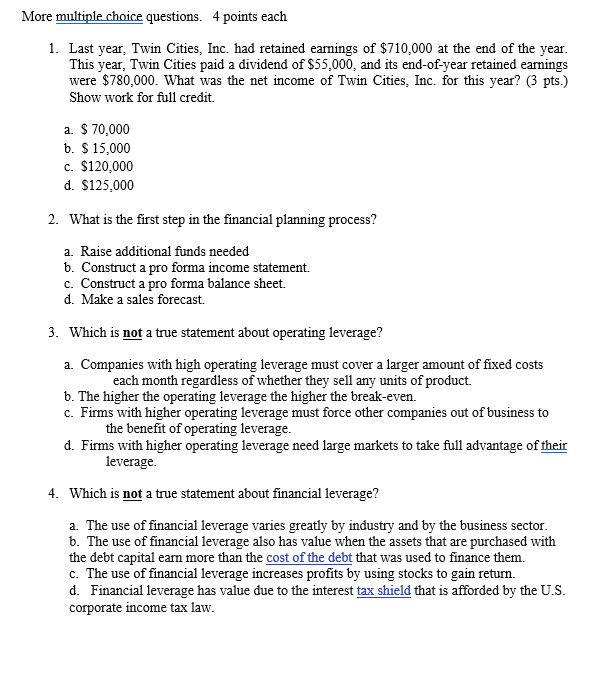

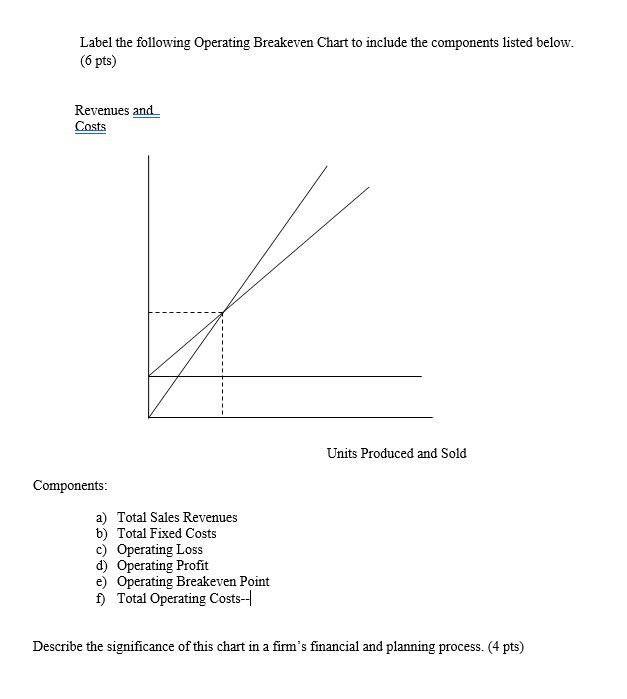

Problem 1: Financial Statement Ratio Analysis (40 points total) Use the following financial statements for Dell, Inc. to answer the questions which follow: BALANCE SHEET (SMil) 2017 10,298 2018 7,972 % 28.9 2019 9,092 % 34.3 40.2 Cash & Short Term Investments Accounts Receivable Inventory Other Current Assets Total Current Assets Net Fixed Assets Intangibles Other Long Term Assets Total Assets 6,152 24.0 660 2.6 2,829 11.3 19.939 76.6 2,409 8.7 0 0 3,287 14.7 25,635 100.0 7,693 27.9 1,180 4.3 3,035 11.0 19,880 72.1 2,668 9.7 2,428 8.8 2,585 9.4 27,561 100.0 6,443 24.3 867 3.3 3,749 14.1 20.151 76.0 2,277 8.6 2,461 9.3 1.611 6.1 26,500 100.0 41.7 0.8 7.0 Accounts Payable Short-Term Debt Accrued Liabilities Other Short-term Liabilities Total Current Liabilities Long Term Debt Other Long Term Liabilities Total Liabilities 10,430 188 2,770 4,403 17,791 569 2,947 40.7 0.7 10.8 17.2 69.4 2.2 11.5 11,492 225 1,920 4.889 18,526 362 4,938 17.7 67.2 1.3 17.9 8.309 113 1,544 4.893 14,859 1,898 5,472 31.4 0.4 5.8 18.5 56.1 7.2 20.6 21,307 83.1 23,826 86.4 22,229 83.9 Total Equity 4,328 16.9 3,735 13.6 4,271 16.1 Total Liabilities & Equity 25,635 100.0 27,561 100.0 26,500 100.0 INCOME STATEMENT ($Mil) 2017 % 57,420 100.0 2018 % 61,133 100.0 2019 % 61,101 100.0 Revenue COGS 47,904 83.4 49,462 80.9 50,144 82.1 Gross Profit 9,516 16.6 11,671 19.1 10,957 17.9 Operating Expenses 7,102 663 11.6 1.1 S G&A R&D Other Operating Income 5,948 498 0 3,070 10.4 0.9 0.0 5.3 7,538 610 83 3,440 12.3 1.0 0.1 5.6 0.0 3,190 5.2 343 Na 461 Na 227 na 5.9 3,872 3,417 5.6 Net Interest Income & Other Earnings Before Interest and Taxes Interest Expense Earnings Before Taxes Income Taxes Earnings After Taxes 6.3 Na 3,390 45 3,345 762 2,583 Na 5.8 1.3 4.5 6.3 45 3,827 880 2,947 93 3,324 846 2,478 na 5.4 1.3 4.1 1.5 4.8 STATEMENT OF CASH FLOWS (SMil) 2017 2018 2019 2583 2947 2478 Cash Flows from Operating Activities Net Income Depreciation & Amortization Deferred Taxes Other Cash from Operations 471 607 0.0 915 3969 0.0 395 3949 769 86 (1439) 1894 Cash Flows from Investing Activities Capital Expenditures Other Cash from Investing (896) 1899 1003 (831) (932) (1763) (440) 617 177 Cash Flows from Financing Activities Net Issuance of Stock Dividends Other Cash from Financing (2712) 0.0 161 (2551) (3868) 0.0 (252) (4120) (2788) 0.0 1382 (1406) Currency Adjustments 71 152 (77) Change in Cash 2492 (1782) 588 FINANCIAL RATIOS Category Current Ratio Quick Ratio 2017 1.12 0.92 2018 1.07 0.85 2019 1.36 1.05 Industry 1.44 1.13 Inventory Turnover Days Sales Outstanding (DSO) Fixed Assets Turnover 77.5 27.7 26.0 53.8 31.6 24.1 49.0 31.9 24.7 56.1 28.6 26.9 Debt to Total Assets Times Interest Earned 5.9 Na 7.4 Na 4.9 6.2 na na Net Profit Margin Return on Total Assets Return on Equity 4.5 10.6 61.1 4.8 11.1 73.1 4.1 9.2 61.9 7.0 12.4 23.5 Price / Earnings Market / Book 18.6 5.4 28.2 5.1 Answer the following questions on the previous information 6 points each box. After doing a thorough analysis of the information and comparison of ratios, both over time and to the industry, comment on the strengths and weaknesses of Dell. Make a solid assessment statement about Dell's information in each of the following areas. Remember to add clarification statements to your answers that show your depth of knowledge. A. Liquidity B. Inventory Turnover". C. Debt: D. Profitability: Multiple Choice questions: Circle the most correct. 