Question

Problem #1 Ratios Lulu, Inc. Balance Sheets E nding Balances per years 2019 2020 Cash 100,000 120,000 Supplies 4 0 ,000 35,000 AR 40,000 3

Problem #1 Ratios

Lulu, Inc.

Balance Sheets

Ending Balances per years

| 2019 |

| 2020 |

|

Cash | 100,000 |

| 120,000 |

|

Supplies | 40,000 |

| 35,000 |

|

AR | 40,000 |

| 35,000 |

|

Inventory | 50,000 |

| 60,000 |

|

Equipment | 150,000 |

| 140,000 |

|

Total | 380,000 |

| 390,000 |

|

|

|

|

|

|

Liabilities |

|

|

|

|

AP | 30,000 |

| 33,000 |

|

Salaries Payable | 20,000 |

| 22,000 |

|

NP | 180,000 |

| 180,000 |

|

Total | 230,000 |

| 235,000 |

|

|

|

|

|

|

Equity |

|

|

|

|

Common stock | 75,000 |

| 75,000 |

|

PIC Common | 40,000 |

| 40,000 |

|

Retained Earnings | 35,000 |

| 40,000 |

|

Total | 150,000 |

| 155,000 |

|

|

|

|

|

|

Total Liabilities &Equity | 380,000 |

| 390,000 |

|

LuLu. Inc.

Income Statement

For the Year Ended 2020

Sales |

|

| 1,000,000 |

COGS |

|

| 450,000 |

Gross Margin |

|

| 550,000 |

Operating Expense |

|

|

|

| Administrative | 100,000 |

|

| Selling | 60,000 |

|

| Total |

| 160,000 |

EBIT |

|

| 390,000 |

Interest |

|

| 10,000 |

EBT |

|

| 380,000 |

Taxes | 50% rate |

| 190,000 |

Operating Income |

|

| 190,000 |

Notes:

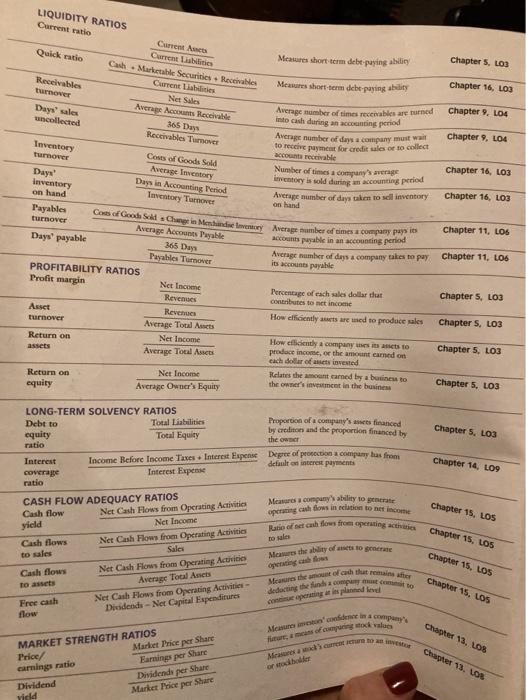

Required: Compute the ratios for 2020. Compute all ratios as are listed in the front cover page of your textbook.

Required: Highlight, underline, circle, or show you answers that I can easily identify them. Also, show all work to arrive at your answers. Failure to provide work = zero.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started