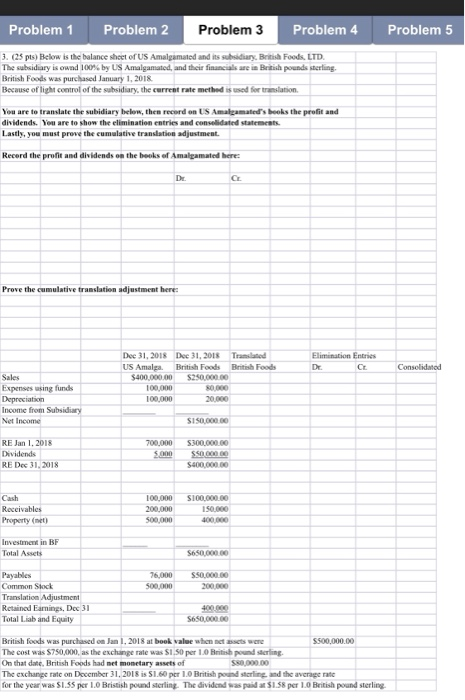

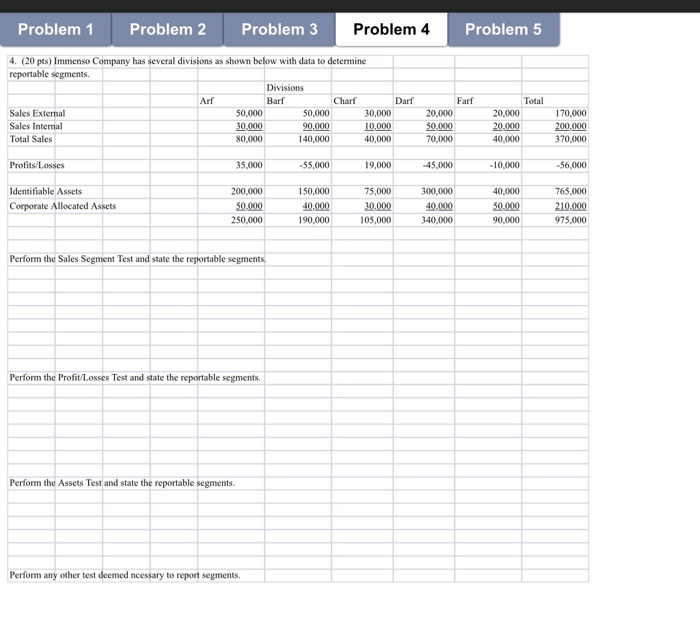

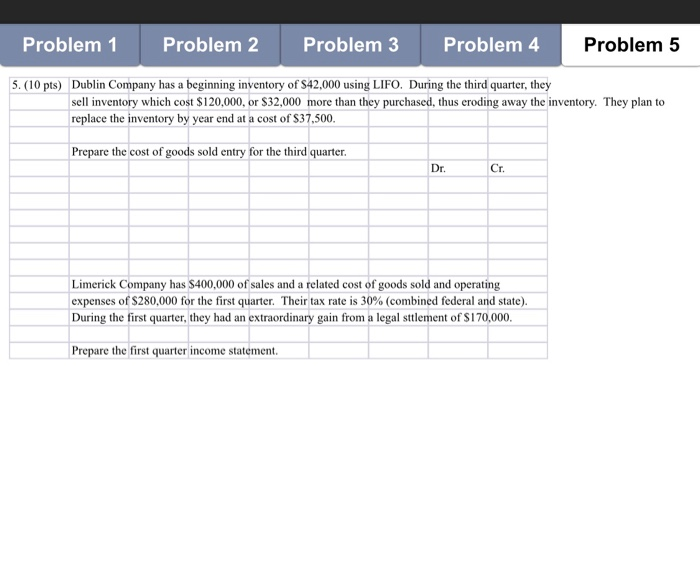

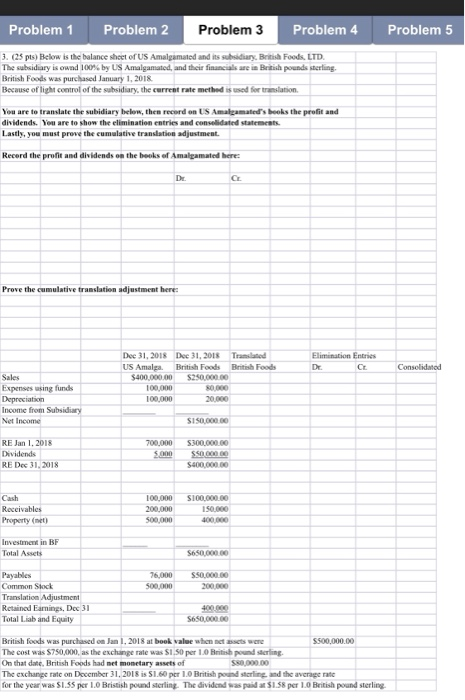

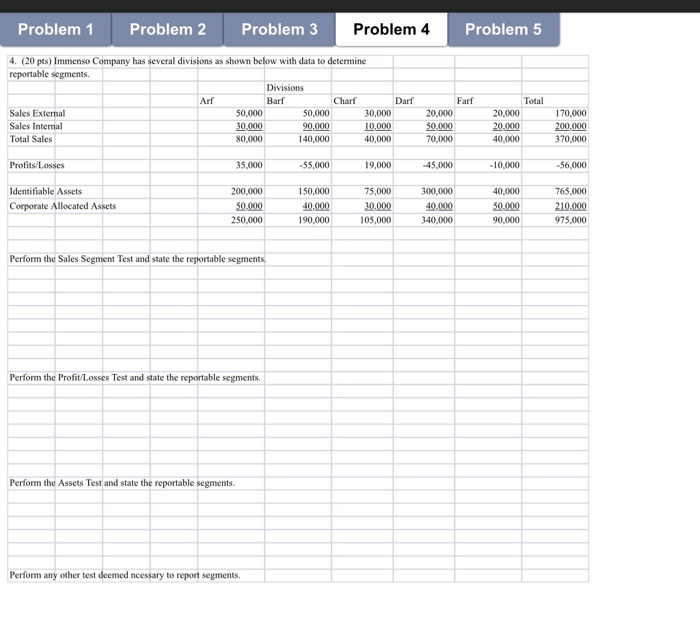

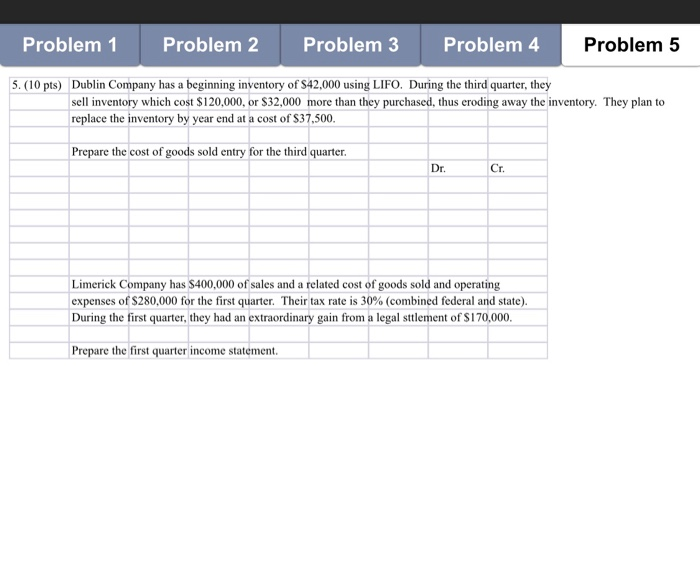

Problem 1 Problem 2 Problem 3 Problem 4 Problem 5 3. (25 pts) Below is the balance shect of US Amalgamated and its subsidiary, Briish Foods LTD The subsidiary is ownd 100% by US Amalgamated, and their fiancak ura Bitih pounds sterling. British Foods was purchased January 1, 2018 Because of light control of the subsidiary, the cerreet rate methed is used for translation You are to translate the subidiary below, then recerd on US Amalgamated's beoks the prolit and dividends. Yeu are to show the elimination entries and convelidated statemests Lastly, you must prove the cumelative translation adjustment. Recerd the profit and dividends on the beoks ef Amalgamated here Dr. Cr. Prove the cumulative translation adjustment here Dee 31, 2018 Dee 31, 2018 Tramslated US Amalga British Foods Bnitish Foods Dr. Cr. $400,000.00 $250,000.00 00,000 100,000 Expenses using funds 20.000 Income from Net Income S150,000 00 RE Jan 1, 2018 Dividends RE Dec 31,2018 700,000 S300.o00.00 $400,000.00 Cash Receivables Property (net 00,000 S100000.0 00,000400000 00,000 150000 Investment in BF Total Assets Payables Common Stock Translation Adjustment Rctained Earnings, Dec 3 Total Liab and Equity $5000000 200000 S650,000 00 British foods was purchased on Jan 1,2018 at book value when net assets wer The cost was $750,000, as the exchange rate was $1.50 per 1.0 British pound sterig On that date, British Foods had net monetary assets of The exchange ratc on December 31.2018 is S1.60 per 1. British pound stcrling and the average ratc for the year was S1.55 per 1.0 Bristish pound sterling. The dividend sas paid an S1.58 per 1.0 British pouand sterling $500,000.00 Problem 1 Problem 2 Problem 3 Problem 4 Problem 5 (20 pts) Immenso Company has several divisions as shown below with data to determine reportable segments. Arf Barf Charf Darf Farf Total Sales External Sales Internal Total Sales 50,000 30.000 80,000 50,000 90,000 140,000 30,000 10,000 