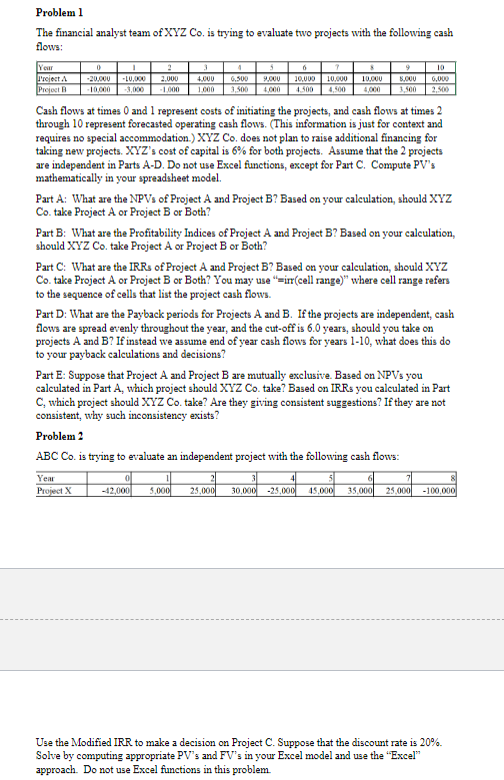

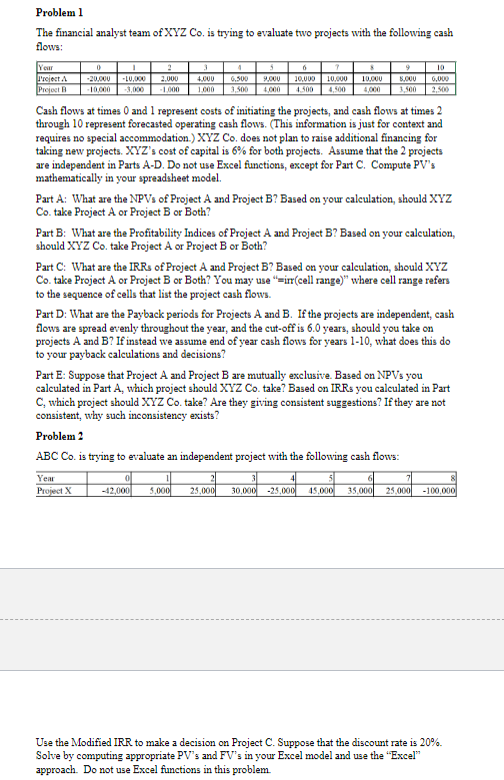

Problem 1 The financial analyst team of XYZ Co. is trying to evaluate two projects with the following cash flows: Your project 0 -20.000 10.000 1 -L0,000 2 2.000 1.000 3 400U 1.000 4 6.500 3.500 5 YOU 6 7 10.000 10.000 5 10.000 9 SOOV 10 6,000 Cash flows at times 0 and 1 represent costs of initiating the projects, and cash flows at times 2 through 10 represent forecasted operating cash flows. This information is just for context and requires no special accommodation.) XYZ Co. does not plan to raise additional financing for taking new projects. XYZ's cost of capital is 6% for both projects. Assume that the 2 projects are independent in Parts A-D. Do not use Excel functions, except for Part C. Compute PV's mathematically in your spreadsheet model. Part A: What are the NPVs of Project A and Project B? Based on your calculation, should XYZ Co take Project A or Project Bor Both? Part B: What are the Profitability Indices of Project A and Project B? Based on your calculation, should XYZ Co take Project A or Project Bor Both? Part C: What are the IRR of Project A and Project B? Based on your calculation, should XYZ Co take Project A or Project Bor Both? You may use "irr(cell range)" where cell range refers to the sequence of cells that list the project cash flows. Part D: What are the Payback periods for Projects A and B. If the projects are independent, cash flows are spread evenly throughout the year, and the cut-off is 6.0 years, should you take on projects A and B? If instead we assume end of year cash flows for years 1-10, what does this do to your payback calculations and decisions? Part E: Suppose that Project A and Project B are mutually exclusive. Based on NPVs you calculated in Part A, which project should XYZ Co take? Based on IRRs you calculated in Part C, which project should XYZ Co take? Are they giving consistent suggestions? If they are not consistent, why such inconsistency exists? Problem 2 ABC Co. is trying to evaluate an independent project with the following cash flows: Year Project X 5.000 25,000 30,000 -25,000 25,000 -100,000 0 -42,000 15.000 35.0001 Use the Modified IRR to make a decision on Project C. Suppose that the discount rate is 20%. Solve by computing appropriate PV's and FV's in your Excel model and use the "Excel" approach. Do not use Excel functions in this