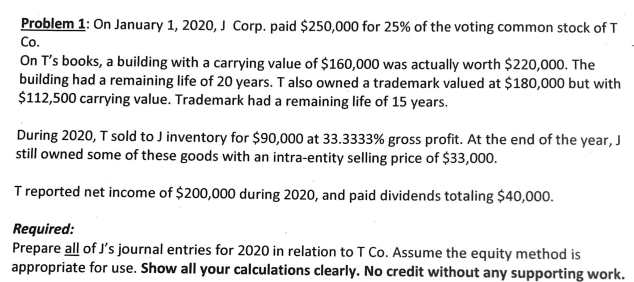

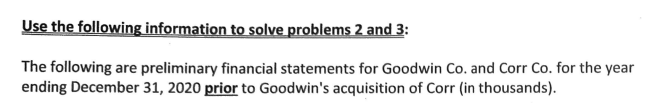

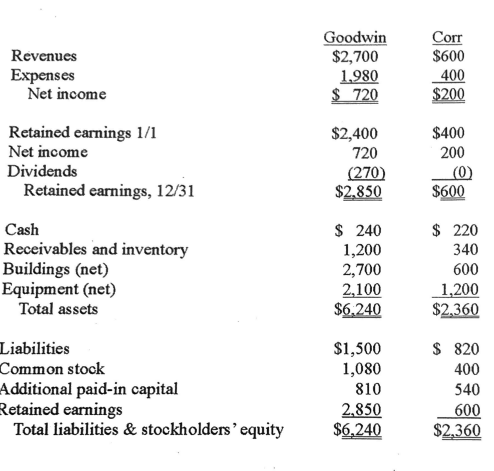

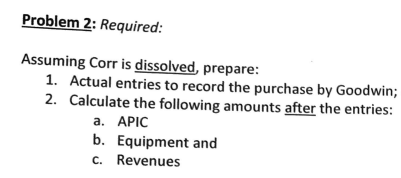

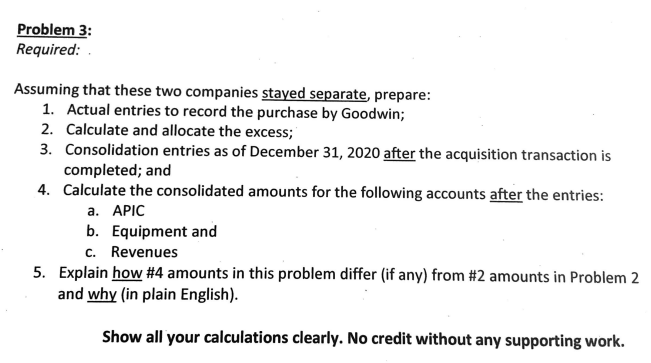

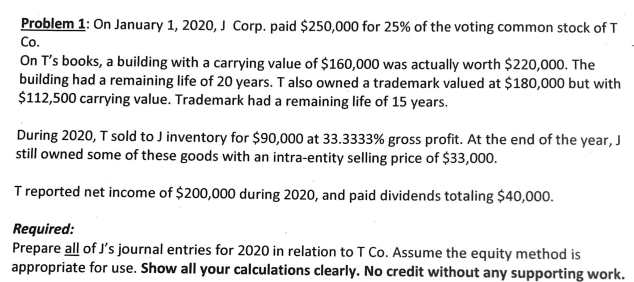

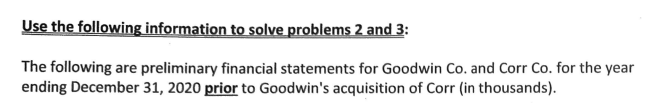

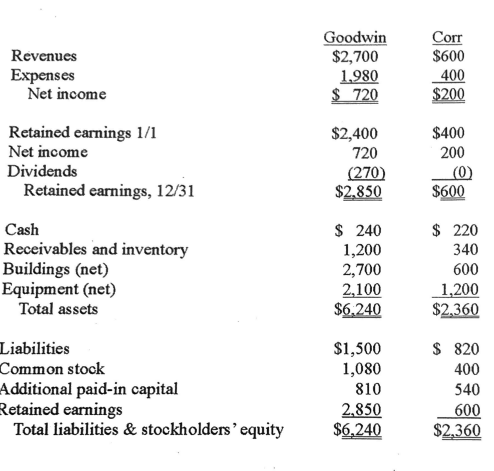

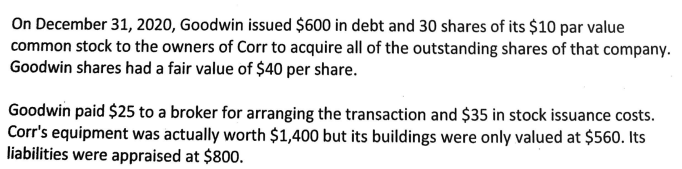

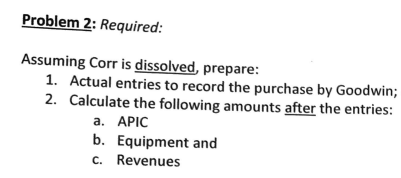

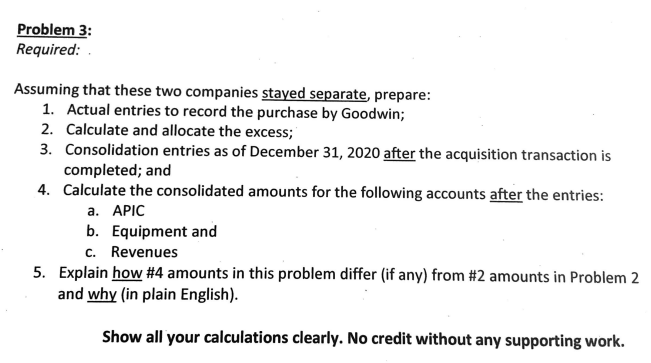

Problem 1: On January 1, 2020, J Corp. paid $250,000 for 25% of the voting common stock of T Co. On T's books, a building with a carrying value of $160,000 was actually worth $220,000. The building had a remaining life of 20 years. T also owned a trademark valued at $180,000 but with $112,500 carrying value. Trademark had a remaining life of 15 years. During 2020, T sold to J inventory for $90,000 at 33.3333% gross profit. At the end of the year, J still owned some of these goods with an intra-entity selling price of $33,000. T reported net income of $200,000 during 2020 , and paid dividends totaling $40,000. Required: Prepare all of J's journal entries for 2020 in relation to T Co. Assume the equity method is appropriate for use. Show all your calculations clearly. No credit without any supporting work. Use the following information to solve problems 2 and 3 : The following are preliminary financial statements for Goodwin Co. and Corr Co. for the year ending December 31, 2020 prior to Goodwin's acquisition of Corr (in thousands). On December 31, 2020, Goodwin issued $600 in debt and 30 shares of its $10 par value Goodwin shares had a fair value of $40 per share. Goodwin paid \$25 to a broker for arranging the transaction and \$35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560. Its liabilities were appraised at $800. Assuming Corr is dissolved, prepare: 1. Actual entries to record the purchase by Goodwin; 2. Calculate the following amounts after the entries: a. APIC b. Equipment and c. Revenues 1. Actual entries to record the purchase by Goodwin; 2. Calculate and allocate the excess; 3. Consolidation entries as of December 31, 2020 after the acquisition transaction is completed; and 4. Calculate the consolidated amounts for the following accounts after the