4 points each 1. Which statement does not describe the fixed assets of Dell. a. Dell's fixed asset turnover was close to the industry standard 2 years ago, dropped and then gained a little, but is still worse than the industry. 6. Dell's fixed assets are decreasing as seen on the balance sheet. c. Dell's seems to have sold some fixed assets as seen on the cash flow statement. d. Dell's fixed assets have the same relationship to sales over time. 2. Which statement does not describe the revenues of Dell. a. Revenues grew in 2018 and slightly dipped in 2019. b. Revenues are increasing as a percentage change in 2019. c. Revenues are being reduced by increasing costs. d. Any increase in revenue seems to be more than proportionately decreased by costs. 3. Which statement is not reflected in the cash flow statement in the year 2019? a. Dell bought some capital expenditures. b. Dell sold some stock. c. Dell kept all of their net earnings as retained earnings. d. Dell issued some long term debt. 4. The primary goal of Dell if it is interested in serving its stockholders should be to: a. Minimize the debt used by a firm. 6. Maximize expected EPS. c. Minimize the chances of losses. d. Maximize the stock price per share. e. Maximize expected net income Problem 2: AFN (16 points total) Consider the following financial information for the Royals, Inc.: 40 Accounts Payable 60 Cash Accounts Receivable 160 20 Inventory 200 80 80 Net Fixed Assets 400 Accruals Notes Payable Bonds Common Stock Retained Earnings Total Liabilities & Equity 80 480 Total Assets 800 800 In the most recent year, the firm had sales of $6,000 with a profit margin of 8%. Management chose to pay out 50% of the firm's income to its shareholders. Royals, Inc. was operating at full capacity. The company expects to increase sales by 20% next year and hopes to improve their profit margin by 2%. A. Determine the company's AFN for next year through use of the formula: AFN = (A*/S)AS - (L*/S)AS-MS:(1-d) Explain what this result will mean for the company. (10 pts.) Place a check next to each factor that will increase a firm's AFN (6 pts.) Factor Increase AFN? Firm improves its production system and increases its profit margin Firm increases its dividend payout ratio Firm's forecasted sales unexpectedly increase Firm previously thought its fixed assets were operating at full capacity, but now learns that it has excess capacity Firm switched its supplier for raw materials to a supplier who offers more favorable credit terms Firm's inventory turnover decreases, with no effect on the sales forecast Problem 3: Break Even (18 pts. Total) Break Even=F/(P-Q) EBIT = PQ-F-VQ ABC Manufacturing has annual fixed costs of $1,000,000. The company manufactures only one product which it sells at a price of $4.65 per