Answered step by step

Verified Expert Solution

Question

1 Approved Answer

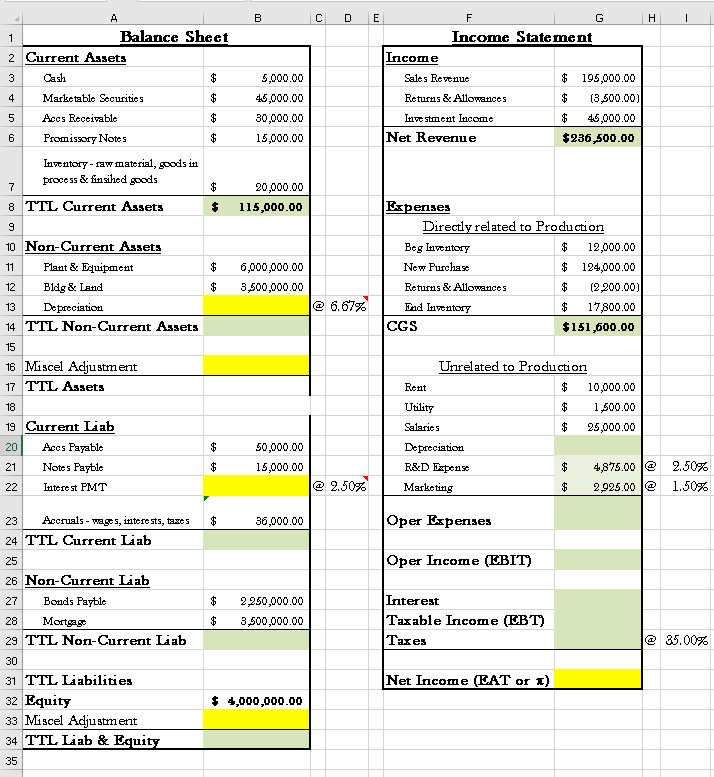

Problem # 1 . The numbers in column D are rates that apply to each line item. - i . e . D 1 3

Problem # The numbers in column D are rates that apply to each line item. ie D represents the annual depreciation rate. The depreciation during the observation period can be calculated using this rate. Likewise, D represents the WAVG overall interest rate on the LT debt of the company. In the Income Statement, CGS is of a typical retail business, not manufacture. Depreciation in G must correspond to the depreciation in the balance sheet. Numbers in column I are ratios of the corresponding line items which are fractions marked to the sales revenue. Accordingly, I represents tax rate.

SHOW ALL WORK DO IT IN EXCEL NEED ALL EXPLANATION AND ALL AREAS FILLED IN WITH EXPLANATION ON HOW ITS DONE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started