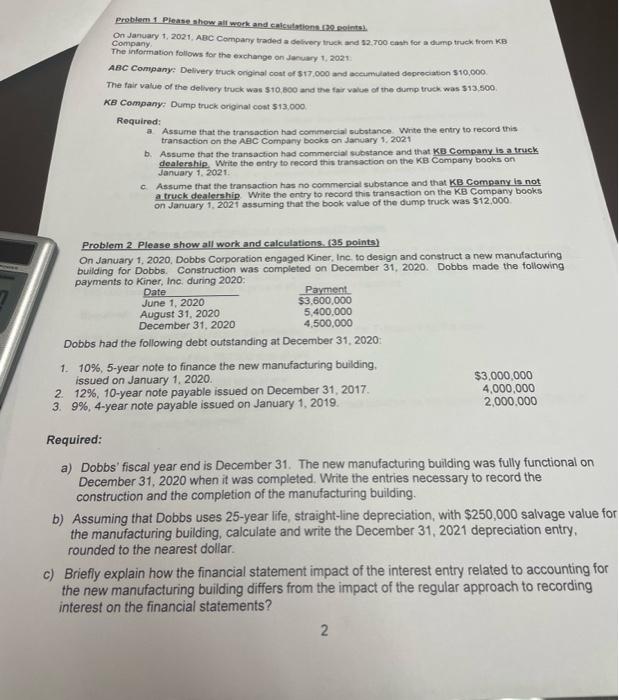

problem 1 Please show all work and cautions on January 1, 2021. ABC Company traded a delivery truck and 52.700 cash for a dump truck from KB Company The information follows for the exchange on January 1, 2021 ABC Company: Delivery truck original cost of $17.000 and accumulated depreciation $10,000 The fair value of the delivery truck was $10,000 and the far value of the dump truck was 513,500 KB Company: Dump truck original cost $13.000 Required: a Assume that the transaction had commercial substance Write the entry to record this transaction on the ABC Company books on January 1, 2021 b. Assume that the transaction had commercial substance and that KB Company is a truck dealership. Write the entry to record this transaction on the KB Company books on January 1, 2021 Assume that the transaction has no commercial substance and that KB Company is not a truck dealership Write the entry to record this transaction on the KB Company books on January 1, 2021 assuming that the book value of the dump truck was $12.000 Problem 2 Please show all work and calculations. (35 points) On January 1, 2020, Dobbs Corporation engaged Kiner, Inc. to design and construct a new manufacturing building for Dobbs. Construction was completed on December 31, 2020. Dobbs made the following payments to Kiner, Inc. during 2020: Date Payment June 1, 2020 $3,600,000 August 31, 2020 5,400,000 December 31, 2020 4,500,000 Dobbs had the following debt outstanding at December 31, 2020: 1. 10%, 5-year note to finance the new manufacturing building, issued on January 1, 2020 $3,000,000 2. 12%, 10-year note payable issued on December 31, 2017 4,000,000 3. 9%, 4-year note payable issued on January 1, 2019 2,000,000 Required: a) Dobbs' fiscal year end is December 31. The new manufacturing building was fully functional on December 31, 2020 when it was completed. Write the entries necessary to record the construction and the completion of the manufacturing building. b) Assuming that Dobbs uses 25-year life, straight-line depreciation with $250,000 salvage value for the manufacturing building, calculate and write the December 31, 2021 depreciation entry. rounded to the nearest dollar c) Briefly explain how the financial statement impact of the interest entry related to accounting for the new manufacturing building differs from the impact of the regular approach to recording interest on the financial statements? 2 problem 1 Please show all work and cautions on January 1, 2021. ABC Company traded a delivery truck and 52.700 cash for a dump truck from KB Company The information follows for the exchange on January 1, 2021 ABC Company: Delivery truck original cost of $17.000 and accumulated depreciation $10,000 The fair value of the delivery truck was $10,000 and the far value of the dump truck was 513,500 KB Company: Dump truck original cost $13.000 Required: a Assume that the transaction had commercial substance Write the entry to record this transaction on the ABC Company books on January 1, 2021 b. Assume that the transaction had commercial substance and that KB Company is a truck dealership. Write the entry to record this transaction on the KB Company books on January 1, 2021 Assume that the transaction has no commercial substance and that KB Company is not a truck dealership Write the entry to record this transaction on the KB Company books on January 1, 2021 assuming that the book value of the dump truck was $12.000 Problem 2 Please show all work and calculations. (35 points) On January 1, 2020, Dobbs Corporation engaged Kiner, Inc. to design and construct a new manufacturing building for Dobbs. Construction was completed on December 31, 2020. Dobbs made the following payments to Kiner, Inc. during 2020: Date Payment June 1, 2020 $3,600,000 August 31, 2020 5,400,000 December 31, 2020 4,500,000 Dobbs had the following debt outstanding at December 31, 2020: 1. 10%, 5-year note to finance the new manufacturing building, issued on January 1, 2020 $3,000,000 2. 12%, 10-year note payable issued on December 31, 2017 4,000,000 3. 9%, 4-year note payable issued on January 1, 2019 2,000,000 Required: a) Dobbs' fiscal year end is December 31. The new manufacturing building was fully functional on December 31, 2020 when it was completed. Write the entries necessary to record the construction and the completion of the manufacturing building. b) Assuming that Dobbs uses 25-year life, straight-line depreciation with $250,000 salvage value for the manufacturing building, calculate and write the December 31, 2021 depreciation entry. rounded to the nearest dollar c) Briefly explain how the financial statement impact of the interest entry related to accounting for the new manufacturing building differs from the impact of the regular approach to recording interest on the financial statements? 2