Answered step by step

Verified Expert Solution

Question

1 Approved Answer

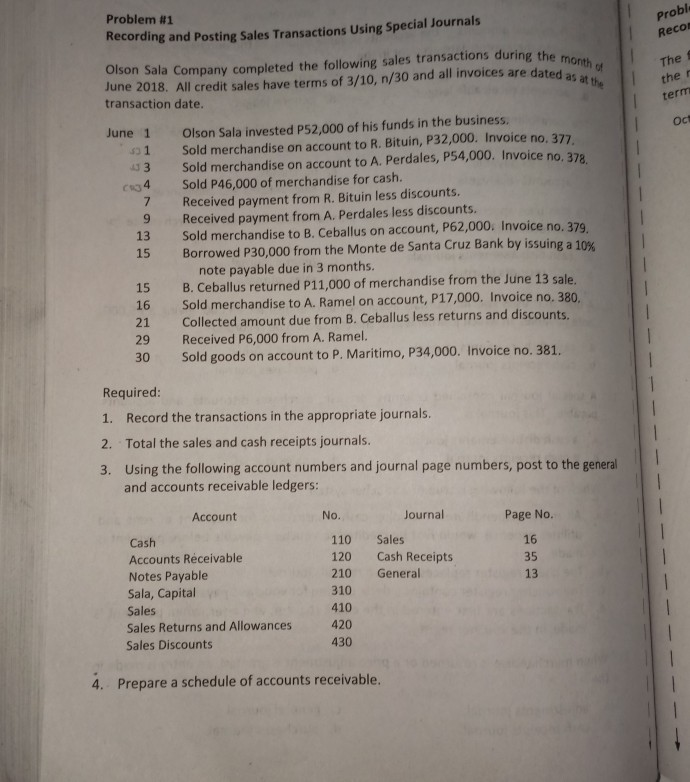

Problem #1 Recording and Posting Sales Transactions Using Special Journals Olson Sala Company completed the following sales transactions during the June 2018. All credit sales

Problem #1 Recording and Posting Sales Transactions Using Special Journals Olson Sala Company completed the following sales transactions during the June 2018. All credit sales have terms of 3/10, n/30 and all invoices are dated a Probl Recon month te The f the r term transaction date. June 1 1 Olson Sala invested P52,000 of his funds in the business. oct Sold merchandise on account to R. Bituin, P32,000. Invoice no. 377 3 Sold merchandise on account to A. Perdales, P54,000. Invoice no. cs4 Sold P46,000 of merchandise for cash. 7 Received payment from R. Bituin less discounts. 9 13 15 Received payment from A. Perdales less discounts. Sold merchandise to B. Ceballus on account, P62,000, Invoice no. 379 Borrowed P30,000 from the Monte de Santa Cruz Bank by issuing a 1 note payable due in 3 months. 0% 15 B. Ceballus returned P11,000 of merchandise from the June 13 sale. 16 Sold merchandise to A. Ramel on account, P17,000. Invoice no. 380. 21 Collected amount due from B. Ceballus less returns and discounts 29 Received P6,000 from A. Ramel. 30 Sold goods on account to P. Maritimo, P34,000. Invoice no. 381. Required 1. Record the transactions in the appropriate journals. 2. Total the sales and cash receipts journals. 3. Using the following account numbers and journal page numbers, post to the general and accounts receivable ledgers: Account No ournal Page No. Cash Accounts Rceivable Notes Payable Sala, Capital Sales Sales Returns and Allowances Sales Discounts 110 Sales 120 Cash Receipts 210 General 310 Ge 420 430 16 35 13 4. Prepare a schedule of accounts receivable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started