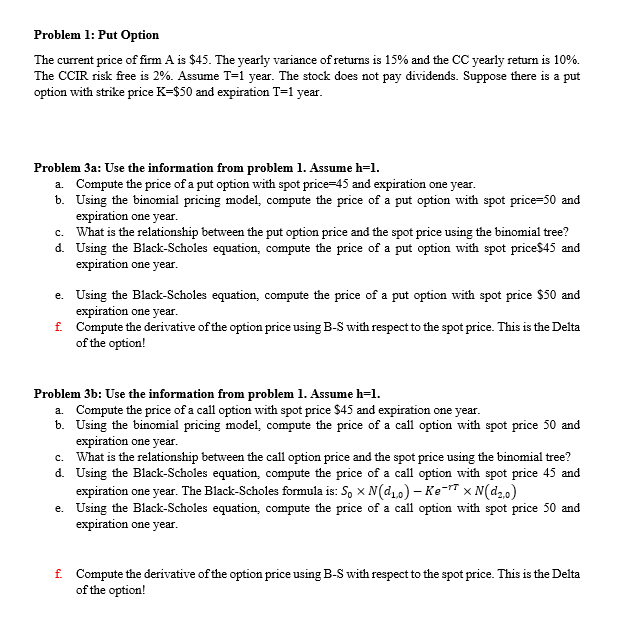

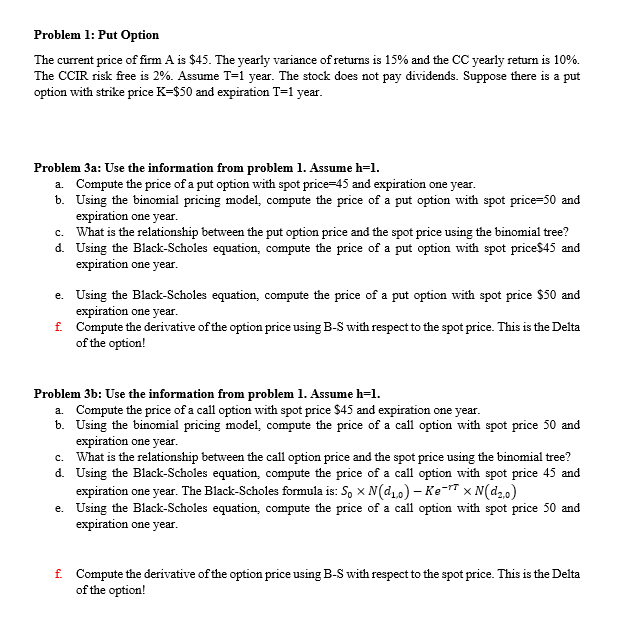

Problem 1: Put Option The current price of firm A is $45. The yearly variance of returns is 15% and the CC yearly return is 10%. The CCIR risk free is 2%. Assume T=1 year. The stock does not pay dividends. Suppose there is a put option with strike price K=$50 and expiration T=1 year. Problem 3a: Use the information from problem 1. Assume h=l. a. Compute the price of a put option with spot price=45 and expiration one year. b. Using the binomial pricing model, compute the price of a put option with spot price=50 and expiration one year c. What is the relationship between the put option price and the spot price using the binomial tree? d. Using the Black-Scholes equation, compute the price of a put option with spot price$45 and expiration one year e. Using the Black-Scholes equation, compute the price of a put option with spot price $50 and expiration one year. f. Compute the derivative of the option price using B-S with respect to the spot price. This is the Delta of the option! Problem 36: Use the information from problem 1. Assume h=l. a. Compute the price of a call option with spot price $45 and expiration one year. b. Using the binomial pricing model compute the price of a call option with spot price 50 and expiration one year. c. What is the relationship between the call option price and the spot price using the binomial tree? d. Using the Black-Scholes equation, compute the price of a call option with spot price 45 and expiration one year. The Black-Scholes formula is: So x 1(210) - Ke="t Nd3,0) e. Using the Black-Scholes equation, compute the price of a call option with spot price 50 and expiration one year. f. Compute the derivative of the option price using B-S with respect to the spot price. This is the Delta of the option! Problem 1: Put Option The current price of firm A is $45. The yearly variance of returns is 15% and the CC yearly return is 10%. The CCIR risk free is 2%. Assume T=1 year. The stock does not pay dividends. Suppose there is a put option with strike price K=$50 and expiration T=1 year. Problem 3a: Use the information from problem 1. Assume h=l. a. Compute the price of a put option with spot price=45 and expiration one year. b. Using the binomial pricing model, compute the price of a put option with spot price=50 and expiration one year c. What is the relationship between the put option price and the spot price using the binomial tree? d. Using the Black-Scholes equation, compute the price of a put option with spot price$45 and expiration one year e. Using the Black-Scholes equation, compute the price of a put option with spot price $50 and expiration one year. f. Compute the derivative of the option price using B-S with respect to the spot price. This is the Delta of the option! Problem 36: Use the information from problem 1. Assume h=l. a. Compute the price of a call option with spot price $45 and expiration one year. b. Using the binomial pricing model compute the price of a call option with spot price 50 and expiration one year. c. What is the relationship between the call option price and the spot price using the binomial tree? d. Using the Black-Scholes equation, compute the price of a call option with spot price 45 and expiration one year. The Black-Scholes formula is: So x 1(210) - Ke="t Nd3,0) e. Using the Black-Scholes equation, compute the price of a call option with spot price 50 and expiration one year. f. Compute the derivative of the option price using B-S with respect to the spot price. This is the Delta of the option