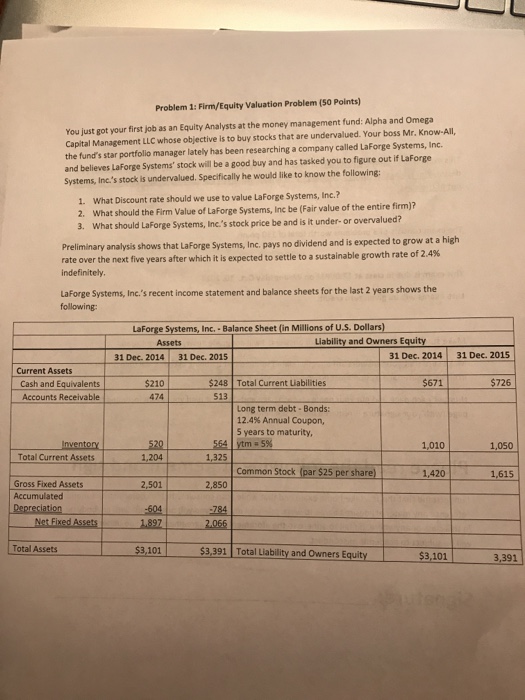

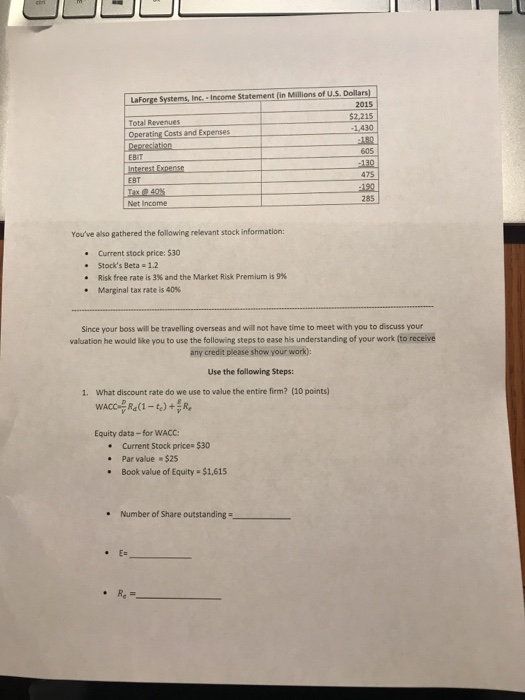

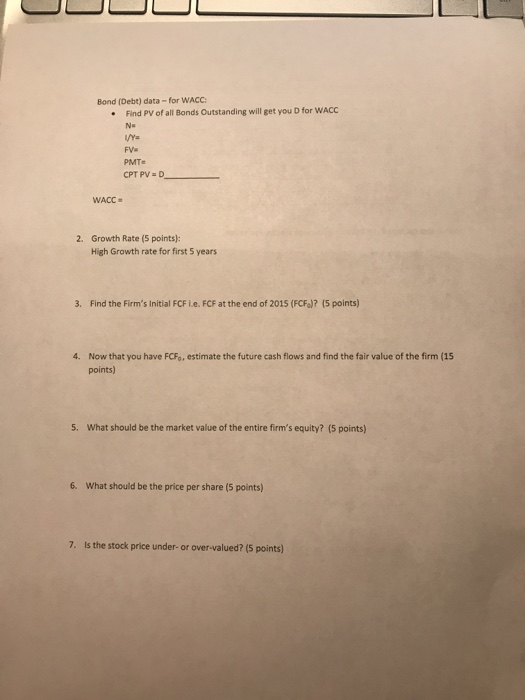

Problem 1: Firm/Equity Valuation Problem (50 Points) You just got your first job as an Equity Analysts at the money management fund: Alpha and Omega Capital Management LLC whose objective is to buy stocks that are undervalued. Your boss Mr. Know-All, the fund's star portfolio manager lately has been researching a company called LaForge Systems, Inc. and believes LaForge Systems' stock will be a good buy and has tasked you to figure out if LaForge Systems, Inc.'s stock is undervalued. Specifically he would like to know the following What Discount rate should we use to value LaForge Systems, Inc.? 2. 1. What should the Firm Value of Laforge Systems, Inc be (Fair value of the entire firm)? 3. What should LaForge Systems, Inc.'s stock price be and is it under- or overvalued? forge Systems, Inc. pays no dividend and is expected to grow at a high Preliminary analysis shows that La rate over the next five years after which it is expected to settle to a sustainable growth rate of indefinitely 2.4% Laforge Systems, Inc.'s recent income statement and balance sheets for the last 2 years shows the following Laforge Systems, Inc. - Balance Sheet (in Millions of U.s. Dollars) Assets Liability and Owners Equity 31 Dec. 2014 31 Dec. 2015 31 Dec. 2014 31 Dec. 2015 Current Assets $210 474 $248 Total Current Liabilities $671 $726 Cash and Equivalents Accounts Receivable 513 Long term debt- Bonds 12.4% Annual Coupon, 5 years to maturity, 520 1,204 Inventory 1,010 1,050 Total Current Assets Common Stock (par $25 per share) 1,420 1,615 Gross Fixed Assets Accumulated 2,501 2,850 Total Assets 101 3,391 Total Liability and Owners Equity 3,101 3,391 Problem 1: Firm/Equity Valuation Problem (50 Points) You just got your first job as an Equity Analysts at the money management fund: Alpha and Omega Capital Management LLC whose objective is to buy stocks that are undervalued. Your boss Mr. Know-All, the fund's star portfolio manager lately has been researching a company called LaForge Systems, Inc. and believes LaForge Systems' stock will be a good buy and has tasked you to figure out if LaForge Systems, Inc.'s stock is undervalued. Specifically he would like to know the following What Discount rate should we use to value LaForge Systems, Inc.? 2. 1. What should the Firm Value of Laforge Systems, Inc be (Fair value of the entire firm)? 3. What should LaForge Systems, Inc.'s stock price be and is it under- or overvalued? forge Systems, Inc. pays no dividend and is expected to grow at a high Preliminary analysis shows that La rate over the next five years after which it is expected to settle to a sustainable growth rate of indefinitely 2.4% Laforge Systems, Inc.'s recent income statement and balance sheets for the last 2 years shows the following Laforge Systems, Inc. - Balance Sheet (in Millions of U.s. Dollars) Assets Liability and Owners Equity 31 Dec. 2014 31 Dec. 2015 31 Dec. 2014 31 Dec. 2015 Current Assets $210 474 $248 Total Current Liabilities $671 $726 Cash and Equivalents Accounts Receivable 513 Long term debt- Bonds 12.4% Annual Coupon, 5 years to maturity, 520 1,204 Inventory 1,010 1,050 Total Current Assets Common Stock (par $25 per share) 1,420 1,615 Gross Fixed Assets Accumulated 2,501 2,850 Total Assets 101 3,391 Total Liability and Owners Equity 3,101 3,391