Question: In each of the scenarios below, answer the following questions: Should you exercise your option? Would it have been better to make a direct

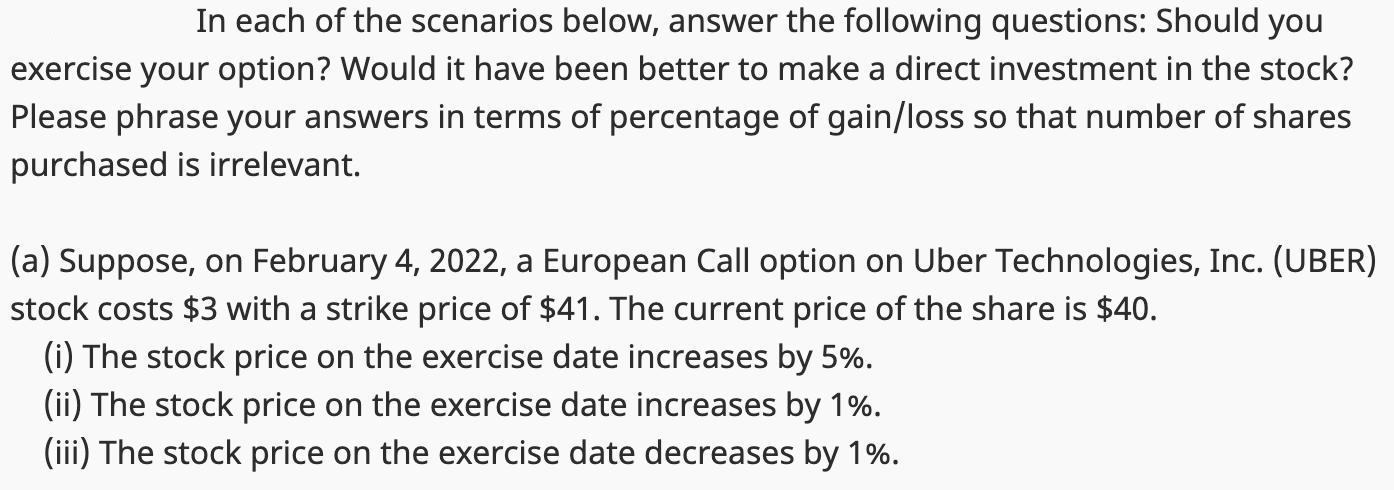

In each of the scenarios below, answer the following questions: Should you exercise your option? Would it have been better to make a direct investment in the stock? Please phrase your answers in terms of percentage of gain/loss so that number of shares purchased is irrelevant. (a) Suppose, on February 4, 2022, a European Call option on Uber Technologies, Inc. (UBER) stock costs $3 with a strike price of $41. The current price of the share is $40. (i) The stock price on the exercise date increases by 5%. (ii) The stock price on the exercise date increases by 1%. (iii) The stock price on the exercise date decreases by 1%.

Step by Step Solution

3.53 Rating (173 Votes )

There are 3 Steps involved in it

i Exercising the option would be lucrative in this circumstance The new stock price is 42 40 105 whi... View full answer

Get step-by-step solutions from verified subject matter experts