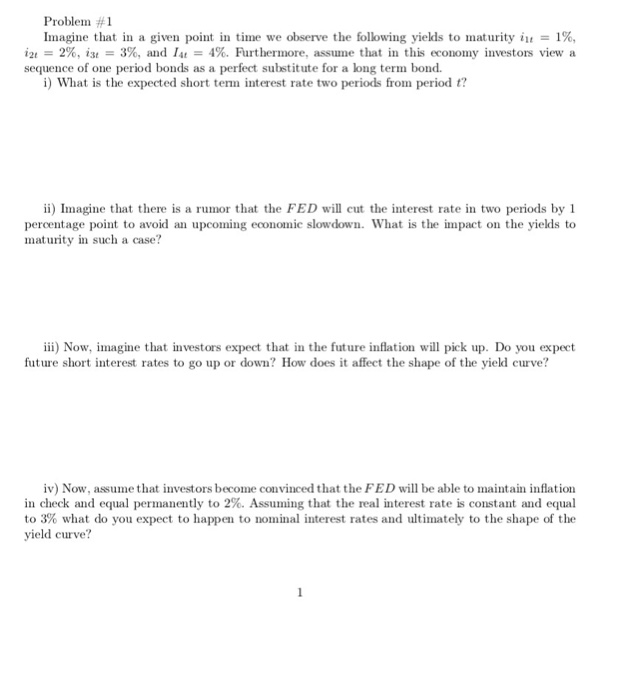

Problem #1 Imagine that in a given point in time we observe the following yields to maturity i 1% iz 2%, it = 3%, and I 4 %. Furthermore, assume that in this economy investors view a sequence of one period bonds as a perfect substitute for a long term bond. i) What is the expected short tem interest rate two periods from period t? ii) Imagine that there is a rumor that the FED will cut the interest rate in two periods by 1 percentage point to avoid an upcoming economic slowdown. What is the impact on the yields to maturity in such a case? iiNow, imagine that investors expect that in the future inflation will pick up. Do you expect future short interest rates to go up or down? How does it affect the shape of the yiekd curve? iv) Now, assume that investors become convinced that the FED will be able to maintain inflation in check and equal permanently to 2%. Assuming that the real interest rate is constant and equal to 3% what do you expect to happen to nominal interest rates and ultimately to the shape of the yield curve? 1 Problem #1 Imagine that in a given point in time we observe the following yields to maturity i 1% iz 2%, it = 3%, and I 4 %. Furthermore, assume that in this economy investors view a sequence of one period bonds as a perfect substitute for a long term bond. i) What is the expected short tem interest rate two periods from period t? ii) Imagine that there is a rumor that the FED will cut the interest rate in two periods by 1 percentage point to avoid an upcoming economic slowdown. What is the impact on the yields to maturity in such a case? iiNow, imagine that investors expect that in the future inflation will pick up. Do you expect future short interest rates to go up or down? How does it affect the shape of the yiekd curve? iv) Now, assume that investors become convinced that the FED will be able to maintain inflation in check and equal permanently to 2%. Assuming that the real interest rate is constant and equal to 3% what do you expect to happen to nominal interest rates and ultimately to the shape of the yield curve? 1