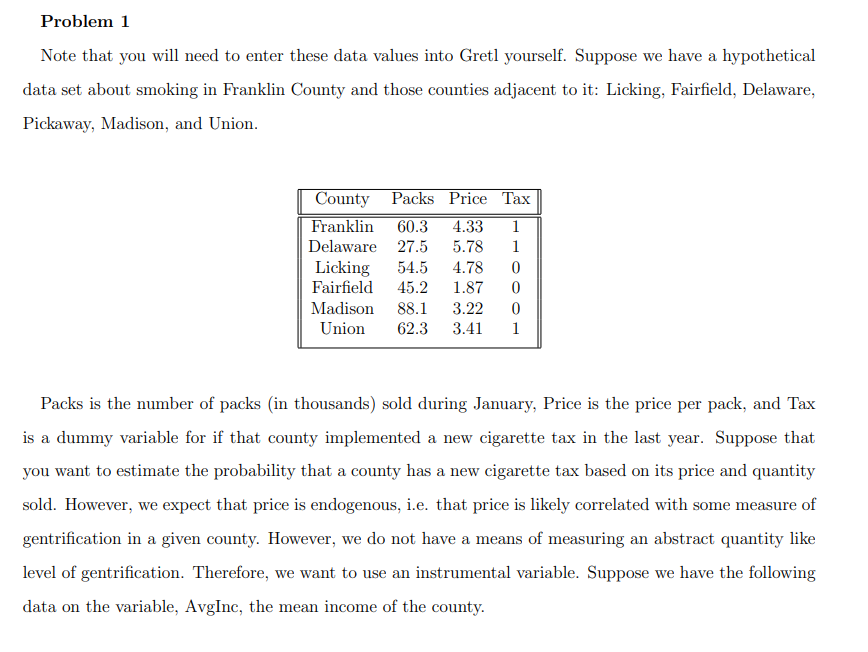

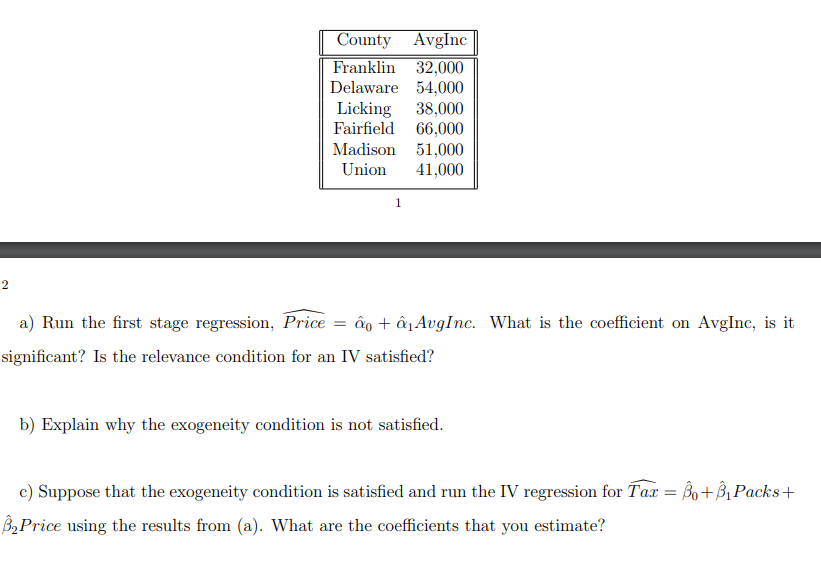

Problem 1 Note that you will need to enter these data values into Gretl yourself. Suppose we have a hypothetical data set about smoking in Franklin County and those counties adjacent to it: Licking, Fairfield, Delaware, Pickaway, Madison, and Union. County Packs Price Tax Franklin 60.3 4.33 1 Delaware 27.5 5.78 1 Licking 54.5 4.78 0 Fairfield 45.2 1.87 0 Madison 88.1 3.22 0 Union 62.3 3.41 1 Packs is the number of packs in thousands) sold during January, Price is the price per pack, and Tax is a dummy variable for if that county implemented a new cigarette tax in the last year. Suppose that you want to estimate the probability that a county has a new cigarette tax based on its price and quantity sold. However, we expect that price is endogenous, i.e. that price is likely correlated with some measure of gentrification in a given county. However, we do not have a means of measuring an abstract quantity like level of gentrification. Therefore, we want to use an instrumental variable. Suppose we have the following data on the variable, AvgInc, the mean income of the county. County AvgInc Franklin 32,000 Delaware 54,000 Licking 38,000 Fairfield 66,000 Madison 51,000 Union 41,000 1 2 a) Run the first stage regression, Price = o + AvgInc. What is the coefficient on AvgInc, is it significant? Is the relevance condition for an IV satisfied? b) Explain why the exogeneity condition is not satisfied. c) Suppose that the exogeneity condition is satisfied and run the IV regression for Tax = o + 1 Packs+ B2Price using the results from (a). What are the coefficients that you estimate? Problem 1 Note that you will need to enter these data values into Gretl yourself. Suppose we have a hypothetical data set about smoking in Franklin County and those counties adjacent to it: Licking, Fairfield, Delaware, Pickaway, Madison, and Union. County Packs Price Tax Franklin 60.3 4.33 1 Delaware 27.5 5.78 1 Licking 54.5 4.78 0 Fairfield 45.2 1.87 0 Madison 88.1 3.22 0 Union 62.3 3.41 1 Packs is the number of packs in thousands) sold during January, Price is the price per pack, and Tax is a dummy variable for if that county implemented a new cigarette tax in the last year. Suppose that you want to estimate the probability that a county has a new cigarette tax based on its price and quantity sold. However, we expect that price is endogenous, i.e. that price is likely correlated with some measure of gentrification in a given county. However, we do not have a means of measuring an abstract quantity like level of gentrification. Therefore, we want to use an instrumental variable. Suppose we have the following data on the variable, AvgInc, the mean income of the county. County AvgInc Franklin 32,000 Delaware 54,000 Licking 38,000 Fairfield 66,000 Madison 51,000 Union 41,000 1 2 a) Run the first stage regression, Price = o + AvgInc. What is the coefficient on AvgInc, is it significant? Is the relevance condition for an IV satisfied? b) Explain why the exogeneity condition is not satisfied. c) Suppose that the exogeneity condition is satisfied and run the IV regression for Tax = o + 1 Packs+ B2Price using the results from (a). What are the coefficients that you estimate