Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1, if possible please do problems 2 and 3. Thanks in advance :} 1. Determine the better of the two alternatives using Net Present

Problem 1, if possible please do problems 2 and 3.

Thanks in advance :}

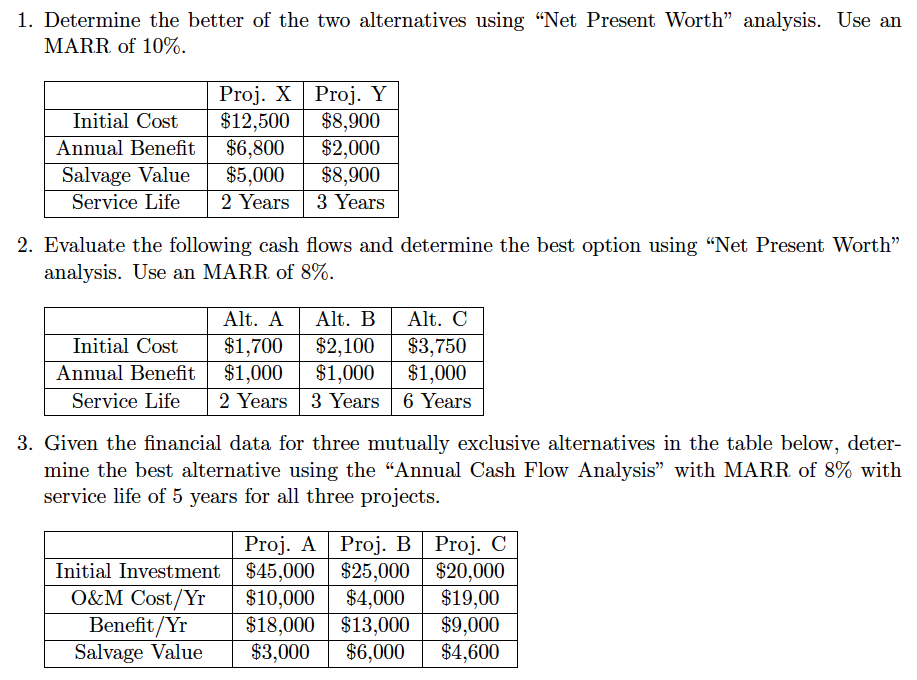

1. Determine the better of the two alternatives using "Net Present Worth" analysis. Use an MARR of 10%. Initial Cost Annual Benefit Salvage Value Service Life Proj. X $12,500 $6,800 $5,000 2 Years Proj. Y $8,900 $2,000 $8,900 3 Years 2. Evaluate the following cash flows and determine the best option using "Net Present Worth" analysis. Use an MARR of 8%. Initial Cost Annual Benefit Service Life Alt. A $1,700 $1,000 2 Years Alt. B Alt. C $2,100 $3,750 $1,000 $1,000 3 Years 6 Years 3. Given the financial data for three mutually exclusive alternatives in the table below, deter- mine the best alternative using the "Annual Cash Flow Analysis" with MARR of 8% with service life of 5 years for all three projects. Proj. A Initial Investment $45,000 O&M Cost/Yr $10,000 Benefit/Yr $18,000 Salvage Value $3,000 Proj. B $25,000 $4,000 $13,000 $6,000 Proj. C $20,000 $19,00 $9,000 $4,600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started