Answered step by step

Verified Expert Solution

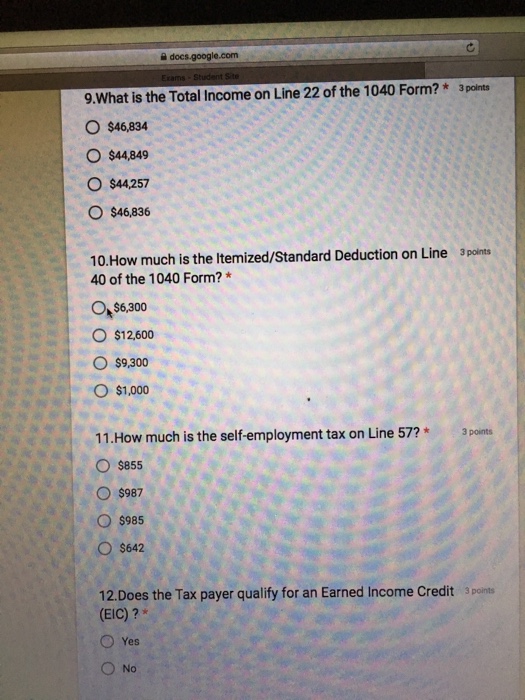

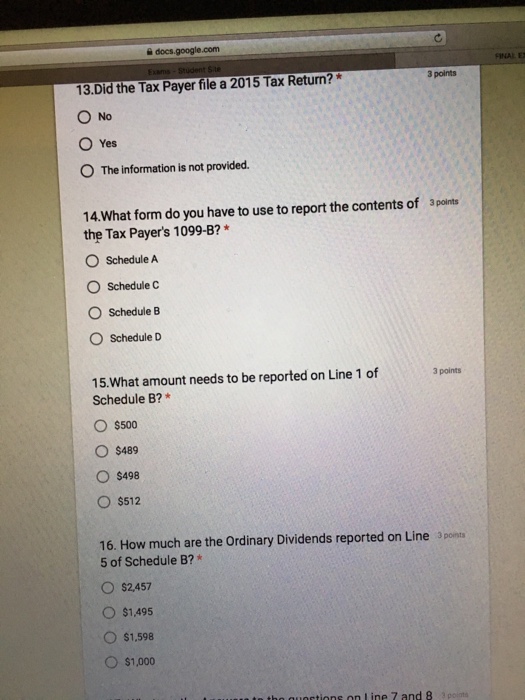

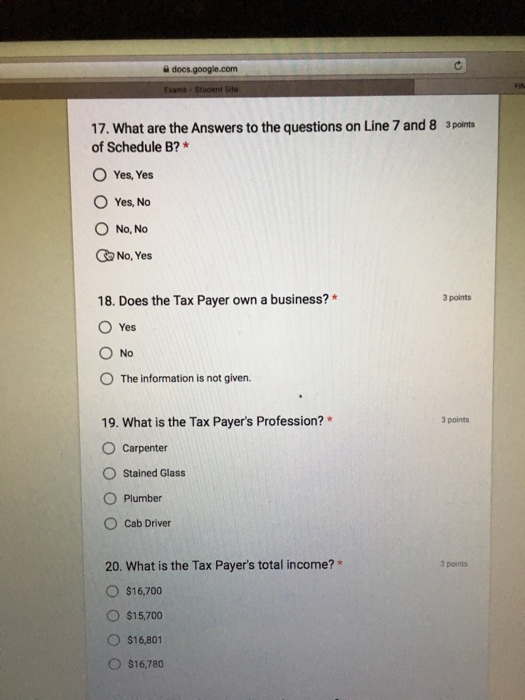

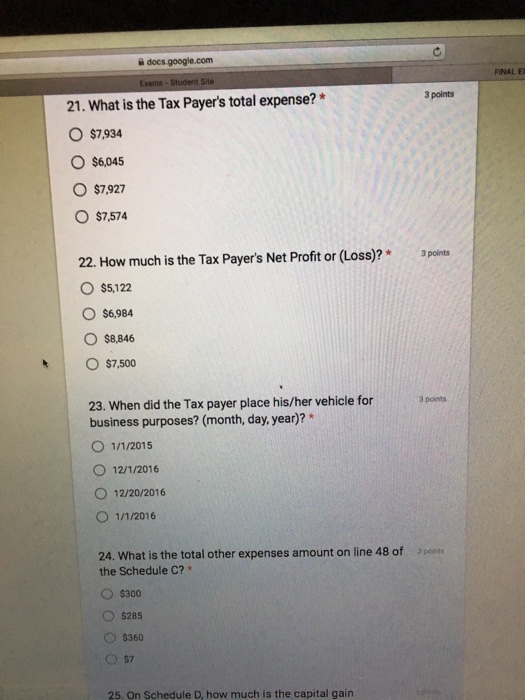

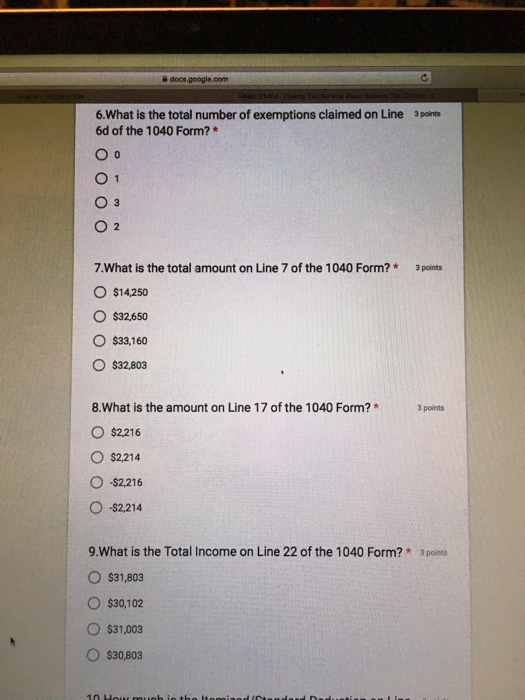

