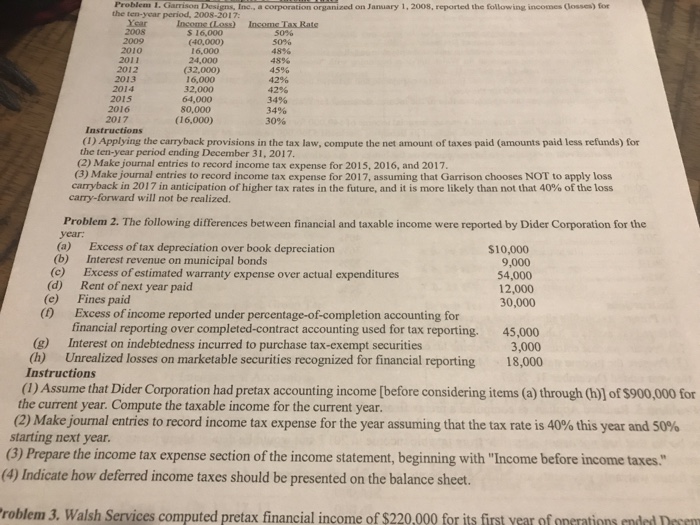

Problem 1. Garrison Designs, Ine., a corporation organized on January 1, 2008, reported the following incomes Closses) for the ten-year period, 2008-2017: Year Incoms (Loss) Insoms Tax Bate 2008 50% 50% 48% 48% 45% 42% 42% 34% 34% 30% S 16,000 (40,000) 2009 2010 16,000 24,000 2011 2012 2013 (32,000) 16,000 32,000 2014 2015 2016 2017 64,000 80,000 (16,000) Instructions () Applying the carryback provisions in the tax law, compute the net amount of taxes paid (amounts paid less refunds) for the ten-year period ending December 31, 2017. (2) Make journal entries to record income tax expense for 2015, 2016, and 2017 (3) Make journal entries to record income tax expense for 2017, assuming that Garrison chooses NOT to apply loss carryback in 2017 in anticipation of higher tax rates in the future, and it is more likely than not that 40% of the loss carry-forward will not be realized. Problem 2. The following differences between financial and taxable income were reported by Dider Corporation for the year. (a) Excess of tax depreciation over book depreciation $10,000 9,000 54,000 12,000 30,000 (b) Interest revenue on municipal bonds (c) Excess of estimated warranty expense over actual expenditures (d) Rent of next year paid (e) Fines paid () Excess of income reported under percentage-of-completion accounting for financial reporting over completed-contract accounting used for tax reporting. 45,000 (g) Interest on indebtedness incurred to purchase tax-exempt securities Unrealized losses on marketable securities recognized for financial reporting 3,000 18,000 (h) Instructions (1) Assume that Dider Corporation had pretax accounting income [before considering items (a) through (h)] of $900,000 for the current year. Compute the taxable income for the current year. (2) Makejournal entries to record income tax expense for the year assuming that the tax rate is 40% this year and 50 % starting next year (3) Prepare the income tax expense section of the income statement, beginning with "Income before income taxes." (4) Indicate how deferred income taxes should be presented on the balance sheet. roblem 3. Walsh Services computed pretax financial income of $220,000 for its first year of onerations endnd Doem Problem 1. Garrison Designs, Ine., a corporation organized on January 1, 2008, reported the following incomes Closses) for the ten-year period, 2008-2017: Year Incoms (Loss) Insoms Tax Bate 2008 50% 50% 48% 48% 45% 42% 42% 34% 34% 30% S 16,000 (40,000) 2009 2010 16,000 24,000 2011 2012 2013 (32,000) 16,000 32,000 2014 2015 2016 2017 64,000 80,000 (16,000) Instructions () Applying the carryback provisions in the tax law, compute the net amount of taxes paid (amounts paid less refunds) for the ten-year period ending December 31, 2017. (2) Make journal entries to record income tax expense for 2015, 2016, and 2017 (3) Make journal entries to record income tax expense for 2017, assuming that Garrison chooses NOT to apply loss carryback in 2017 in anticipation of higher tax rates in the future, and it is more likely than not that 40% of the loss carry-forward will not be realized. Problem 2. The following differences between financial and taxable income were reported by Dider Corporation for the year. (a) Excess of tax depreciation over book depreciation $10,000 9,000 54,000 12,000 30,000 (b) Interest revenue on municipal bonds (c) Excess of estimated warranty expense over actual expenditures (d) Rent of next year paid (e) Fines paid () Excess of income reported under percentage-of-completion accounting for financial reporting over completed-contract accounting used for tax reporting. 45,000 (g) Interest on indebtedness incurred to purchase tax-exempt securities Unrealized losses on marketable securities recognized for financial reporting 3,000 18,000 (h) Instructions (1) Assume that Dider Corporation had pretax accounting income [before considering items (a) through (h)] of $900,000 for the current year. Compute the taxable income for the current year. (2) Makejournal entries to record income tax expense for the year assuming that the tax rate is 40% this year and 50 % starting next year (3) Prepare the income tax expense section of the income statement, beginning with "Income before income taxes." (4) Indicate how deferred income taxes should be presented on the balance sheet. roblem 3. Walsh Services computed pretax financial income of $220,000 for its first year of onerations endnd Doem