Question: Problem 1 (Risk and Returns, 50 points) You are interested in investing in two firms' stocks. The following table displays the two firms' stocks expected

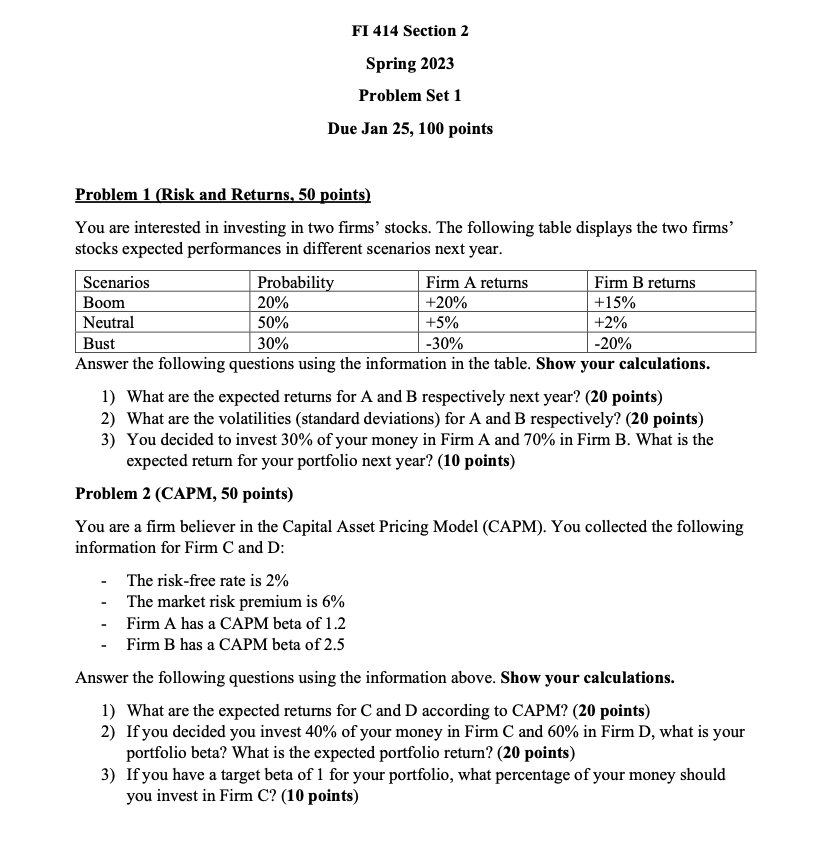

Problem 1 (Risk and Returns, 50 points) You are interested in investing in two firms' stocks. The following table displays the two firms' stocks expected performances in different scenarios next year. Answer the following questions using the information in the table. Show your calculations. 1) What are the expected returns for A and B respectively next year? (20 points) 2) What are the volatilities (standard deviations) for A and B respectively? (20 points) 3) You decided to invest 30% of your money in Firm A and 70% in Firm B. What is the expected return for your portfolio next year? (10 points) Problem 2 (CAPM, 50 points) You are a firm believer in the Capital Asset Pricing Model (CAPM). You collected the following information for Firm C and D: - The risk-free rate is 2% - The market risk premium is 6% - Firm A has a CAPM beta of 1.2 - Firm B has a CAPM beta of 2.5 Answer the following questions using the information above. Show your calculations. 1) What are the expected returns for C and D according to CAPM? (20 points) 2) If you decided you invest 40% of your money in Firm C and 60% in Firm D, what is your portfolio beta? What is the expected portfolio return? (20 points) 3) If you have a target beta of 1 for your portfolio, what percentage of your money should you invest in Firm C? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts