Answered step by step

Verified Expert Solution

Question

1 Approved Answer

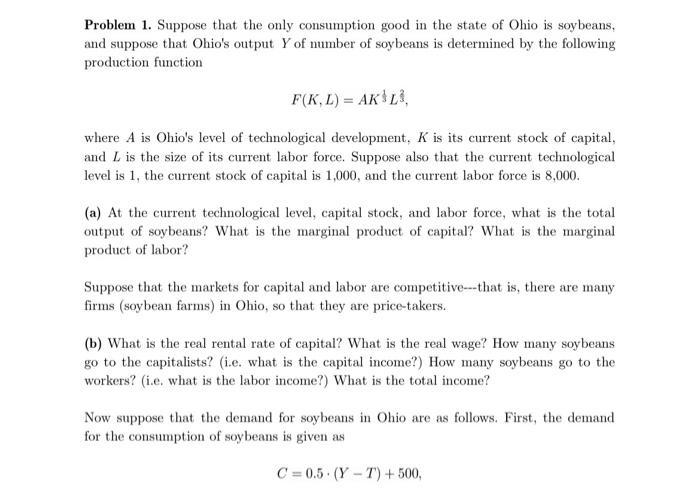

Problem 1. Suppose that the only consumption good in the state of Ohio is soybeans, and suppose that Ohio's output Y of number of

Problem 1. Suppose that the only consumption good in the state of Ohio is soybeans, and suppose that Ohio's output Y of number of soybeans is determined by the following production function F(K, L) = AK L, where A is Ohio's level of technological development. K is its current stock of capital, and L is the size of its current labor force. Suppose also that the current technological level is 1, the current stock of capital is 1,000, and the current labor force is 8,000. (a) At the current technological level, capital stock, and labor force, what is the total output of soybeans? What is the marginal product of capital? What is the marginal product of labor? Suppose that the markets for capital and labor are competitive---that is, there are many firms (soybean farms) in Ohio, so that they are price-takers. (b) What is the real rental rate of capital? What is the real wage? How many soybeans go to the capitalists? (i.e. what is the capital income?) How many soybeans go to the workers? (i.e. what is the labor income?) What is the total income? Now suppose that the demand for soybeans in Ohio are as follows. First, the demand for the consumption of soybeans is given as C=0.5 (Y-T) +500, where T is the number of soybeans taxed by the Ohio state government. Second, the demand for investing soybeans for future production is given as I = 1500-100r, where r is the real interest rate in percent. Finally, the demand for soybeans from the Ohio state government is G = 400 as the government collect the same amount as taxes T and spend it on running the Ohio State University. (c) What is the marginal propensity to consume of Ohio state residents? What are the equilibrium interest rate, investment, and consumption? What are the national, private, and public saving? (d) Suppose the Ohio state government reduces the taxation to T = 200 while maintaining the same spending of G = 400, as a part of COVID-19 stimulus package. What is the government surplus/deficit? What is the effect of this government policy on the equilibrium interest rate, investment, and consumption? What is the effect on national, private, and public saving? Explain your intuition behind these results. Suppose instead that Ohio state residents' consumption demand also depends on the real interest rate: C=0.5 (Y-T) + 600-50r. That is, for every percentage point increase in the interest rate, the Ohio state resident would rather not consume 50 soybeans and save them instead. (e) Analyze again the effects of reduced taxation from T = 400 to T = 200, using the new consumption demand but using everything else the same as before. Are the effects of the stimulus package smaller or larger under this revised consumption demand? What is your intuition behind the results?

Step by Step Solution

★★★★★

3.58 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

1 production function of the A Cobb Doug...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started