Answered step by step

Verified Expert Solution

Question

1 Approved Answer

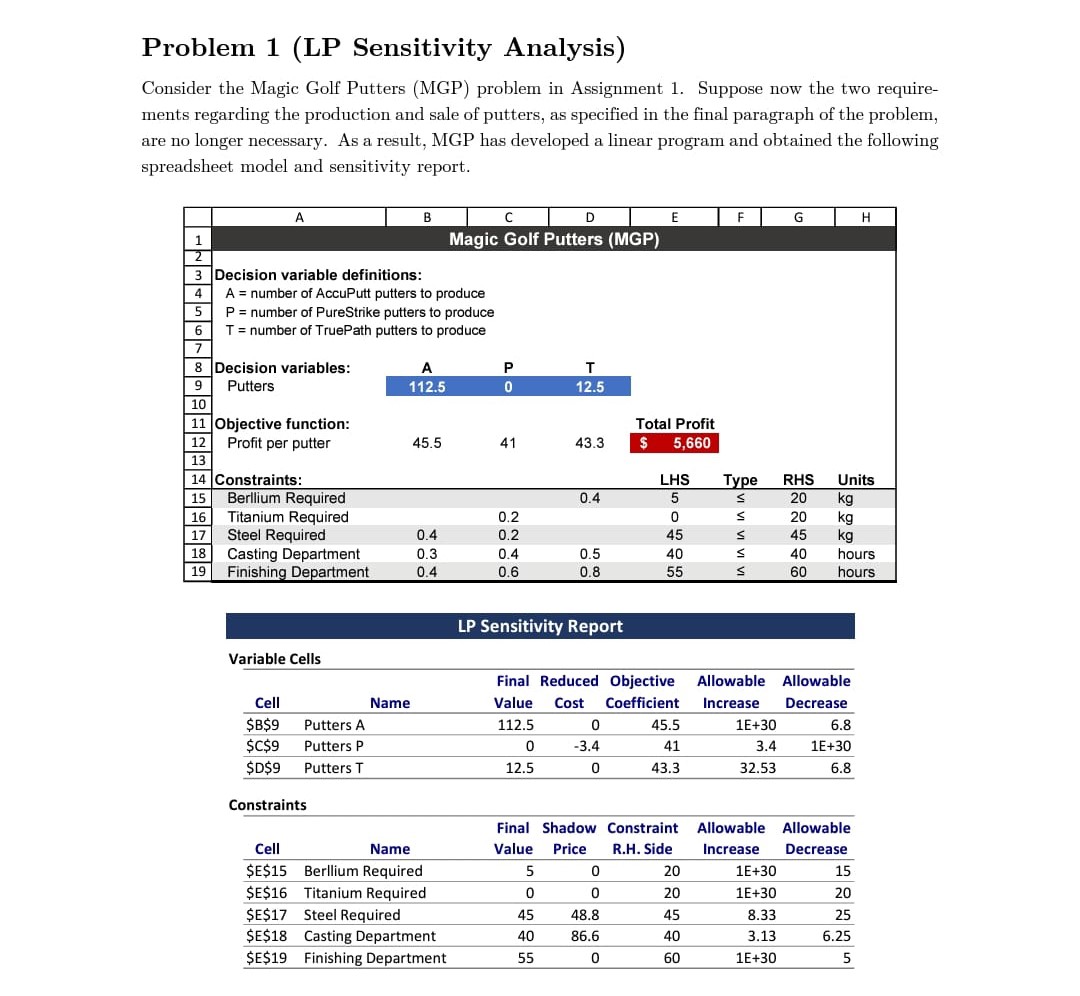

Problem 1 (LP Sensitivity Analysis) Consider the Magic Golf Putters (MGP) problem in Assignment 1. Suppose now the two requirements regarding the production and sale

