Answered step by step

Verified Expert Solution

Question

1 Approved Answer

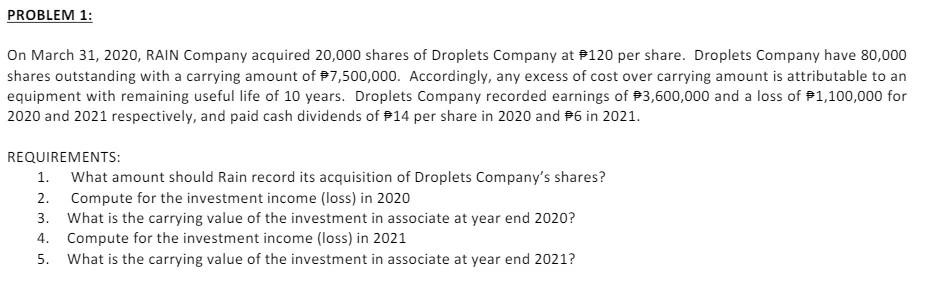

PROBLEM 1: On March 31, 2020, RAIN Company acquired 20,000 shares of Droplets Company at P120 per share. Droplets Company have 80,000 shares outstanding with

PROBLEM 1: On March 31, 2020, RAIN Company acquired 20,000 shares of Droplets Company at P120 per share. Droplets Company have 80,000 shares outstanding with a carrying amount of $7,500,000. Accordingly, any excess of cost over carrying amount is attributable to an equipment with remaining useful life of 10 years. Droplets Company recorded earnings of P3,600,000 and a loss of $1,100,000 for 2020 and 2021 respectively, and paid cash dividends of P14 per share in 2020 and 6 in 2021. REQUIREMENTS: 1. What amount should Rain record its acquisition of Droplets Company's shares? 2. Compute for the investment income (loss) in 2020 3. What is the carrying value of the investment in associate at year end 2020? 4. Compute for the investment income (loss) in 2021 5. What is the carrying value of the investment in associate at year end 2021? PROBLEM 1: On March 31, 2020, RAIN Company acquired 20,000 shares of Droplets Company at P120 per share. Droplets Company have 80,000 shares outstanding with a carrying amount of $7,500,000. Accordingly, any excess of cost over carrying amount is attributable to an equipment with remaining useful life of 10 years. Droplets Company recorded earnings of P3,600,000 and a loss of $1,100,000 for 2020 and 2021 respectively, and paid cash dividends of P14 per share in 2020 and 6 in 2021. REQUIREMENTS: 1. What amount should Rain record its acquisition of Droplets Company's shares? 2. Compute for the investment income (loss) in 2020 3. What is the carrying value of the investment in associate at year end 2020? 4. Compute for the investment income (loss) in 2021 5. What is the carrying value of the investment in associate at year end 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started