Answered step by step

Verified Expert Solution

Question

1 Approved Answer

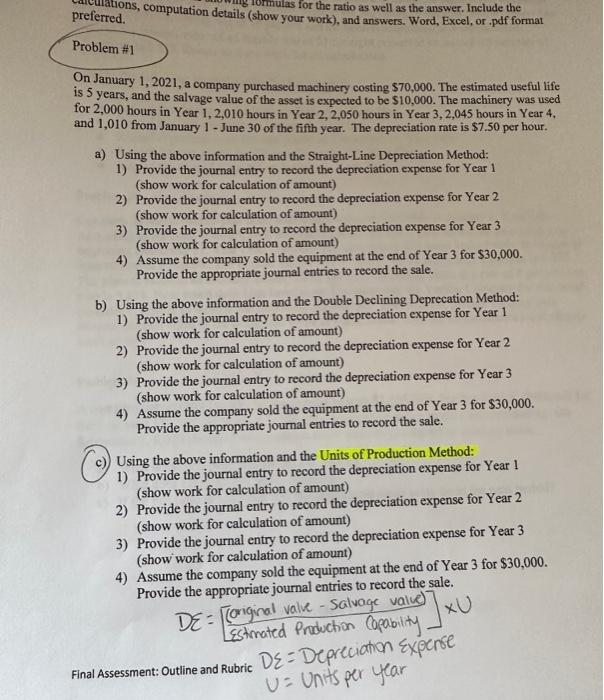

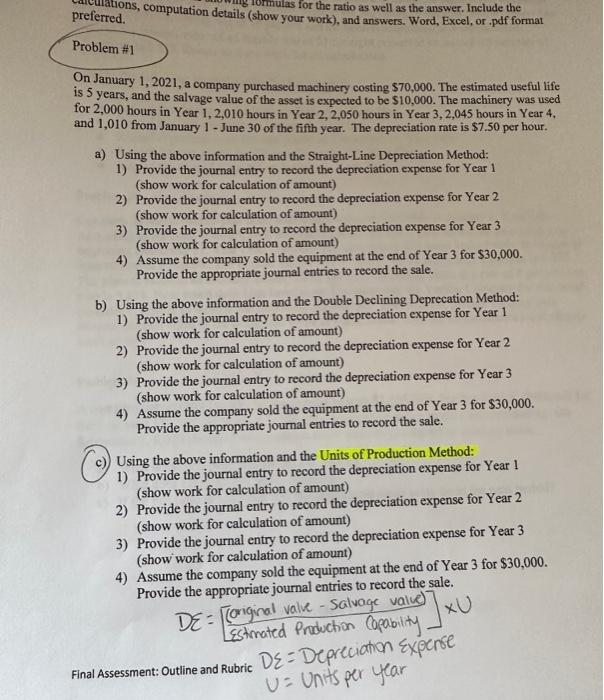

Problem 1 Section C only please. Provided formula but cant figure it out. Help! preferred. for the ratio as well as the answer. Include the

Problem 1 Section C only please. Provided formula but cant figure it out. Help!

preferred. for the ratio as well as the answer. Include the Problem \#1 On January 1,2021 , a company purchased machinery costing $70,000. The estimated useful life is 5 years, and the salvage value of the asset is expected to be $10,000. The machinery was used for 2,000 hours in Year 1,2,010 hours in Year 2, 2,050 hours in Year 3,2,045 hours in Year 4, and 1,010 from January 1 - June 30 of the fifth year. The depreciation rate is $7.50 per hour. a) Using the above information and the Straight-Line Depreciation Method: 1) Provide the journal entry to record the depreciation expense for Year 1 (show work for calculation of amount) 2) Provide the journal entry to record the depreciation expense for Year 2 (show work for calculation of amount) 3) Provide the journal entry to record the depreciation expense for Year 3 (show work for calculation of amount) 4) Assume the company sold the equipment at the end of Year 3 for $30,000. Provide the appropriate journal entries to record the sale. b) Using the above information and the Double Declining Deprecation Method: 1) Provide the journal entry to record the depreciation expense for Year 1 (show work for calculation of amount) 2) Provide the journal entry to record the depreciation expense for Year 2 (show work for calculation of amount) 3) Provide the journal entry to record the depreciation expense for Year 3 (show work for calculation of amount) 4) Assume the company sold the equipment at the end of Year 3 for $30,000. Provide the appropriate journal entries to record the sale. c) Using the above information and the Units of Production Method: 1) Provide the journal entry to record the depreciation expense for Year 1 (show work for calculation of amount) 2) Provide the journal entry to record the depreciation expense for Year 2 (show work for calculation of amount) 3) Provide the journal entry to record the depreciation expense for Year 3 (show work for calculation of amount) 4) Assume the company sold the equipment at the end of Year 3 for $30,000. Provide the appropriate journal entries to record the sale. DE=[EsstmatedPrebuctionCopability(originalvaluesalvagevalue)]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started