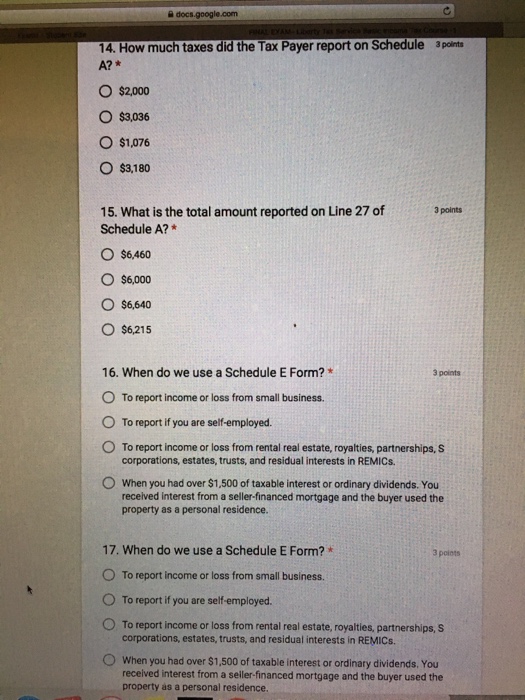

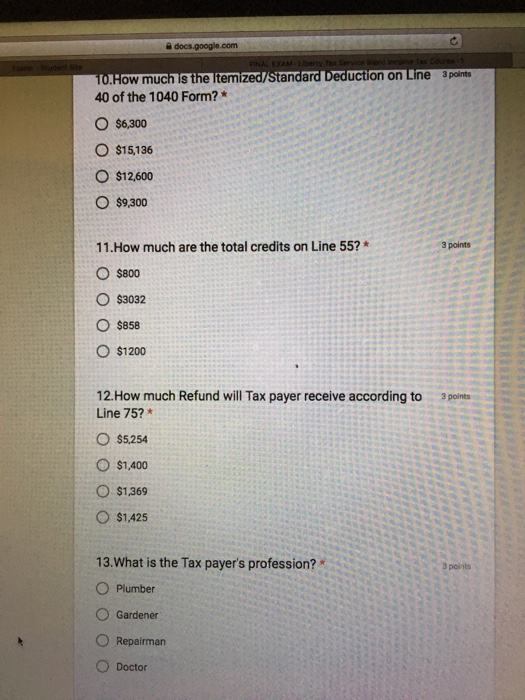

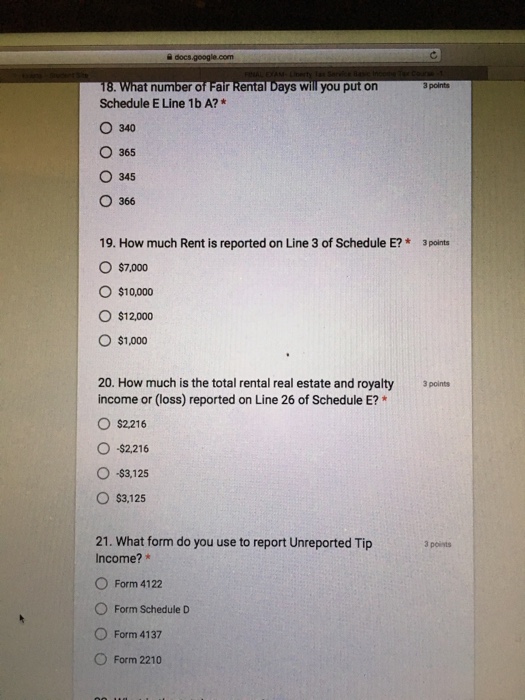

Question

1 Approved Answer

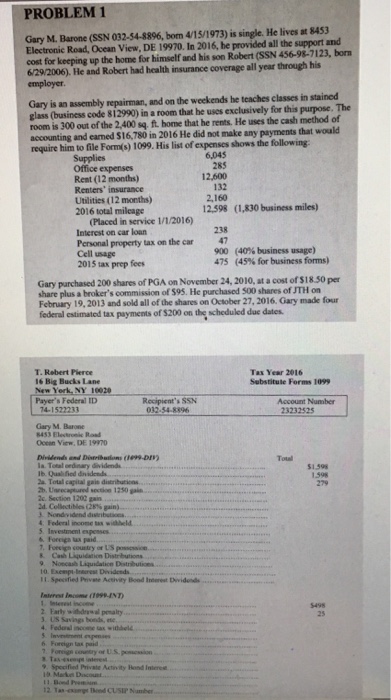

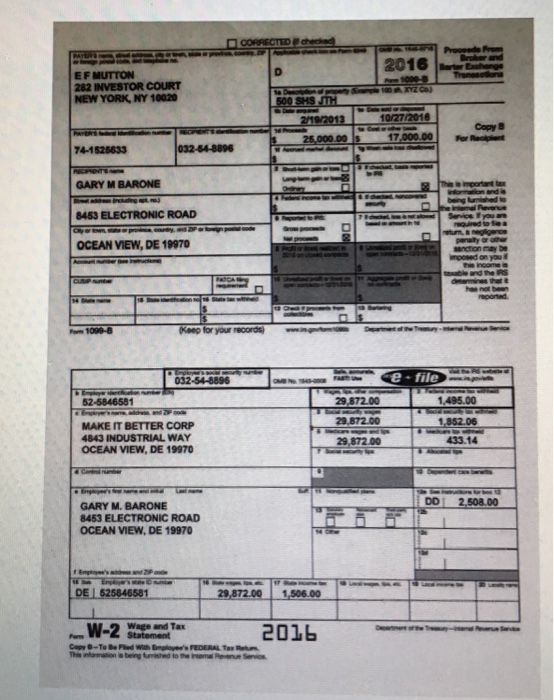

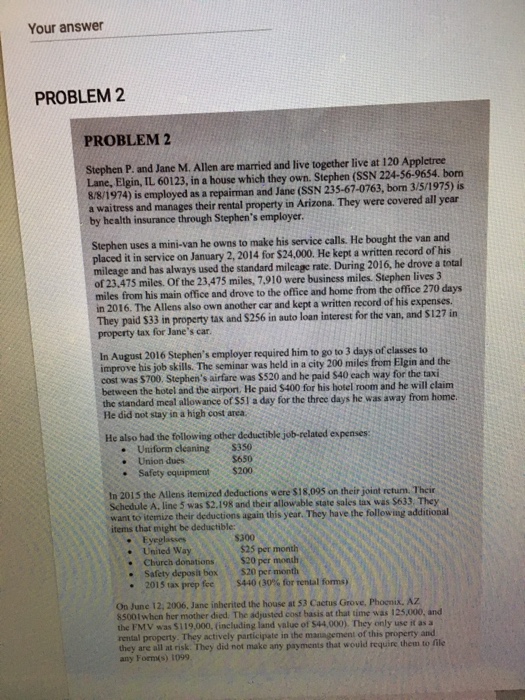

