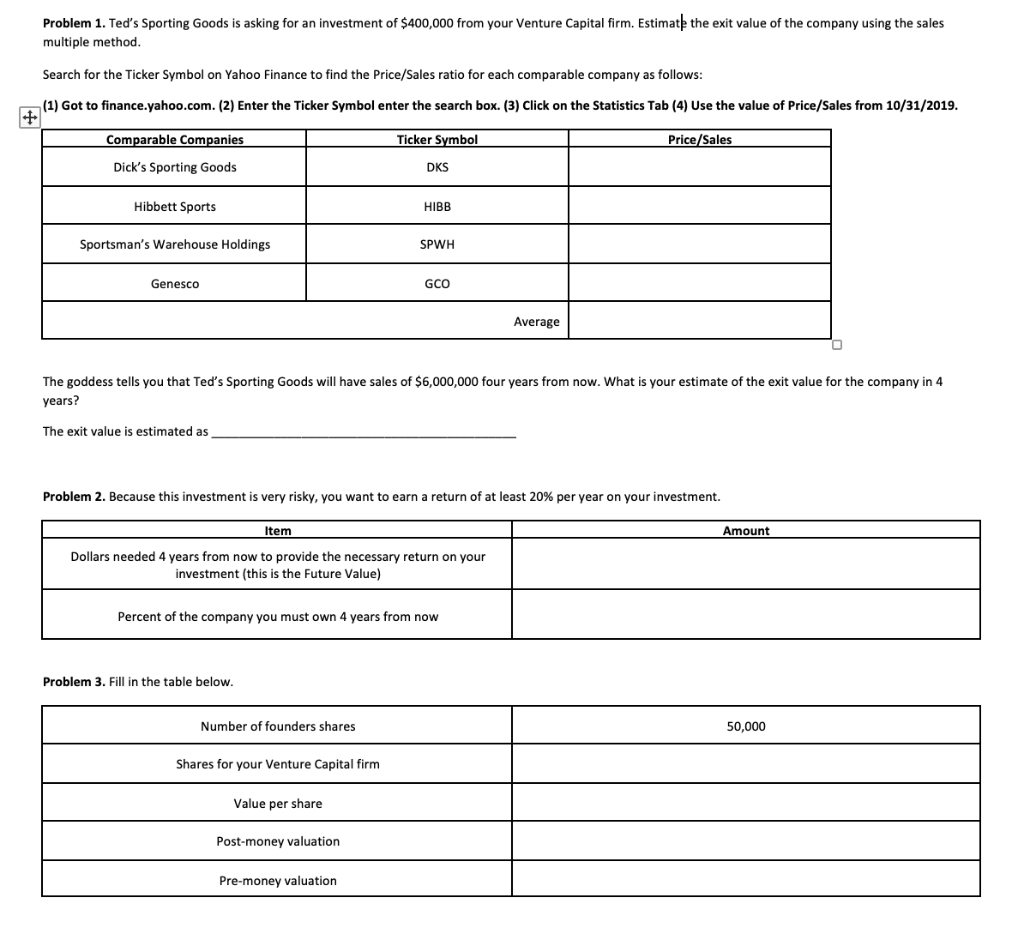

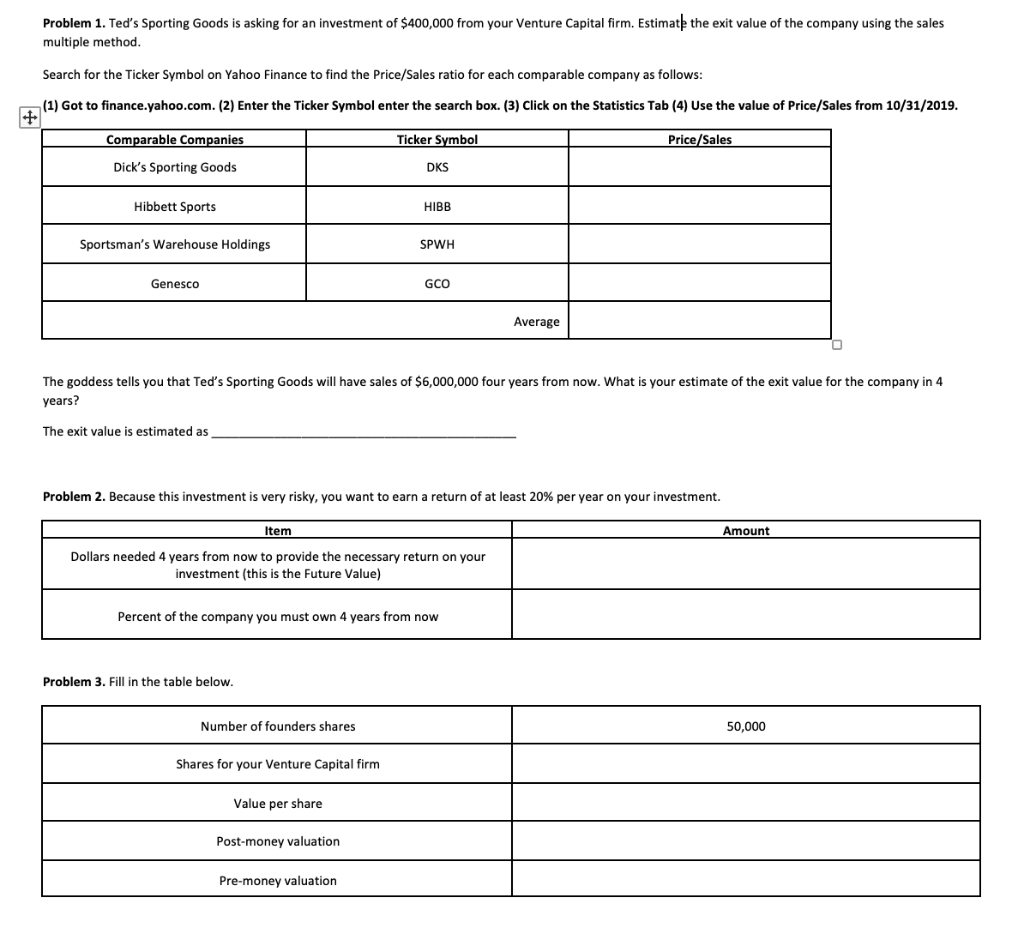

Problem 1. Ted's Sporting Goods is asking for an investment of $400,000 from your Venture Capital firm. Estimate the exit value of the company using the sales multiple method. Search for the Ticker Symbol on Yahoo Finance to find the Price/Sales ratio for each comparable company as follows: (1) Got to finance.yahoo.com. (2) Enter the Ticker Symbol enter the search box. (3) Click on the Statistics Tab (4) Use the value of Price/Sales from 10/31/2019. Comparable Companies Ticker Symbol Price/Sales Dick's Sporting Goods DKS Hibbett Sports HIBB Sportsman's Warehouse Holdings SPWH Genesco GCO Average The goddess tells you that Ted's Sporting Goods will have sales of $6,000,000 four years from now. What is your estimate of the exit value for the company in 4 years? The exit value is estimated as Problem 2. Because this investment is very risky, you want to earn a return of at least 20% per year on your investment. Item Amount Dollars needed 4 years from now to provide the necessary return on your investment (this is the Future Value) prove to prove the receitary return on your Percent of the company you must own 4 years from now Problem 3. Fill in the table below. Number of founders shares 50,000 Shares for your Venture Capital firm Value per share Post-money valuation Pre-money valuation Problem 1. Ted's Sporting Goods is asking for an investment of $400,000 from your Venture Capital firm. Estimate the exit value of the company using the sales multiple method. Search for the Ticker Symbol on Yahoo Finance to find the Price/Sales ratio for each comparable company as follows: (1) Got to finance.yahoo.com. (2) Enter the Ticker Symbol enter the search box. (3) Click on the Statistics Tab (4) Use the value of Price/Sales from 10/31/2019. Comparable Companies Ticker Symbol Price/Sales Dick's Sporting Goods DKS Hibbett Sports HIBB Sportsman's Warehouse Holdings SPWH Genesco GCO Average The goddess tells you that Ted's Sporting Goods will have sales of $6,000,000 four years from now. What is your estimate of the exit value for the company in 4 years? The exit value is estimated as Problem 2. Because this investment is very risky, you want to earn a return of at least 20% per year on your investment. Item Amount Dollars needed 4 years from now to provide the necessary return on your investment (this is the Future Value) prove to prove the receitary return on your Percent of the company you must own 4 years from now Problem 3. Fill in the table below. Number of founders shares 50,000 Shares for your Venture Capital firm Value per share Post-money valuation Pre-money valuation