40,000 20,000 50.000 70,000 20.000 40,000 170,000 200,000 370,000 35,000 55,000 19,000 45,000 10,000 Identifiable Assets 200,000 0.000 250,000 150,000 40.000 90,000 75,000 30.000 105,000 40,000 50.000 0,000 765,000 210.000 975,000 Corporate Allocated Assets 40.000 Perform the Sales Segment Test and state the reportable segments Perform the Profit/Losses Test and state the reportable segments Perform the Assets Test and state the reportable segments Perform any other test ncessary to report segments. Problem 1 Problem 2 Problem 3 Problem 4 Problem 5 5. (10 pts) Dublin Company has a beginning inventory of S42,000 using LIFO. During the third quarter, they sell inventory which cost S120,000, or S32,000 more than they purchased, thus eroding away the inventory. They plan to replace the inventory by year end at a cost of $37,500 Prepare the cost of goods sold entry for the third quarter. Dr. r. Limerick Company has $400,000 of sales and a related cost of goods sold and operating expenses of$280,000 for the first quarter. Their tax rate is 30% (combined federal and state) During the first quarter, they had an extraordinary gain from a legal sttlement of S170,000 Prepare the first quarter income statemernt Problem 1 Problem 2 Problem 3 Problem 4 Problem 5 3. (25 pts) Below is the balance shect of US Amalgamated and its subsidiary, Briish Foods LTD The subsidiary is ownd 100% by US Amalgamated, and their fiancak ura Bitih pounds sterling. British Foods was purchased January 1, 2018 Because of light control of the subsidiary, the cerreet rate methed is used for translation You are to translate the subidiary below, then recerd on US Amalgamated's beoks the prolit and dividends. Yeu are to show the elimination entries and convelidated statemests Lastly, you must prove the cumelative translation adjustment. Recerd the profit and dividends on the beoks ef Amalgamated here Dr. Cr. Prove the cumulative translation adjustment here Dee 31, 2018 Dee 31, 2018 Tramslated US Amalga British Foods Bnitish Foods Dr. Cr. $400,000.00 $250,000.00 00,000 100,000 Expenses using funds 20.000 Income from Net Income S150,000 00 RE Jan 1, 2018 Dividends RE Dec 31,2018 700,000 