Answered step by step

Verified Expert Solution

Question

1 Approved Answer

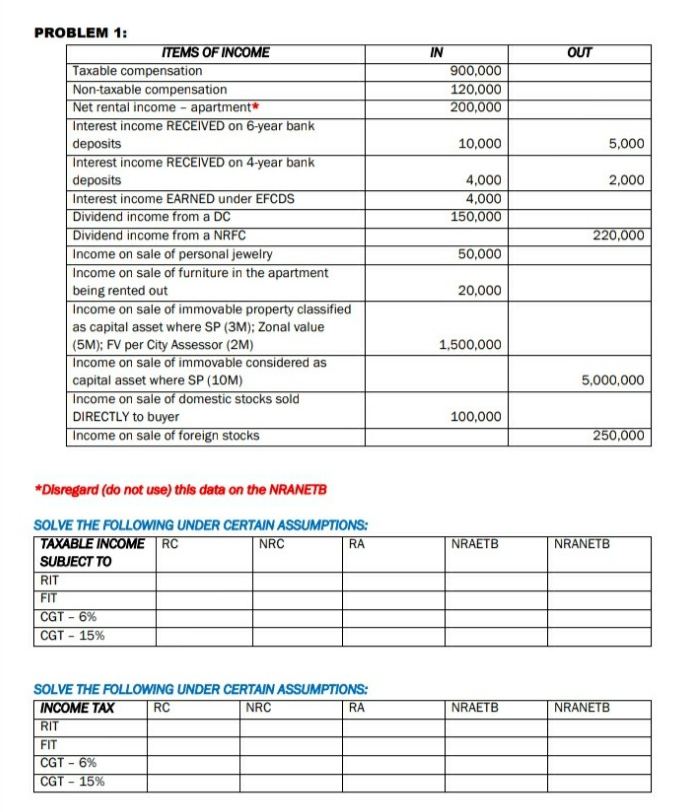

PROBLEM 1: Taxable compensation Non-taxable compensation Net rental income - apartment* ITEMS OF INCOME Interest income RECEIVED on 6-year bank deposits Interest income RECEIVED

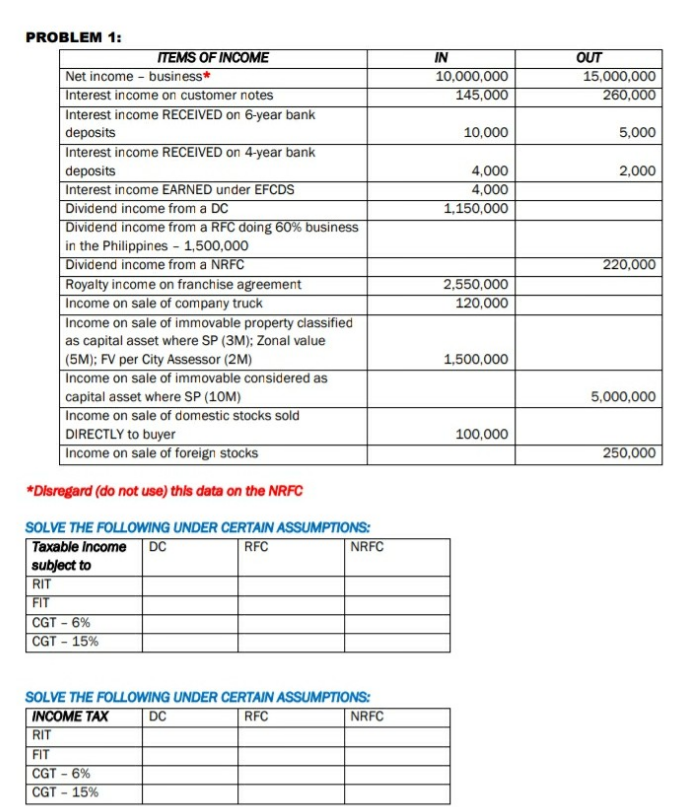

PROBLEM 1: Taxable compensation Non-taxable compensation Net rental income - apartment* ITEMS OF INCOME Interest income RECEIVED on 6-year bank deposits Interest income RECEIVED on 4-year bank deposits Interest income EARNED under EFCDS Dividend income from a DC Dividend income from a NRFC Income on sale of personal jewelry Income on sale of furniture in the apartment being rented out Income on sale of immovable property classified as capital asset where SP (3M); Zonal value (5M); FV per City Assessor (2M) Income on sale of immovable considered as capital asset where SP (10M) Income on sale of domestic stocks sold DIRECTLY to buyer Income on sale of foreign stocks *Disregard (do not use) this data on the NRANETB SOLVE THE FOLLOWING UNDER CERTAIN ASSUMPTIONS: TAXABLE INCOME RC NRC SUBJECT TO RIT FIT CGT - 6% CGT -15% RIT FIT CGT - 6% CGT -15% RA SOLVE THE FOLLOWING UNDER CERTAIN ASSUMPTIONS: INCOME TAX RC NRC RA IN 900,000 120,000 200,000 10,000 4,000 4,000 150,000 50,000 20,000 1,500,000 100,000 NRAETB NRAETB OUT 5,000 2,000 220,000 5,000,000 250,000 NRANETB NRANETB PROBLEM 1: RIT FIT ITEMS OF INCOME Net income - business* Interest income on customer notes Interest income RECEIVED on 6-year bank deposits Interest income RECEIVED on 4-year bank deposits Interest income EARNED under EFCDS Dividend income from a DC Dividend income from a RFC doing 60% business in the Philippines - 1,500,000 Dividend income from a NRFC Royalty income on franchise agreement Income on sale of company truck Income on sale of immovable property classified as capital asset where SP (3M); Zonal value (5M); FV per City Assessor (2M) Income on sale of immovable considered as capital asset where SP (10M) Income on sale of domestic stocks sold DIRECTLY to buyer Income on sale of foreign stocks *Disregard (do not use) this data on the NRFC SOLVE THE FOLLOWING UNDER CERTAIN ASSUMPTIONS: Taxable income DC RFC subject to CGT - 6% CGT -15% NRFC SOLVE THE FOLLOWING UNDER CERTAIN ASSUMPTIONS: INCOME TAX RFC RIT FIT CGT -6% CGT -15% DC NRFC IN 10,000,000 145,000 10,000 4,000 4,000 1,150,000 2,550,000 120,000 1,500,000 100,000 OUT 15,000,000 260,000 5,000 2,000 220,000 5,000,000 250,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the solutions with calculations Taxable Income RIT 120000 FIT 120000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started