Answered step by step

Verified Expert Solution

Question

1 Approved Answer

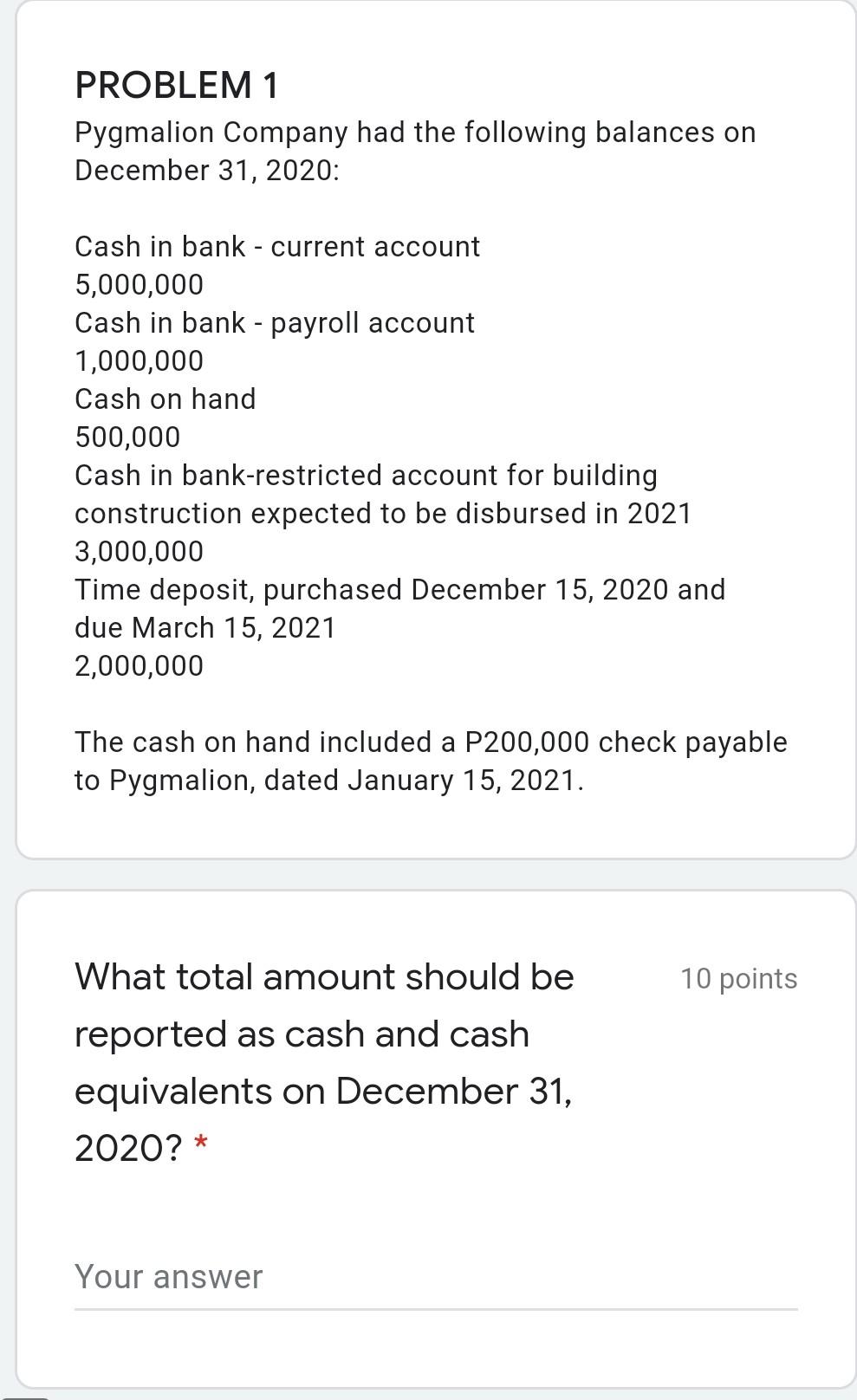

PROBLEM 1 Pygmalion Company had the following balances on December 31, 2020: Cash in bank - current account 5,000,000 Cash in bank - payroll account

