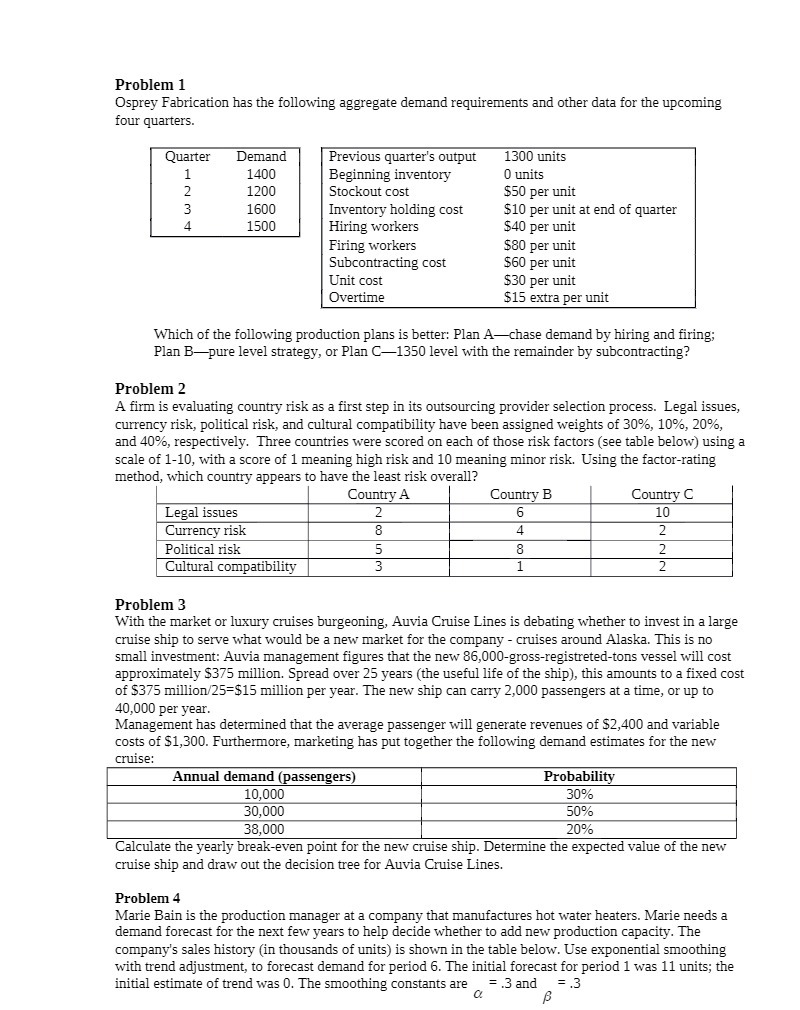

Problem 1 Osprey Fabrication has the following aggregate demand requirements and other data for the upcoming four quarters. Quarter Demand Previous quarter's output 1300 units 1400 Beginning inventory 0 units 1200 Stockout cost $50 per unit 1600 Inventory holding cost $10 per unit at end of quarter 1500 Hiring workers $40 per unit Firing workers $80 per unit Subcontracting cost $60 per unit Unit cost $30 per unit Overtime $15 extra per unit Which of the following production plans is better: Plan A-chase demand by hiring and firing; Plan B-pure level strategy, or Plan C-1350 level with the remainder by subcontracting? Problem 2 A firm is evaluating country risk as a first step in its outsourcing provider selection process. Legal issues, currency risk, political risk, and cultural compatibility have been assigned weights of 30%, 10%, 20%, and 40%, respectively. Three countries were scored on each of those risk factors (see table below) using a scale of 1-10, with a score of 1 meaning high risk and 10 meaning minor risk. Using the factor-rating method, which country appears to have the least risk overall? Country A Country B Country C Legal issues 10 Currency risk Political risk WUCo 8 Cultural compatibility Problem 3 With the market or luxury cruises burgeoning, Auvia Cruise Lines is debating whether to invest in a large cruise ship to serve what would be a new market for the company - cruises around Alaska. This is no small investment: Auvia management figures that the new 86,000-gross-registreted-tons vessel will cost approximately $375 million. Spread over 25 years (the useful life of the ship), this amounts to a fixed cost of $375 million/25=$15 million per year. The new ship can carry 2,000 passengers at a time, or up to 40,000 per year. Management has determined that the average passenger will generate revenues of $2,400 and variable costs of $1,300. Furthermore, marketing has put together the following demand estimates for the new cruise: Annual demand (passengers) Probability 10,000 30% 30,000 50% 38,000 20% Calculate the yearly break-even point for the new cruise ship. Determine the expected value of the new cruise ship and draw out the decision tree for Auvia Cruise Lines. Problem 4 Marie Bain is the production manager at a company that manufactures hot water heaters. Marie needs a demand forecast for the next few years to help decide whether to add new production capacity. The company's sales history (in thousands of units) is shown in the table below. Use exponential smoothing with trend adjustment, to forecast demand for period 6. The initial forecast for period 1 was 11 units; the initial estimate of trend was 0. The smoothing constants are = .3 and = .3 B