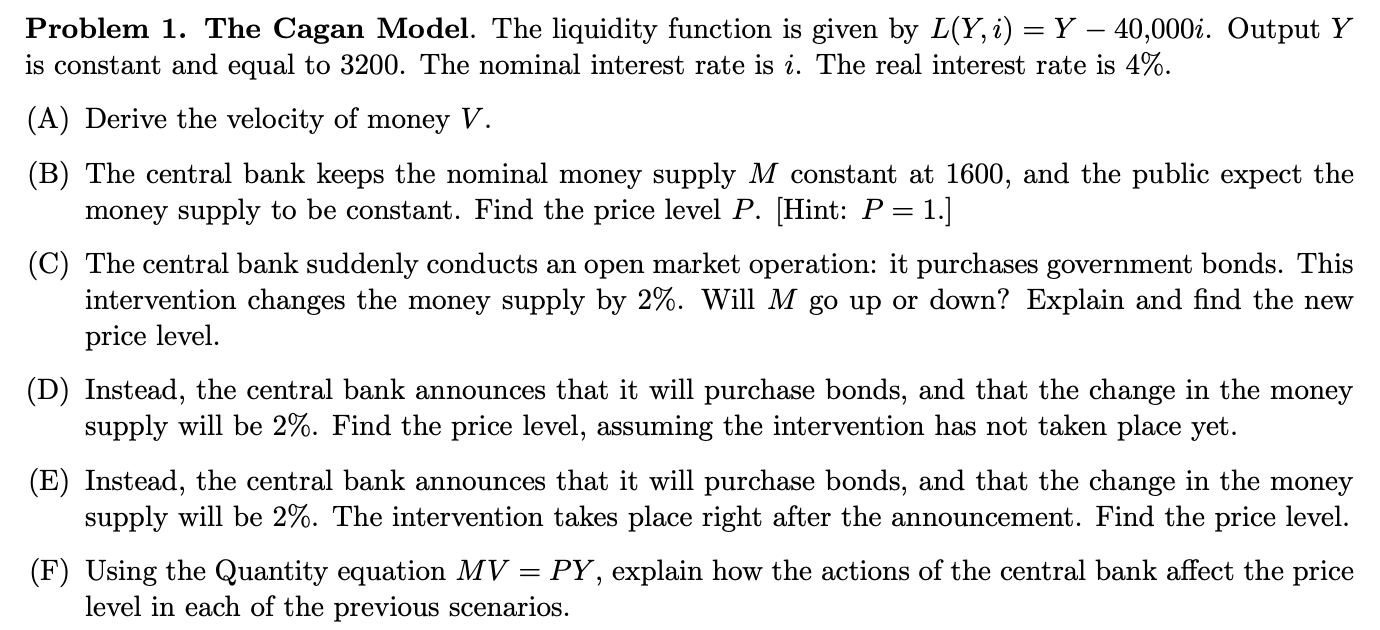

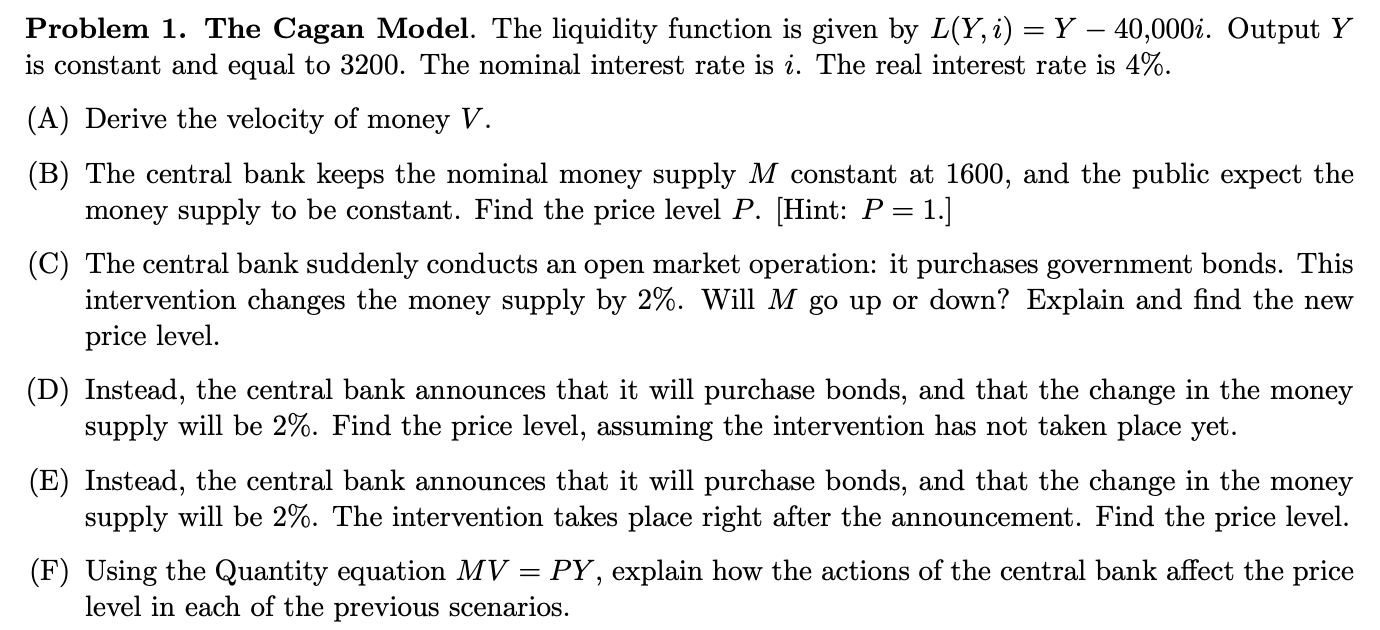

Problem 1. The Cagan Model. The liquidity function is given by L(Y, i) =Y 40,000i. Output Y is constant and equal to 3200. The nominal interest rate is i. The real interest rate is 4%. (A) Derive the velocity of money V. (B) The central bank keeps the nominal money supply M constant at 1600, and the public expect the money supply to be constant. Find the price level P. (Hint: P= 1.] (C) The central bank suddenly conducts an open market operation: it purchases government bonds. This intervention changes the money supply by 2%. Will M go up or down? Explain and find the new price level. (D) Instead, the central bank announces that it will purchase bonds, and that the change in the money supply will be 2%. Find the price level, assuming the intervention has not taken place yet. (E) Instead, the central bank announces that it will purchase bonds, and that the change in the money supply will be 2%. The intervention takes place right after the announcement. Find the price level. (F) Using the Quantity equation MV = PY, explain how the actions of the central bank affect the price level in each of the previous scenarios. Problem 1. The Cagan Model. The liquidity function is given by L(Y, i) =Y 40,000i. Output Y is constant and equal to 3200. The nominal interest rate is i. The real interest rate is 4%. (A) Derive the velocity of money V. (B) The central bank keeps the nominal money supply M constant at 1600, and the public expect the money supply to be constant. Find the price level P. (Hint: P= 1.] (C) The central bank suddenly conducts an open market operation: it purchases government bonds. This intervention changes the money supply by 2%. Will M go up or down? Explain and find the new price level. (D) Instead, the central bank announces that it will purchase bonds, and that the change in the money supply will be 2%. Find the price level, assuming the intervention has not taken place yet. (E) Instead, the central bank announces that it will purchase bonds, and that the change in the money supply will be 2%. The intervention takes place right after the announcement. Find the price level. (F) Using the Quantity equation MV = PY, explain how the actions of the central bank affect the price level in each of the previous scenarios