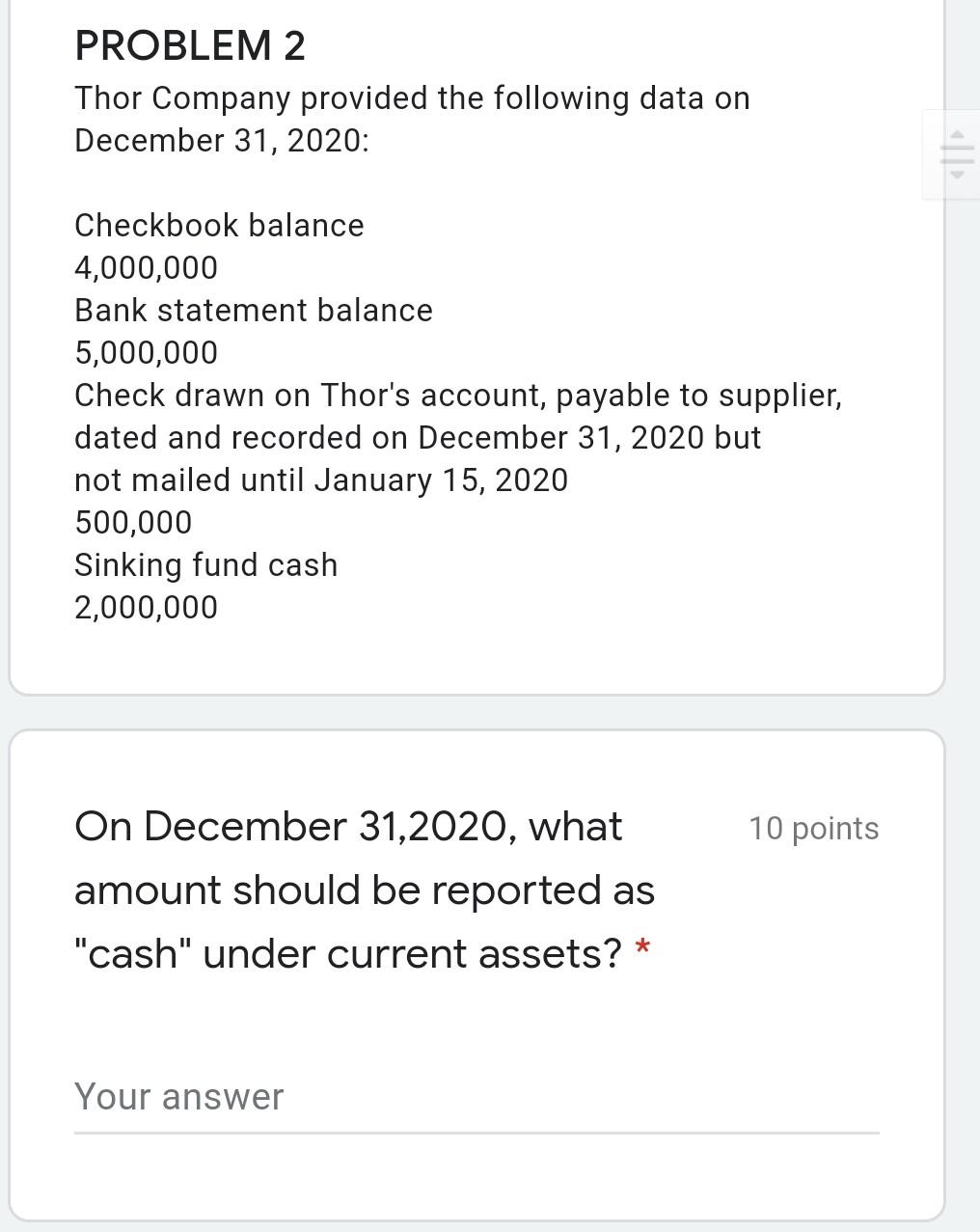

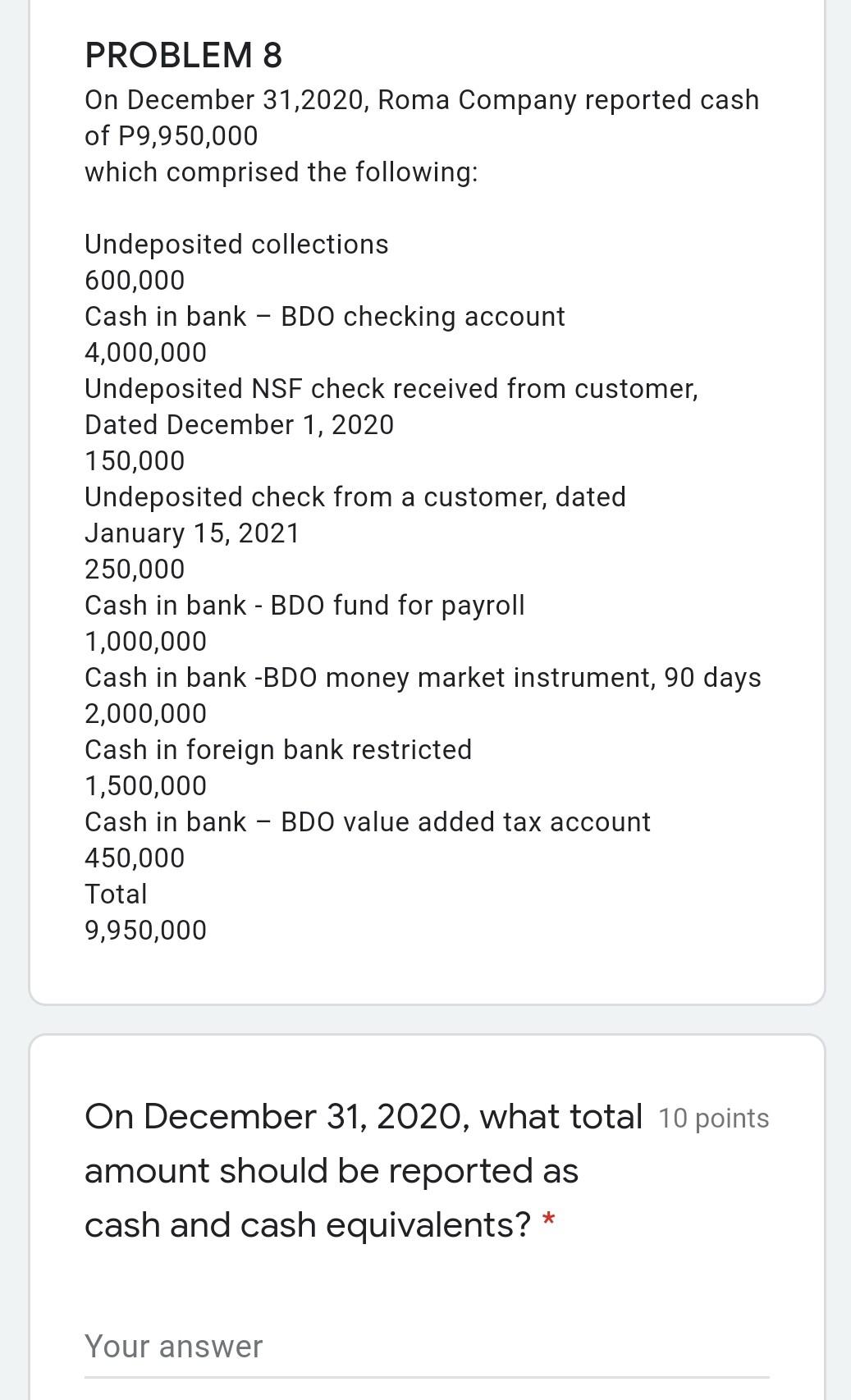

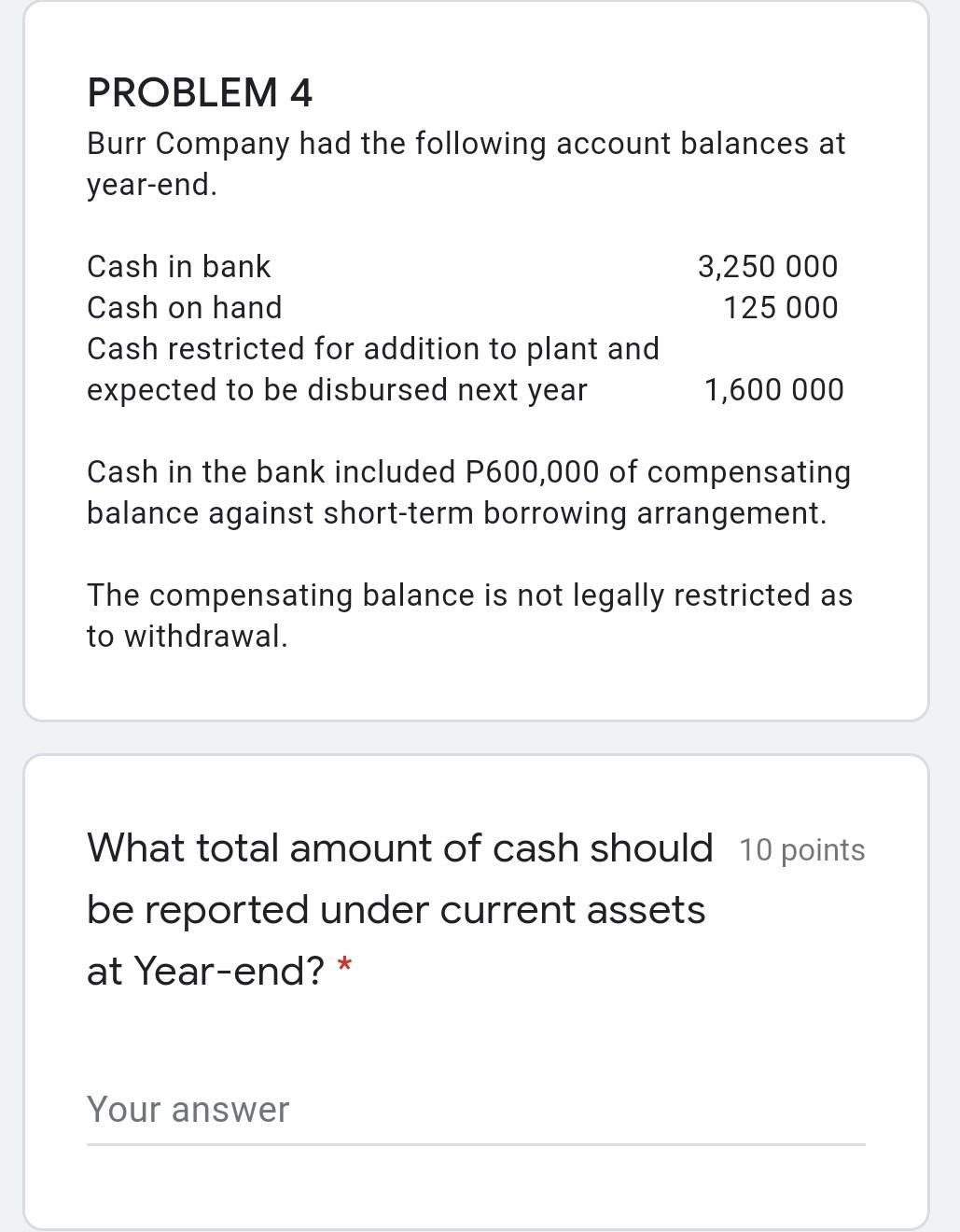

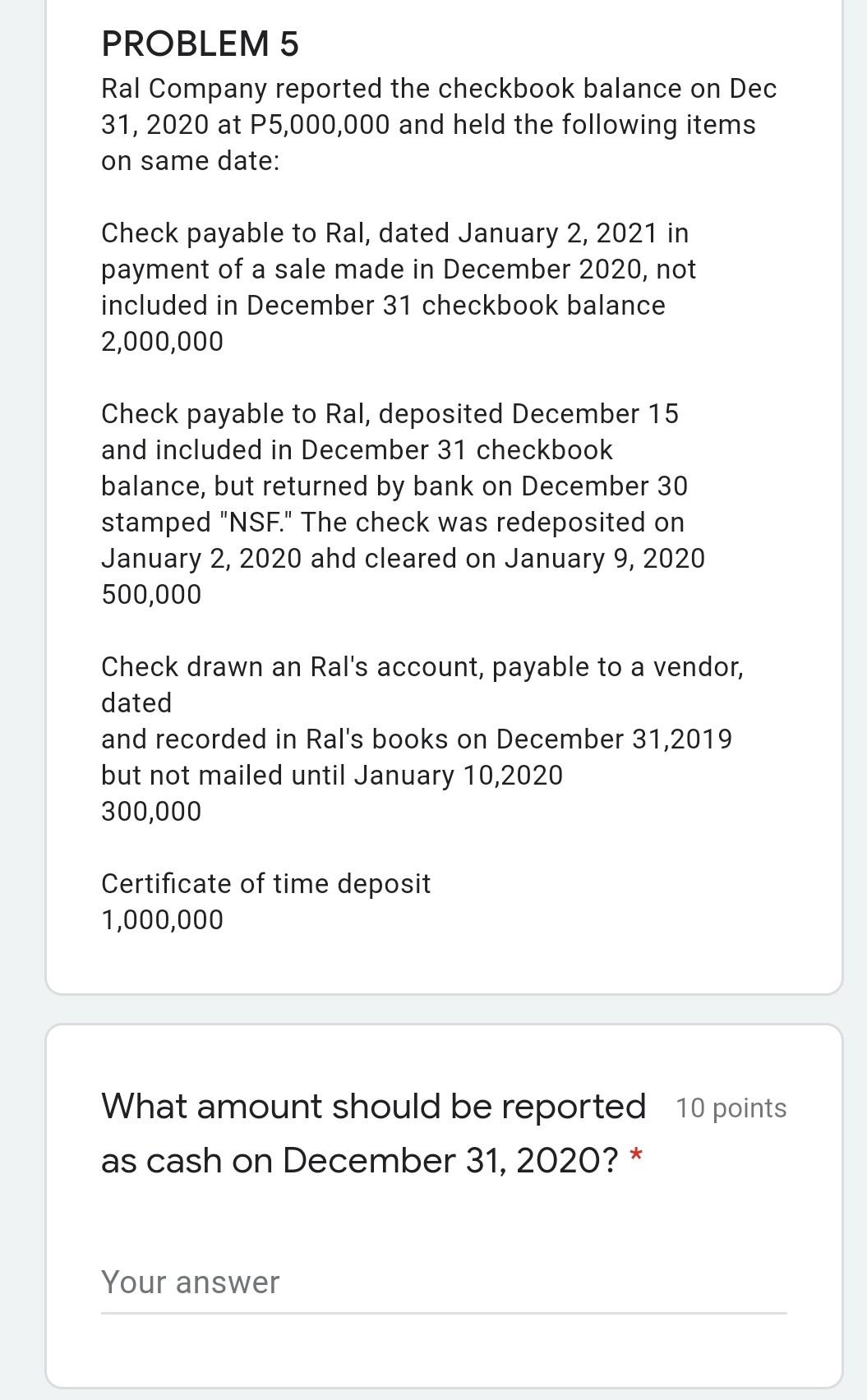

PROBLEM 1 Pygmalion Company had the following balances on December 31, 2020: Cash in bank - current account 5,000,000 Cash in bank - payroll account 1,000,000 Cash on hand 500,000 Cash in bank-restricted account for building construction expected to be disbursed in 2021 3,000,000 Time deposit, purchased December 15, 2020 and due March 15, 2021 2,000,000 The cash on hand included a P200,000 check payable to Pygmalion, dated January 15, 2021. 10 points What total amount should be reported as cash and cash equivalents on December 31, 2020? * Your answer PROBLEM 2 Thor Company provided the following