entries: a. APIC b. Equipment and c. Revenues 5. Explain how #4 amounts in this problem differ (if any) from #2 amounts in Problem 2 and why (in plain English). Show all your calculations clearly. No credit without any supporting work. Problem 1: On January 1, 2020, J Corp. paid $250,000 for 25% of the voting common stock of T Co. On T's books, a building with a carrying value of $160,000 was actually worth $220,000. The building had a remaining life of 20 years. T also owned a trademark valued at $180,000 but with $112,500 carrying value. Trademark had a remaining life of 15 years. During 2020, T sold to J inventory for $90,000 at 33.3333% gross profit. At the end of the year, J still owned some of these goods with an intra-entity selling price of $33,000. T reported net income of $200,000 during 2020 , and paid dividends totaling $40,000. Required: Prepare all of J's journal entries for 2020 in relation to T Co. Assume the equity method is appropriate for use. Show all your calculations clearly. No credit without any supporting work. Use the following information to solve problems 2 and 3 : The following are preliminary financial statements for Goodwin Co. and Corr Co. for the year ending December 31, 2020 prior to Goodwin's acquisition of Corr (in thousands). On December 31, 2020, Goodwin issued $600 in debt and 30 shares of its $10 par value Goodwin shares had a fair value of $40 per share. Goodwin paid \$25 to a broker for arranging the transaction and \$35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560. Its liabilities were appraised at $800. Assuming Corr is dissolved, prepare: 1. Actual entries to record the purchase by Goodwin; 2. Calculate the following amounts after the entries: a. APIC b. Equipment and c. Revenues 1. Actual entries to record the purchase by Goodwin; 2. Calculate and allocate the excess; 3. Consolidation entries as of December 31, 2020 after the acquisition transaction is completed; and 4. Calculate the consolidated amounts for the following accounts after the entries: a. APIC b. Equipment and c. Revenues 5. Explain how #4 amounts in this problem differ (if any) from #2 amounts in Problem 2 and why (in plain English). Show all your calculations clearly. No credit without any supporting work