Question

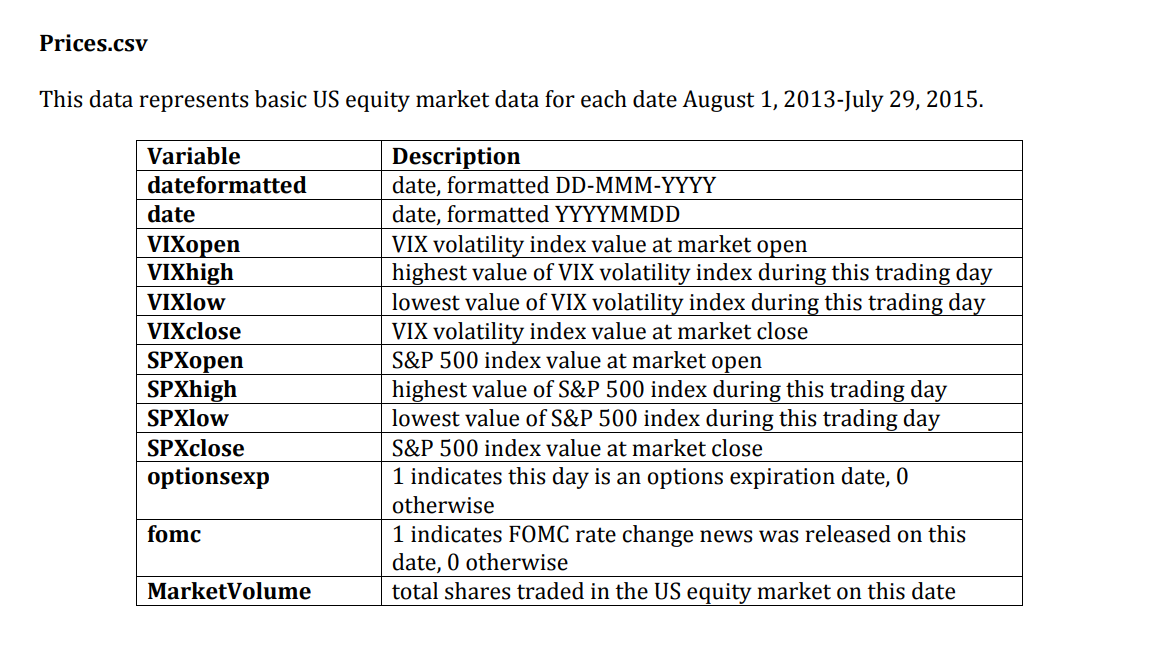

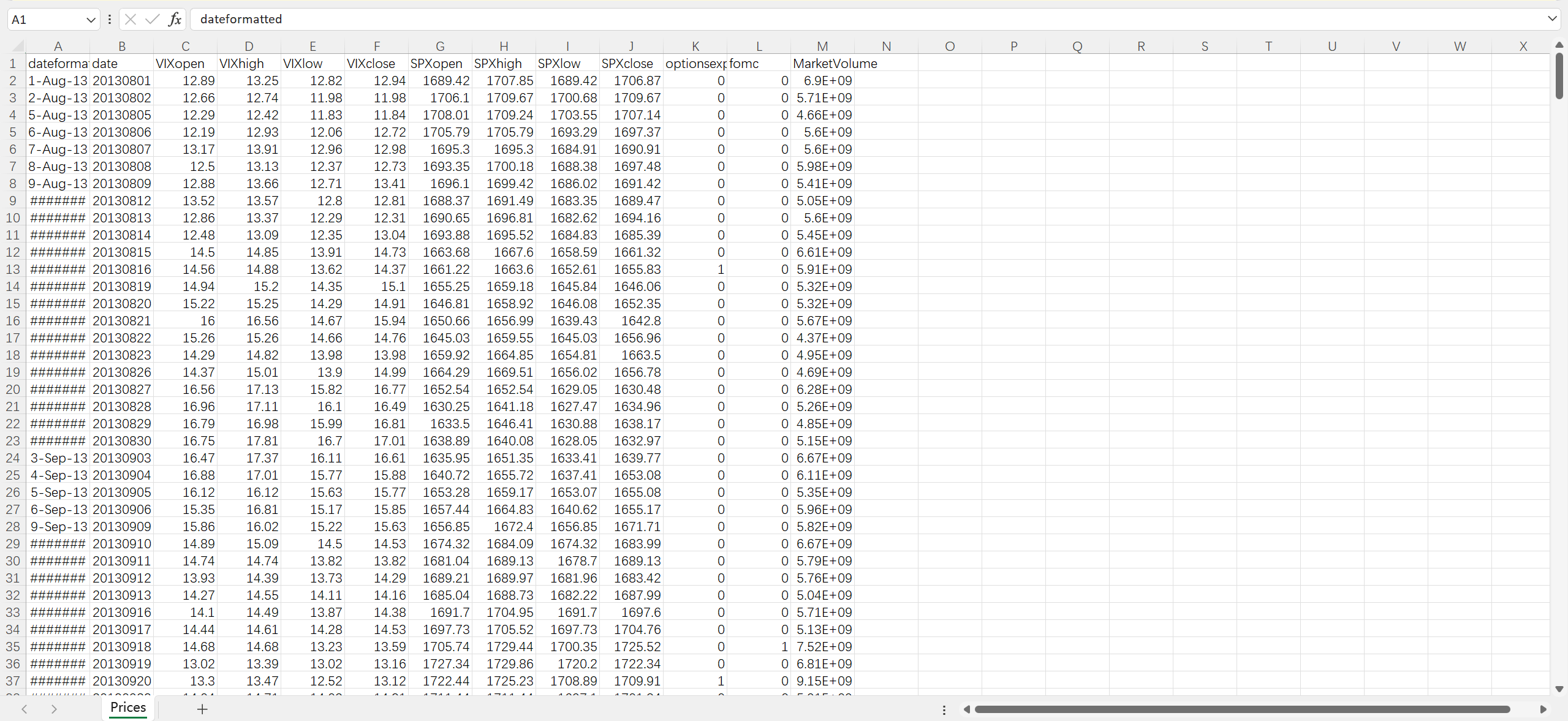

Problem 1 Scenario: You are working as a financial analyst at MISYFin and have been taskedto analyze US equity market data. Use the Prices.csv dataset

Problem 1 Scenario: You are working as a financial analyst at MISYFin and have been taskedto analyze US equity market data. Use the Prices.csv dataset to answer thequestions in this problem. For ALL problems, level of significance a = 0.05 You will be creating a regression model to predict Market Volume, using thevolatility index at close, whether a day is an options expiration day, and whetherthe Federal Open Market Committee (FOMC) issues a press release on interestrates. a) What kind of regression model will you build and why? Without dividingthe data, build this model and write your model equation. b) Without dividing the data, make a single prediction of Market Volume whenthe Volatility lndex at close is 12, on a non-options expiration day, but on a daywhen FOMC does issue a rate change press release. What is your predictedMarket Volume? (Make sure you include units). c) Now, use RStudio to divide the data into a training set and a test set. Whatpercentage (%) of the data you've collected did you put into your training setand what percentage (%) in the test set? With what method did you select theobservations for your training dataset? Chronologically (earliest data intraining set) or randomly? d) Now build a model using only your training set data to predict MarketVolume. What is your model equation? e) What is the mean absolute error/residual in the training set and what does itmean? (Explain in complete sentence making sure you mention units f) What is the mean absolute error/residual in the test set and what does itmean? (Explain in complete sentence making sure you mention units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started