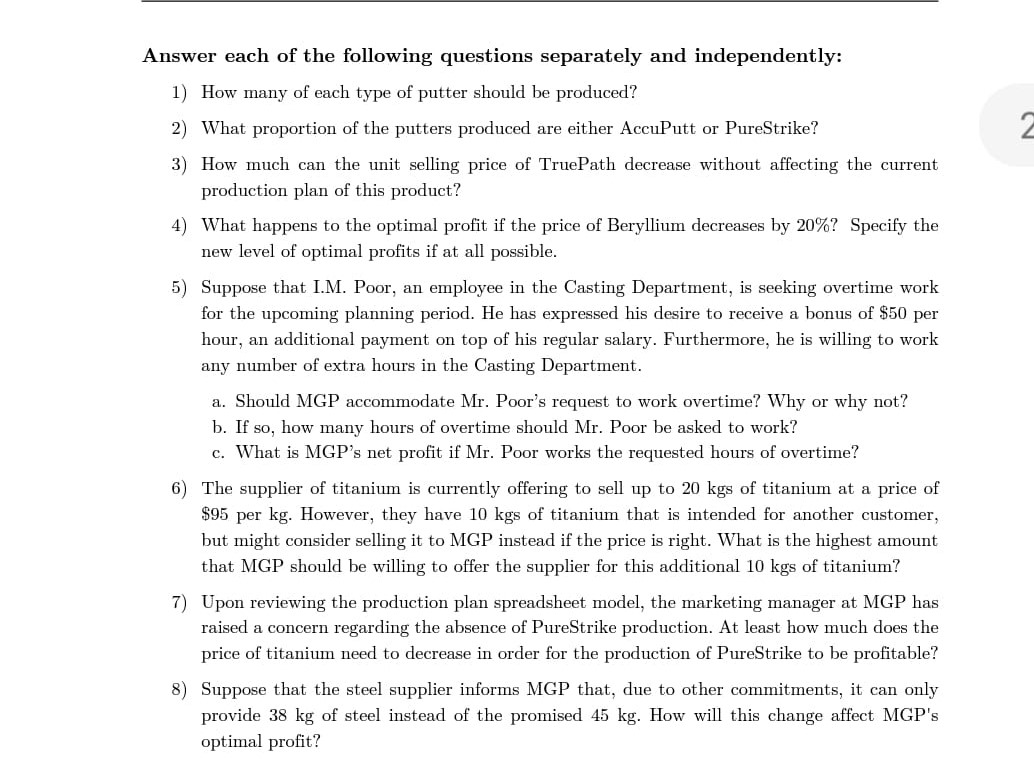

Problem 1 (LP Sensitivity Analysis) Consider the Magic Golf Putters (MGP) problem in Assignment 1. Suppose now the two requirements regarding the production and sale of putters, as specified in the final paragraph of the problem, are no longer necessary. As a result, MGP has developed a linear program and obtained the following spreadsheet model and sensitivity report. Constraints Answer each of the following questions separately and independently: 1) How many of each type of putter should be produced? 2) What proportion of the putters produced are either AccuPutt or PureStrike? 3) How much can the unit selling price of TruePath decrease without affecting the current production plan of this product? 4) What happens to the optimal profit if the price of Beryllium decreases by 20% ? Specify the new level of optimal profits if at all possible. 5) Suppose that I.M. Poor, an employee in the Casting Department, is seeking overtime work for the upcoming planning period. He has expressed his desire to receive a bonus of $50 per hour, an additional payment on top of his regular salary. Furthermore, he is willing to work any number of extra hours in the Casting Department. a. Should MGP accommodate Mr. Poor's request to work overtime? Why or why not? b. If so, how many hours of overtime should Mr. Poor be asked to work? c. What is MGP's net profit if Mr. Poor works the requested hours of overtime? 6) The supplier of titanium is currently offering to sell up to 20kgs of titanium at a price of $95 per kg. However, they have 10kgs of titanium that is intended for another customer, but might consider selling it to MGP instead if the price is right. What is the highest amount that MGP should be willing to offer the supplier for this additional 10kgs of titanium? 7) Upon reviewing the production plan spreadsheet model, the marketing manager at MGP has raised a concern regarding the absence of PureStrike production. At least how much does the price of titanium need to decrease in order for the production of PureStrike to be profitable? 8) Suppose that the steel supplier informs MGP that, due to other commitments, it can only provide 38kg of steel instead of the promised 45kg. How will this change affect MGP's optimal profit

Problem 1 (LP Sensitivity Analysis) Consider the Magic Golf Putters (MGP) problem in Assignment 1. Suppose now the two requirements regarding the production and sale of putters, as specified in the final paragraph of the problem, are no longer necessary. As a result, MGP has developed a linear program and obtained the following spreadsheet model and sensitivity report. Constraints Answer each of the following questions separately and independently: 1) How many of each type of putter should be produced? 2) What proportion of the putters produced are either AccuPutt or PureStrike? 3) How much can the unit selling price of TruePath decrease without affecting the current production plan of this product? 4) What happens to the optimal profit if the price of Beryllium decreases by 20% ? Specify the new level of optimal profits if at all possible. 5) Suppose that I.M. Poor, an employee in the Casting Department, is seeking overtime work for the upcoming planning period. He has expressed his desire to receive a bonus of $50 per hour, an additional payment on top of his regular salary. Furthermore, he is willing to work any number of extra hours in the Casting Department. a. Should MGP accommodate Mr. Poor's request to work overtime? Why or why not? b. If so, how many hours of overtime should Mr. Poor be asked to work? c. What is MGP's net profit if Mr. Poor works the requested hours of overtime? 6) The supplier of titanium is currently offering to sell up to 20kgs of titanium at a price of $95 per kg. However, they have 10kgs of titanium that is intended for another customer, but might consider selling it to MGP instead if the price is right. What is the highest amount that MGP should be willing to offer the supplier for this additional 10kgs of titanium? 7) Upon reviewing the production plan spreadsheet model, the marketing manager at MGP has raised a concern regarding the absence of PureStrike production. At least how much does the price of titanium need to decrease in order for the production of PureStrike to be profitable? 8) Suppose that the steel supplier informs MGP that, due to other commitments, it can only provide 38kg of steel instead of the promised 45kg. How will this change affect MGP's optimal profit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started