unit. The product's variable cost per unit is $3.75. How many units must it sell for the company's operations to break even? Use the formula or calculator but SHOW WORK or INPUTS! (3 pts.) Suppose the firm wants to generate net operating income of $1,500,000; how many units must it sell? Use the formula or calculator but SHOW WORK or INPUTS! (5 pts.) The company's marketing director believes the firm will only be able to sell 1,790,000 units, but is confident the firm can increase its price per unit. Assuming the company can sell 1,790,000 units, what price must it charge to meets its operating income objective of $1,500,000? Use the formula or calculator but SHOW WORK or INPUTS! (5 pts.) Factors which influence a firm's operating break even point are listed below. Place a check in the box indicating whether the factor increases, decreases, is undetermined, or has no change on determining breakeven. (5 pts.) Increase Decrease Undetermined No change Factor Firm depreciates its fixed assets more quickly Only the sales price increases Only the fixed cost increases Amount of debt increases, but variable cost decreases Only the variable cost per unit increases More multiple choice questions. 4 points each 1. Last year, Twin Cities, Inc. had retained earnings of $710,000 at the end of the year. This year, Twin Cities paid a dividend of $55,000, and its end-of-year retained earnings were $780,000. What was the net income of Twin Cities. Inc. for this year? (3 pts.) Show work for full credit. a. $ 70,000 6. $ 15,000 c. $120,000 d. $125,000 2. What is the first step in the financial planning process? a. Raise additional funds needed b. Construct a pro forma income statement. c. Construct a pro forma balance sheet. d. Make a sales forecast. 3. Which is not a true statement about operating leverage? a. Companies with high operating leverage must cover a larger amount of fixed costs each month regardless of whether they sell any units of product. 6. The higher the operating leverage the higher the break-even. c. Firms with higher operating leverage must force other companies out of business to the benefit of operating leverage. d. Firms with higher operating leverage need large markets to take full advantage of their leverage. 4. Which is not a true statement about financial leverage? a. The use of financial leverage varies greatly by industry and by the business sector. 6. The use of financial leverage also has value when the assets that are purchased with the debt capital earn more than the cost of the debt that was used to finance them. c. The use of financial leverage increases profits by using stocks to gain return. d. Financial leverage has value due to the interest tax shield that is afforded by the U.S. corporate income tax law. Label the following Operating Breakeven Chart to include the components listed below. (6 pts) Revenues and Costs Units Produced and Sold Components: a) Total Sales Revenues b) Total Fixed Costs c) Operating Loss d) Operating Profit e) Operating Breakeven Point f) Total Operating Costs- Describe the significance of this chart in a firm's financial and planning process. (4 pts)