Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 The Clean Laundry Company is contemplating the acquisition of a higher capacity automatic washing machine. The new machine would cost P 1,920,000 and

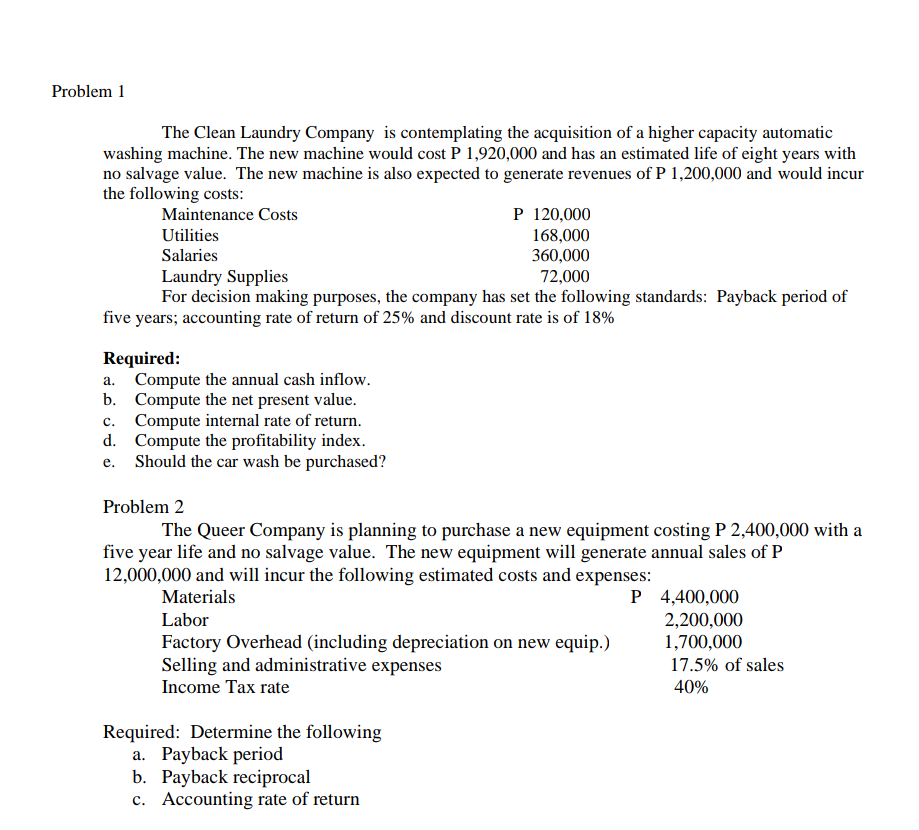

Problem 1 The Clean Laundry Company is contemplating the acquisition of a higher capacity automatic washing machine. The new machine would cost P 1,920,000 and has an estimated life of eight years with no salvage value. The new machine is also expected to generate revenues of P 1,200,000 and would incur the following costs: Maintenance Costs P 120,000 Utilities 168,000 Salaries 360,000 Laundry Supplies 72,000 For decision making purposes, the company has set the following standards: Payback period of five years, accounting rate of return of 25% and discount rate is of 18% Required: a. Compute the annual cash inflow. b. Compute the net present value. Compute internal rate of return. d. Compute the profitability index. Should the car wash be purchased? c. e. Problem 2 The Queer Company is planning to purchase a new equipment costing P 2,400,000 with a five year life and no salvage value. The new equipment will generate annual sales of P 12,000,000 and will incur the following estimated costs and expenses: Materials P 4,400,000 Labor 2,200,000 Factory Overhead (including depreciation on new equip.) 1,700,000 Selling and administrative expenses 17.5% of sales Income Tax rate 40% Required: Determine the following a. Payback period b. Payback reciprocal c. Accounting rate of return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started