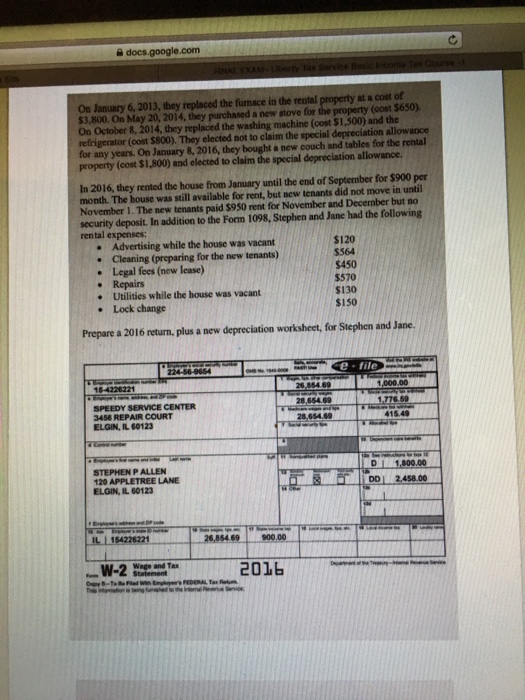

PROBLEM 1 Gary M. Barone (SSN 032-54-8896, born 415/1973) is single. He lives n453 Electronic Road, Ocean View, DE 19970. In 2016, he provided all

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started