data on December 31, 2020: Checkbook balance 4,000,000 Bank statement balance 5,000,000 Check drawn on Thor's account, payable to supplier, dated and recorded on December 31, 2020 but not mailed until January 15, 2020 500,000 Sinking fund cash 2,000,000 10 points On December 31,2020, what amount should be reported as "cash" under current assets? * Your answer PROBLEM 8 On December 31,2020, Roma Company reported cash of P9,950,000 which comprised the following: Undeposited collections 600,000 Cash in bank - BDO checking account 4,000,000 Undeposited NSF check received from customer, Dated December 1, 2020 150,000 Undeposited check from a customer, dated January 15, 2021 250,000 Cash in bank - BDO fund for payroll 1,000,000 Cash in bank -BDO money market instrument, 90 days 2,000,000 Cash in foreign bank restricted 1,500,000 Cash in bank - BDO value added tax account 450,000 Total 9,950,000 On December 31, 2020, what total 10 points amount should be reported as cash and cash equivalents? * Your answer PROBLEM 4 Burr Company had the following account balances at year-end. 3,250 000 125 000 Cash in bank Cash on hand Cash restricted for addition to plant and expected to be disbursed next year 1,600 000 Cash in the bank included P600,000 of compensating balance against short-term borrowing arrangement. The compensating balance is not legally restricted as to withdrawal. What total amount of cash should 10 points be reported under current assets at Year-end? * Your answer PROBLEM 5 Ral Company reported the checkbook balance on Dec 31, 2020 at P5,000,000 and held the following items on same date: Check payable to Ral, dated January 2, 2021 in payment of a sale made in December 2020, not included in December 31 checkbook balance 2,000,000 Check payable to Ral, deposited December 15 and included in December 31 checkbook balance, but returned by bank on December 30 stamped "NSF." The check was redeposited on January 2, 2020 ahd cleared on January 9, 2020 500,000 Check drawn an Ral's account, payable to a vendor, dated and recorded in Ral's books on December 31,2019 but not mailed until January 10,2020 300,000 Certificate of time deposit 1,000,000 What amount should be reported 10 points as cash on December 31, 2020?* Your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started