Problem 1: On January 1, 2022, Smith Corp. issued 5-year 12% bonds with face amount of P5,000,000 at a price of P4,497,320 which yields

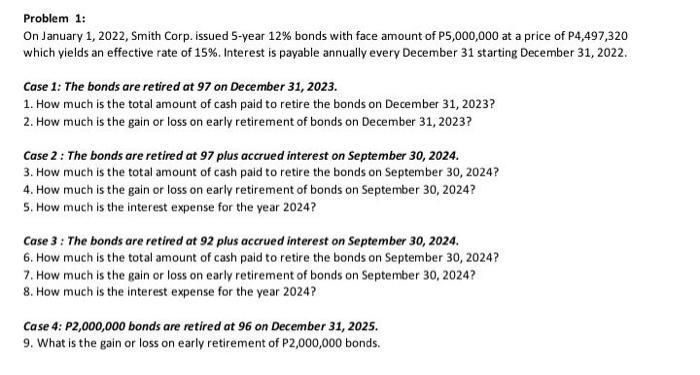

Problem 1: On January 1, 2022, Smith Corp. issued 5-year 12% bonds with face amount of P5,000,000 at a price of P4,497,320 which yields an effective rate of 15%. Interest is payable annually every December 31 starting December 31, 2022. Case 1: The bonds are retired at 97 on December 31, 2023. 1. How much is the total amount of cash paid to retire the bonds on December 31, 2023? 2. How much is the gain or loss on early retirement of bonds on December 31, 2023? Case 2: The bonds are retired at 97 plus accrued interest on September 30, 2024. 3. How much is the total amount of cash paid to retire the bonds on September 30, 2024? 4. How much is the gain or loss on early retirement of bonds on September 30, 2024? 5. How much is the interest expense for the year 2024? Case 3: The bonds are retired at 92 plus accrued interest on September 30, 2024. 6. How much is the total amount of cash paid to retire the bonds on September 30, 2024? 7. How much is the gain or loss on early retirement of bonds on September 30, 2024? 8. How much is the interest expense for the year 2024? Case 4: P2,000,000 bonds are retired at 96 on December 31, 2025. 9. What is the gain or loss on early retirement of P2,000,000 bonds. Problem 1: On January 1, 2022, Smith Corp. issued 5-year 12% bonds with face amount of P5,000,000 at a price of P4,497,320 which yields an effective rate of 15%. Interest is payable annually every December 31 starting December 31, 2022. Case 1: The bonds are retired at 97 on December 31, 2023. 1. How much is the total amount of cash paid to retire the bonds on December 31, 2023? 2. How much is the gain or loss on early retirement of bonds on December 31, 2023? Case 2: The bonds are retired at 97 plus accrued interest on September 30, 2024. 3. How much is the total amount of cash paid to retire the bonds on September 30, 2024? 4. How much is the gain or loss on early retirement of bonds on September 30, 2024? 5. How much is the interest expense for the year 2024? Case 3: The bonds are retired at 92 plus accrued interest on September 30, 2024. 6. How much is the total amount of cash paid to retire the bonds on September 30, 2024? 7. How much is the gain or loss on early retirement of bonds on September 30, 2024? 8. How much is the interest expense for the year 2024? Case 4: P2,000,000 bonds are retired at 96 on December 31, 2025. 9. What is the gain or loss on early retirement of P2,000,000 bonds.

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started