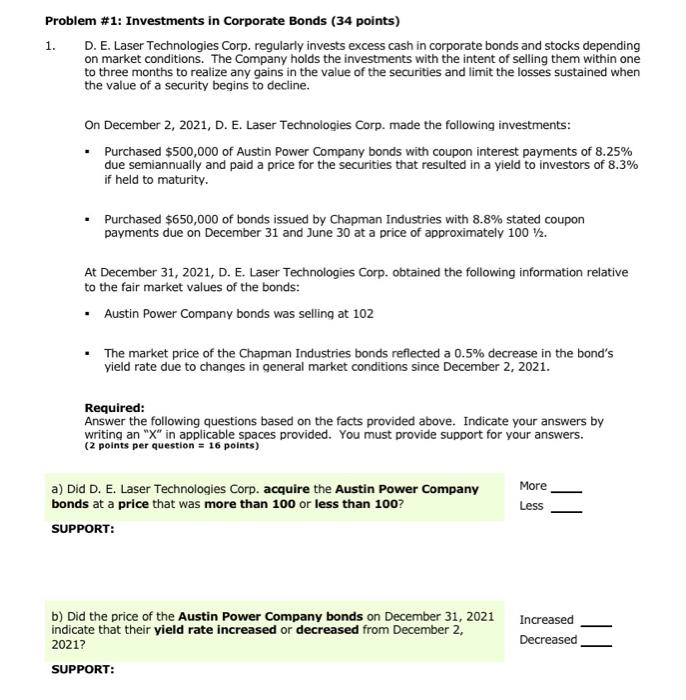

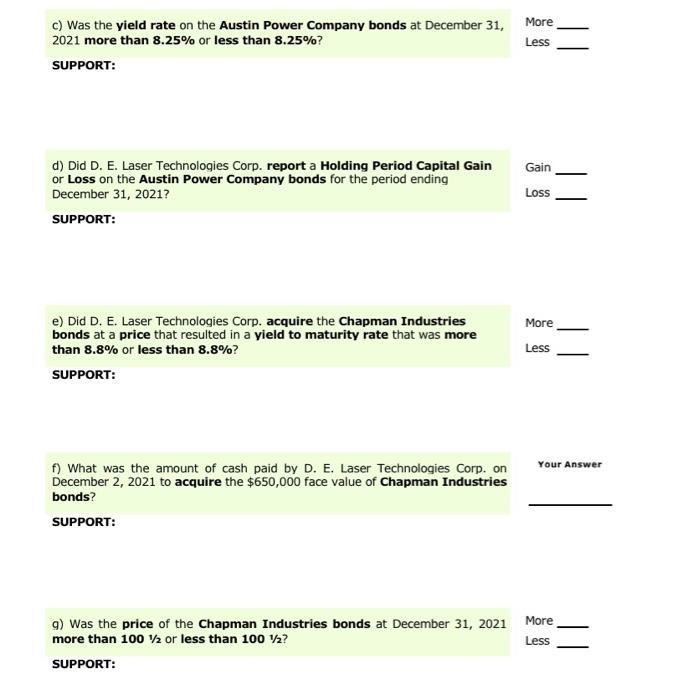

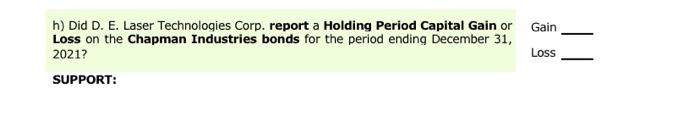

Problem #1: Investments in Corporate Bonds (34 points) 1. D. E. Laser Technologies Corp. regularly invests excess cash in corporate bonds and stocks depending on market conditions. The Company holds the investments with the intent of selling them within one to three months to realize any gains in the value of the securities and limit the losses sustained when the value of a security begins to decline. On December 2, 2021, D. E. Laser Technologies Corp. made the following investments: Purchased $500,000 of Austin Power Company bonds with coupon interest payments of 8.25% due semiannually and paid a price for the securities that resulted in a yield to investors of 8.3% if held to maturity Purchased $650,000 of bonds issued by Chapman Industries with 8.8% stated coupon payments due on December 31 and June 30 at a price of approximately 100 V2. At December 31, 2021, D. E. Laser Technologies Corp. obtained the following information relative to the fair market values of the bonds: Austin Power Company bonds was selling at 102 The market price of the Chapman Industries bonds reflected a 0.5% decrease in the bond's yield rate due to changes in general market conditions since December 2, 2021. Required: Answer the following questions based on the facts provided above. Indicate your answers by writing an "X" in applicable spaces provided. You must provide support for your answers. (2 points per question = 16 points) More a) Did D. E. Laser Technologies Corp. acquire the Austin Power Company bonds at a price that was more than 100 or less than 100? Less SUPPORT: Increased b) Did the price of the Austin Power Company bonds on December 31, 2021 indicate that their yield rate increased or decreased from December 2, Decreased 2021? SUPPORT: More c) Was the yield rate on the Austin Power Company bonds at December 31, 2021 more than 8.25% or less than 8.25%? Less SUPPORT: Gain d) Did D. E. Laser Technologies Corp. report a Holding Period Capital Gain or Loss on the Austin Power Company bonds for the period ending December 31, 2021? Loss SUPPORT: More e) Did D. E. Laser Technologies Corp. acquire the Chapman Industries bonds at a price that resulted in a yield to maturity rate that was more than 8.8% or less than 8.8%? - Less SUPPORT: Your Answer f) What was the amount of cash paid by D. E. Laser Technologies Corp. on December 2, 2021 to acquire the $650,000 face value of Chapman Industries bonds? SUPPORT: More g) was the price of the Chapman Industries bonds at December 31, 2021 more than 100 v2 or less than 100 V? Less | | SUPPORT: h) Did D. E. Laser Technologies Corp. report a Holding Period Capital Gain or Gain Loss on the Chapman Industries bonds for the period ending December 31, 2021? LOSS SUPPORT