S300.o00.00 $400,000.00 Cash Receivables Property (net 00,000 S100000.0 00,000400000 00,000 150000 Investment in BF Total Assets Payables Common Stock Translation Adjustment Rctained Earnings, Dec 3 Total Liab and Equity $5000000 200000 S650,000 00 British foods was purchased on Jan 1,2018 at book value when net assets wer The cost was $750,000, as the exchange rate was $1.50 per 1.0 British pound sterig On that date, British Foods had net monetary assets of The exchange ratc on December 31.2018 is S1.60 per 1. British pound stcrling and the average ratc for the year was S1.55 per 1.0 Bristish pound sterling. The dividend sas paid an S1.58 per 1.0 British pouand sterling $500,000.00 Problem 1 Problem 2 Problem 3 Problem 4 Problem 5 (20 pts) Immenso Company has several divisions as shown below with data to determine reportable segments. Arf Barf Charf Darf Farf Total Sales External Sales Internal Total Sales 50,000 30.000 80,000 50,000 90,000 140,000 30,000 10,000 40,000 20,000 50.000 70,000 20.000 40,000 170,000 200,000 370,000 35,000 55,000 19,000 45,000 10,000 Identifiable Assets 200,000 0.000 250,000 150,000 40.000 90,000 75,000 30.000 105,000 40,000 50.000 0,000 765,000 210.000 975,000 Corporate Allocated Assets 40.000 Perform the Sales Segment Test and state the reportable segments Perform the Profit/Losses Test and state the reportable segments Perform the Assets Test and state the reportable segments Perform any other test ncessary to report segments. Problem 1 Problem 2 Problem 3 Problem 4 Problem 5 5. (10 pts) Dublin Company has a beginning inventory of S42,000 using LIFO. During the third quarter, they sell inventory which cost S120,000, or S32,000 more than they purchased, thus eroding away the inventory. They plan to replace the inventory by year end at a cost of $37,500 Prepare the cost of goods sold entry for the third quarter. Dr. r. Limerick Company has $400,000 of sales and a related cost of goods sold and operating expenses of$280,000 for the first quarter. Their tax rate is 30% (combined federal and state) During the first quarter, they had an extraordinary gain from a legal sttlement of S170,000 Prepare the first quarter income statemernt